The lamb selling decision

By Dwayne Cowin

As the lamb schedule begins its seasonal decline as we enter the peak lamb kill and processing period, this year farmers have the added benefit of the lamb schedule starting from record pricing levels of more than $9.50/kg carcaseweight.

Based on the recent record schedule pricing, a common question being asked at the moment is “when should I sell my lambs?” What seems a relatively simple question is often much more complicated to answer in isolation. It requires consideration of the wider farm system and recent performance achieved by the farm.

For some farmers who have robust and repeatable systems, and are able to achieve consistently good levels of finishing performance, without impacting on the subsequent year’s reproductive performance, the answer might be as simple as “stick to your knitting” and continue with their normal lamb sales pattern.

With the high schedule pricing, a 17.5kg lamb could this year achieve close to $150/head, based on an $8.50/kg schedule price. Under last season’s average schedule pricing of $6.50/kg, the same lamb yielded an average of $114/head. A close to $35/head lift in lamb sale price this year for no change in system or management is certainly something that would have farmers smiling all the way to the bank.

For other farmers though, this season could present an opportune time to potentially capture value from their current season’s lamb crop, while at the same time moving towards a system where reproductive and finishing performance can deliver more consistent medium and longer-term results.

In order to identify potential refinements to the lamb finishing system, a review can be undertaken to assess where performance levels are. It may be as simple as reviewing last year’s (or this year’s if weaning has already been completed) results and asking some of the following questions:

- How was my lambing percentage, relative to previous years, and/or other farms in the same year? (This can help understand the flock reproductive performance).

- What percentage of lambs were sold prime off mum to the works? (To gain an idea of ‘weaning weight’).

- What is my average lamb kill date? (This provides an insight to post-weaning growth rates).

Based on the review, and any potential gaps that may have been identified, a plan can be implemented to address any potential limitations within our system. There should be two main areas of focus – maximising this year’s lamb crop revenue, without compromising next year’s reproductive performance potential.

With the dynamic and unpredictable nature of farming, actual results are rarely going to be a mirror image reflection of best laid plans. However a robust plan outline allows objective decisions to be made, potentially well ahead of when a decision would have otherwise been made.

While feed might be of abundance, we rarely meet a farmer who has too few lambs on the farm as the season progresses towards February and March, and next season’s rapidly approaching mating date.

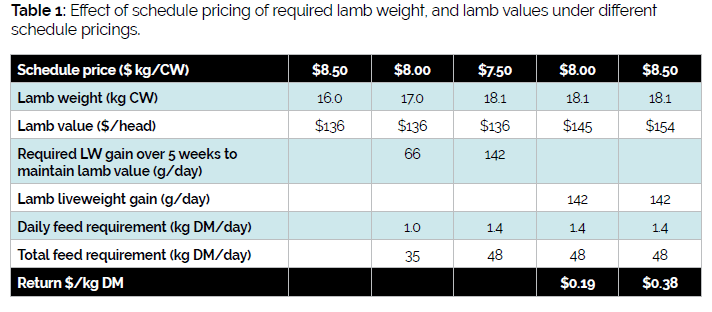

If we look at the example of taking ‘the bird in the hand’ value of a 16kg CW lamb at weaning on an $8.50/kg CW schedule (giving a lamb value of $136/head), Table 1 shows the corresponding lamb carcase weight required in order to match the lamb’s current value.

As Table 1 shows, to maintain our $136/head lamb value, at a $7.50/kg schedule we would need a 18.1kg carcase (or an extra 5kg of lamb liveweight). A $1 drop in schedule pricing could equate to a $0.20 weekly decline for the five weeks post-weaning, and the lamb would need to grow at 142g/day just to ‘beat the schedule decline’ and maintain its value.

A key question for the farmer at this point is “do I know how fast my lambs grow?” To achieve this liveweight gain, lambs should be offered at least 1.5kg DM/head/day of high quality feed. Some simple liveweight monitoring of the mob will also help the farmer know if the targeted liveweight gains are being achieved, and will allow a proactive measurement to assess if the targeted number of lambs to be sold prime at the next draft will be achieved.

Table 1 also shows the extra value generated if a lamb liveweight gain of 142g/day is achieved under two different schedule prices. If the schedule only dropped $0.10 a week for five weeks, we would lift our lamb value by $9/head, and generate a return on the feed consumed of $0.19/kg DM.

Based on Table 1, a few conclusions can be made which may help us execute our plan. If we have the feed available, and we can grow the lamb at over 142g/day, and we think the schedule will drop by less than $1/kg, it makes good financial sense to finish our lamb to a higher kill weight. If not, careful consideration needs to be given as to the rationale behind retaining the lamb on the farm when it could be sold at its current value.

Lamb crop value maximisation is the first focus, but before we enter a period of a feed quality deficit and finishing stock start to compete with breeding stock for feed, we need to make sure that this is not the determinant of next year’s performance.

Lifting BCS benefits

The benefits of lifting light body condition scoring ewes have been well-documented in recent times. Quantifying the benefit of doing so can help ease the pain of selling a lamb at a supposedly sub-par weight to make way for a light ewe to consume feed.

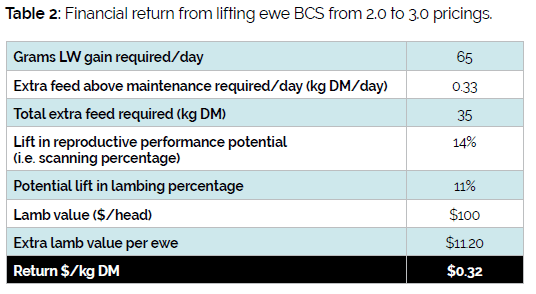

Although there will be some degree of variation between breed and type of sheep, a general rule of thumb is a ewe needs to gain between 7kg to 9kg of liveweight to lift their BCS from 2.0 to 3.0. Assuming just over 100 days from mating to weaning, and 7kg gained, this equates to an average liveweight gain requirement of 65g per day.

Table 2 shows the financial return from utilising feed to lift a ewes BCS from 2.0 to 3.0. Based on a 2% lift in reproductive performance potential per kilogram of liveweight gain, and a 20% scanning to weaning loss, lifting ewe BCS from 2.0 to 3.0 could generate an, or extra 0.11 lambs per ewe whose BCS has been lifted (or a corresponding 11% lift in lambing percentage).

A 32c/kg DM return

Based on an average lamb value at weaning of $100/head (28kg x 42% of an $8.50/kg schedule), and extra $11.20 per ewe could be generated, and a return on feed consumed of $0.32/kg DM.

Based on the return generated from lifting ewe BCS, we would need a pretty much static schedule pricing (or much faster growth rate than 142g/day) to compete with lamb finishing returns. If this is not possible, and feed quality and/or quantity is limiting, again serious consideration needs to be given to the lamb’s presence onfarm during this period.

While this season presents many challenges with international logistics disruptions, and the ever-looming threat of Covid-19 and the impact that could have on processing and/or market access, there is also a prime opportunity for farmers.

This season’s lamb crop value has the potential to generate solid financial returns. It is also an opportune time to review and evaluate the lamb finishing strategy and performance. A chance to implement some strategies to future-proof the farm system so next year’s, and beyond, lamb crop delivers consistently strong financial returns back to farmers.

Simple measurements such as a lamb liveweight gain, or knowing the ewes which are below BCS 3.0 allow decisions to be made more proactively than would otherwise be possible. With the current schedule pricing, the benefit of getting decisions made in a timely fashion can have a significant impact on bottom line financial performance to the farm.

- Dwayne Cowin, is a senior consultant with Perrin Ag.