Wool Impact announces game-changing breakthrough for strong wool

There can only be one way for farm gate prices for strong wool - and it’s up! Wool Impact knows it will be what farmers judge their performance on, so how far away is it? Words Tony Leggett Photos Wool Impact.

Wool Impact’s chief executive, Andy Caughey, is not surprised that a major announcement in late August 2024 was overlooked by most strong wool growers given the sentiment of sheep farmers towards wool’s woes.

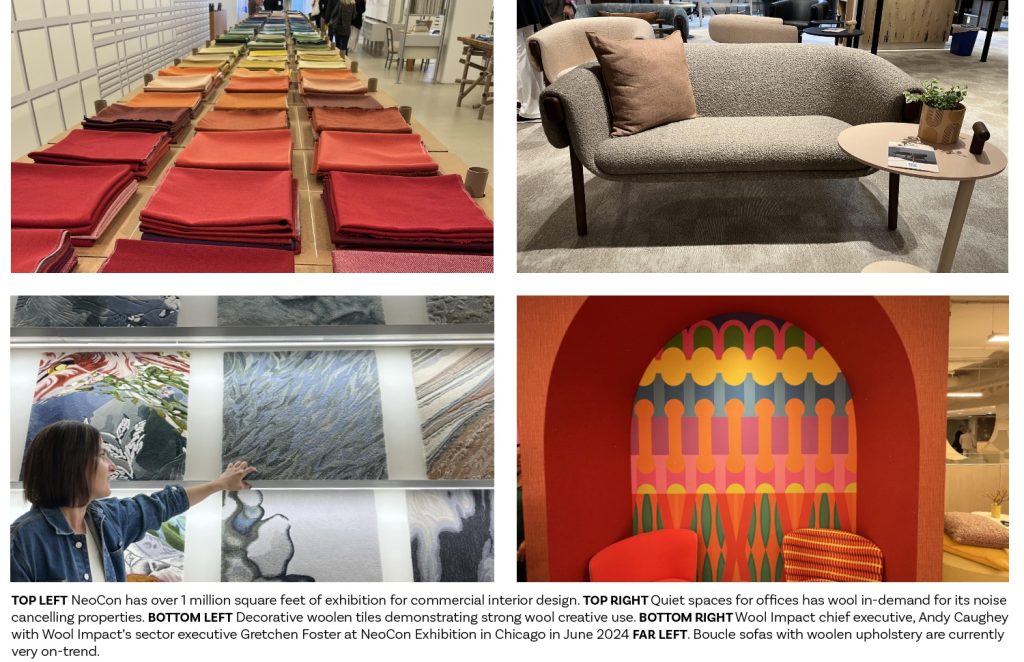

The announcement was that Wool Impact would be working with Gensler – one of the world’s leading architecture, design and planning consultancy firms. And it doesn’t get much bigger as they will open the door for New Zealand strong wool to become a hero component in some of the categories of products the consultancy recommends to architects and interior designers.

With their head-office in the United States, Gensler employs more than 4,000 staff who operate from nearly 60 offices around the world and have taken a big shine to New Zealand strong wool, thanks to the collaborative efforts of a tiny team from Wool Impact which has been working with the company over the past year.

Wool Impact was set up just over two years ago to facilitate change within the New Zealand strong wool sector. Chief executive Andy Caughey knows the only way is up for the farm gate price of strong wool and most farmers will judge his team’s performance on that one metric.

“We have kept this story at a high level, recognising that Gensler is the most impactful influencer when it comes to consulting with business and residential architecture and design firms,” Caughey says.

Caughey says companies developing new offices or renovating existing offices increasingly want to reflect their sustainability values through the design and products used. With the cycle of refurbishment for large global brands typically every 7-8 years it’s increasingly important that products on offer meet new sustainability and health goals.

“This is where Gensler comes in. They have extensive libraries of materials and fabrics from which they curate collections for architecture and interior design firms to specify in their clients designs and fitouts.”

‘This is an opportunity to do something impactful and be a contributing part of the solution required for reviving the strong wool prices at farm gate.’ – Andy Caughey, chief executive, Wool Impact

Gensler has developed its own set of standards, called the Gensler Product Sustainability (GPS) standards, which are applied to thousands of products, with many showcased in its libraries. The GPS standard supports Gensler’s clients in making informed choices through better information. “The GPS standards are encouraging companies to make more considered decisions in the products they use in their offices. They reflect the global shift towards products with lower carbon footprints, and a more circular economy.”

Caughey and his small team have been working closely with Gensler strategy and sustainability executives to study wool’s role in product development within the architecture and design industry and provide strategies for growth.

Wool Impact introduced them to wool and its special performance benefits from a basic level through to its end uses as a sustainably produced, low-carbon material for flooring, acoustic panelling and furnishing fabrics.

It started with Wool Impact providing a comprehensive story of wool growing in New Zealand, from the different sheep breeds farmed here, through to the process of wool harvesting; all wrapped within NZ’s story of working with nature and the need to be sustainable.

“As a result, Gensler completed a deep dive into a wide range of different, natural products made from wool and prioritised them under three categories – flooring, acoustic panels and upholstery. Reassuringly, our strong wool works well in all three,” Caughey says.

The next step is to identify and select manufacturing brands which could be connected to each category, based on their capability, production capacity and their ability to source wool sourced from farms that allow those end products to meet GPS standards, most notably the requirement for low embodied carbon.

“Developing and engaging with global organisations like Gensler, and the manufacturers supplying the architecture and design industry, is a step change in the right direction to unlock value from closer brand-grower relationships. For this to work, Wool Impact needs certified growers who operate low or zero carbon farming systems,” he says.

Caughey says woolgrowers will need to be accredited with the advanced NZ Farm Assurance Programme (NZFAP) or The New Zealand Merino Company’s ZQRX assurance programme, or similar, to supply their wool to companies that manufacture the flooring, upholstery or acoustic panelling products specified by Gensler.

“Growers will be closely aligned through to the approved brands to create an inter-dependency between growers and manufacturers that is not commonly seen with strong wool.”

Caughey says with strong wool production still declining, the prices Wool Impact wants to secure for New Zealand wool growers will require a shift from the commodity market to farm-specific sourcing. Sustainable prices negotiated between manufacturing brands and growers is vital for the long-term future of hill country farming, he says. “The influence of Gensler has the potential to turn our strong wool sector around really quickly through the generation of new demand.

“We still have much to develop to identify the brands our growers will work with, but once we get the formula and approach right, then we can scale up quickly and bring in other brands too.”

Caughey is hopeful the linkage with Gensler will encourage a new group of farmers to emerge who see wool as a contemporary fibre, and understand the need for data to support stronger market value propositions.

The surge in demand for low or zero carbon products presents a great opportunity to change price expectations for accredited strong wool produced in NZ.

Wool Impact will also continue to foster local brands to assist them to develop and accelerate growth, Caughey says. “We are cultivating and supporting those domestic brands and it’s encouraging to see such strong creativity and aspiration for growth, particularly those in the non-woven category.”

There are local companies using wool for new end-uses such as medical applications, horticultural uses, personal hygiene, acoustic panelling and air filtration products.

Domestic brands operating in the carpet tufting and non-woven categories are using about 13,000 tonnes per year of strong wool but Caughey estimates that could more than double within the next five years.