Swift action needed for markets

AgriHQ senior analyst Mel Croad has been following lamb export markets and prices and says this red-meat season has got to be better than last.

It has been a torturous 12 months for lamb prices. The realisation that returns this spring aren’t going to match previous years has been a blow. But the warnings have come much earlier this year, enabling better preparation for the new red-meat season ahead. Moving swiftly to better align with market signals may put us in a better position as we transition into the new season. This is a vastly different scenario to last year.

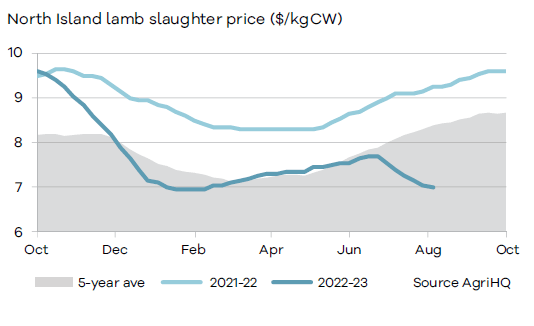

After closing in once again on a peak of $9.60/kg last spring, prices quickly unravelled. The sudden downside was a result of farmgate prices losing their grip on what was occurring in the export markets. There had been indications that export prices were starting to struggle against falling demand, but that hadn’t been reflected in farmgate payments. However, by late September the pressure really came on and the speed at which in-market prices unravelled caught even the most seasoned exporter by surprise.

The pull back in prices was global and it occurred almost simultaneously. In other years at least one market could be called on to balance out the downside elsewhere, but that was lacking last year. The overseas price fall was felt acutely at the farmgate. From the peak to Christmas last year, $1.90/kg was wiped off lamb, sending returns below five-year average levels. Typically downside through this period ranges between a more manageable 30–80c/kg.

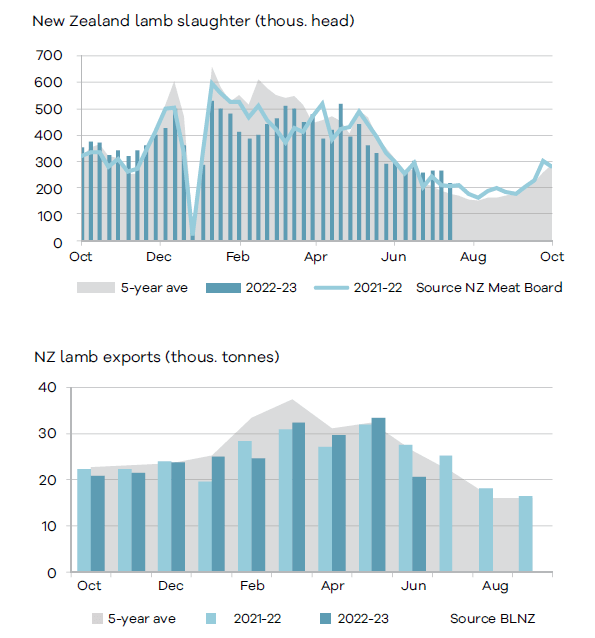

Early 2023 continued to deliver pain at the farmgate with prices continuing to fall to $7/kg and below. Challenging weather conditions stalled lamb growth rates, slowing production. The silver lining was a summer without drought that ensured there was no shortage of feed. This enabled farmers to hold on to lambs for longer to grow out weights and condition. By March, after two months of a very slow lamb slaughter, farmgate prices started to climb. This coincided with some renewed optimism, that with China breaking free of their Covid restrictions, they would start to demand large volumes of lamb. For a few short weeks, export prices did rally, boosted by renewed interest from China. There was a sense that the lamb job would once again head toward the $9/kg mark by spring. Such was the confidence, store lamb buyers jumped in to secure numbers. With farmgate slaughter prices marching towards $8/kg it appeared a safe move.

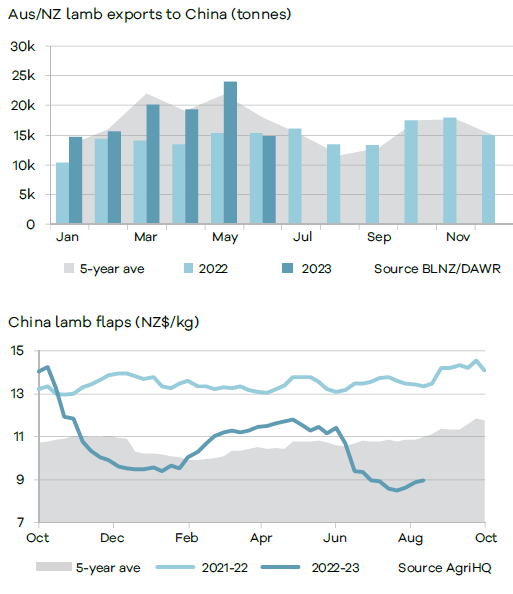

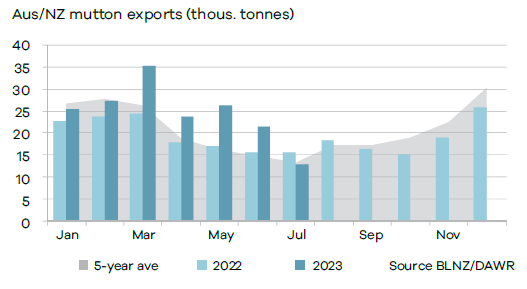

By mid-autumn, market dynamics were swiftly changing. Interest out of China had run out of steam and inventories were building amid slower consumption. The glimmer of hope that China had presented back in April saw NZ exporters target this market with much higher export volumes. Australia followed suit, dropping record volumes of lamb into China. Again, consumption wasn’t anywhere near at a level to absorb these supplies. Economic activity within China was also constrained. Suddenly export prices were back under pressure. There was a definite domino effect, with other markets retreating to the sidelines, noting similar conditions but also contending with hot summer conditions that always dampen demand for lamb.

Aussie competition

Another key factor that hampered market direction this year has been the surge of Australian lamb hitting export markets. NZ has had a relatively free run in recent years, holding the upper hand in terms of volumes and therefore having some sway in setting prices. This ability to influence prices looks to be evaporating as Australia’s focus on lamb export markets grows. In the three months to July, Australia shipped 15% more lamb than NZ had been able to, and in many cases at lower values. Export prices are returning to levels witnessed in mid-2020 or in some instances as far back as 2016.

As the export pressure came on, farmgate prices fell. July farmgate prices were lower than what had been attained in June, which is previously unheard of, but explains the extent of changing market conditions. Even into August, lamb prices remained under pressure. The downside did little to persuade finishers to hold out for better money. Plenty pushed go and offloaded large volumes into the processing plants. Slaughter rates climbed through July as the message remained clear – there was no knowing when or if export markets would show renewed interest for NZ lamb.

The drop in farmgate prices saw prices return to either side of $7/kg by mid-August. For farmgate prices to show any pricing upside before the end of the year, export markets will have to change tack and start looking for lamb. Lower export values may encourage a head start by some markets to secure supplies again, leading into the higher winter consumption period.

There have been subtle signs of some improvement to export markets in August, but more evidence is needed that this is indeed the turning point. Domestically, AgriHQ is not ruling out some procurement pressure popping up. But it will be a short-term measure to kick start the flow of lambs into processors, particularly if traders hold off for heavier weights to ratchet margins into the green. The pull back in prices was global and it occurred almost simultaneously.

- Mel Croad is a senior analyst with AgriHQ.