To finish or not to finish

Kerry Dwyer considers the options for sheep farmers with this summer’s lamb trade.

Kerry Dwyer considers the options for sheep farmers with this summer’s lamb trade.

You are sitting reading this early in December pondering where the lamb market has gone since I wrote this in early November, and where it might go in the next few months. Has the tide of pessimism continued to subdue both store and prime markets?

Sheep farmers have some choices to make. Sell store lambs or finish them yourselves? Buy store lambs or use the feed for other stock or supplement?

If you’re a pessimistic breeder the best option might look to be selling store lambs before prices go into freefall and the drought impacts on pasture growth.

If you’re an optimistic finisher then buying might look to be a good option because there is plenty of feed and prices will be similar to last year through the summer.

In between these extremes is a world of possibilities.

I have run some figures through my computer to see how a summer lamb option might look. Note that with any finishing option there are three key parts to the deal: the start price; how well you grow the stock; and the end price.

You can access computing power that will give a myriad of these three factors and weigh up the likely options. The reality is we do not know the future and will rely heavily on judgement to make the final decision – to finish lambs or not?

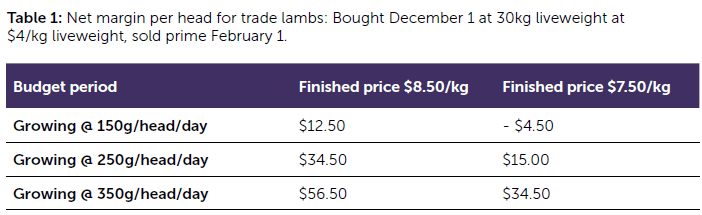

In Table 1 I have the results for a simple store lamb trade, taking them from 30kg liveweight at the start of December and selling February 1, at two different sale prices and three different growth rates. taken off are for transport, animal health, drench, and interest on capital.

The figures show that if the sale price stays at $8.50/kg carcaseweight you will make a fair margin, and very good if they grow well. If the sale price drops you will need to grow them very well to counter the decline. A low growth rate will give a negative margin when combined with a price drop.

Note that I have not taken the cost of feed into account here. How fast you can grow the lambs will reflect feed quality and quantity offered to them, along with genetics and animal health.

The cost of offering a chicory/plantain/clover mix to lambs is higher than a permanent pasture mix, but that is another story and has a myriad of possibilities depending on your own individual farm and cost structure.

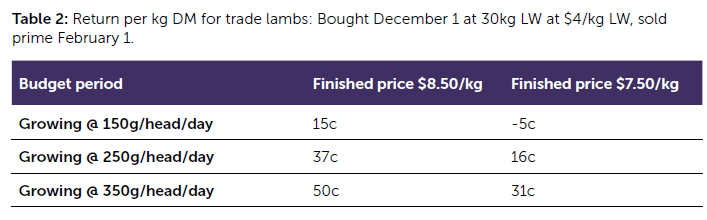

In Table 2 I have taken the net margin and calculated the return per kg drymatter (DM) eaten for the same options as Table 1. The figures show that fast growing lambs give a good return even in the event of some sale price drop.

If you think about the opportunity cost of the feed, which could be used for other purposes, then relate it to selling balage at 30c/kg DM, with a removal of fertility off-farm. Or dairy heifer grazing at about 20c/kg DM.

Another option I ran through the computer was buying 100kg Friesian bull calves at the same time, December 1, at $500/head (or $5/kg liveweight). If they grow 1kg LW for the same 60-day period and you sell at $4/kg LW the margin is more than $110/head and 40c/kg DM.

You are sitting reading this early in December pondering where the lamb market is at and where it might go. The factors you can control are at least as important as those that you cannot.

- Kerry Dwyer is a North Otago farm consultant and farmer.