Over the past decade more than $80 million has been poured into action plans to raise the value of NZ’s coarse wool. Robert Pattison asks who has benefited.

Twenty years on and sheep farmers are still searching for a silver bullet to restore the onfarm value of New Zealand’s coarse wool.

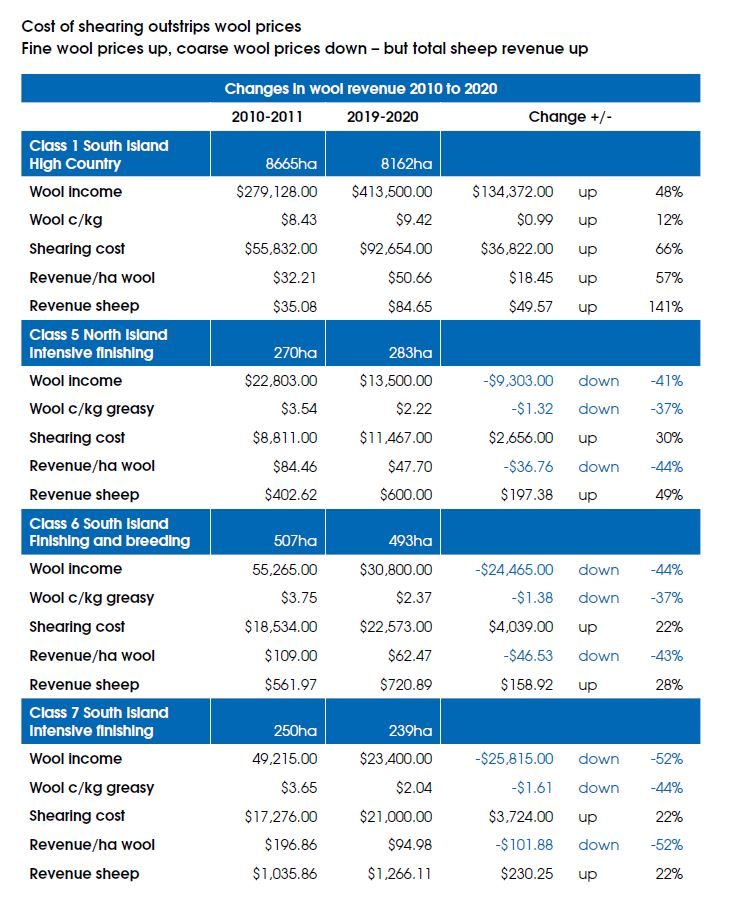

That’s not surprising as the FOB export value of the wool clip has dropped from $715 million in 2010-11 to $535m for 2018-19 – that’s a fall of $180m, $7/sheep, or 25%.

That’s despite more than $80m being spent on wool research, product development and marketing programmes in the past 10 years. That doesn’t include grants from the Ministry of Business, Innovation and Employment (MBIE) or NZ Trade and Enterprises (NZTE).

All the research applications for coarse wool have claimed they will add thousands of dollars in value, but the onfarm value of NZ wool continues to fall – the coarse wool indicator was $1.89 on August 27 this year (that’s less than $10/sheep). Sheepfarmers are asking why.

Perhaps they should be doing some navel-gazing and looking at past decision-making inside their own farm gates. For more than a decade Romcross sheep farmers have individually chosen not to collectively invest in wool harvesting, coarse wool research and product development.

In July 2018, Minister of Agriculture Damian O’Connor agreed to form and fund another group of farmers and wool industry representatives, named the Wool Industry Working Group (WWG), to search for ways to halt the declining farm value of the coarse wool clip.

Since then, however, despite finding highly intelligent, innovative people to come up with ideas and recommendations not much has happened.

There have been a few press releases and rhetoric from farmer politicians and Federated Farmers claiming the industry is united and willing to work together to produce an action plan that will benefit farmers and industry players. In the meantime wool prices continue their downward trend.

From the group’s initial meeting in July 2018, a “Project Action Group” (PAG) representing farmers, wool and textile industry representatives has been selected. An independent chairman, John Rodwell, has been appointed. Rodwell has a background in corporate finance, investment banking and agribusiness.

Rodwell says terms of reference were drawn up and a draft annual plan prepared and sent to the Minister of Agriculture. The outcome to date is a 32-page report, the “Vision and Action for New Zealand’s Wool Sector”, has been released. The report was to be published in December 2019,but didn’t make it until July 2020. Six months late. Not a good start for an action group. Rodwell said the Minister had been busy since the Covid-19 virus pandemic struck, causing the delay.

To be fair, Rodwell asked for this story to be delayed for another week to allow for an announcement on new initiatives and progress to date. Unfortunately this writer has waited since July for an interview and couldn’t delay any further because of the magazine deadline.

This latest report, for which we don’t have the terms of reference, is in addition to the report “Restoring Profitability to the Strong Wool Sector”, released in February 2010.

The recommendations in this 28-page report, commissioned by the Wool Industry Task Force set up by the National Government’s Minister of Agriculture David Carter in July 2009, apparently wasn’t what this latest wool industry think tank wanted.

It seems Carter’s report is collecting dust on a shelf in the Beehive and it seems no effort or actions have been taken to implement any of the recommendations.

Commissioning another report is history uprepeating itself. At least 30 reports have been commissioned over the past 30 years. And coarse wool farmers have failed to take action or adopt any of them. The common theme with all of them has been recommendations to increase wool prices and on farm profitability.

The following statement is from the Wool Industry Network’s “Model for Change” report, produced in 2007.

“Co-operation between growers, industry and the market is the surest way for each to benefit. None can act in isolation of the others. The advantage of market-led initiatives is; consumer understanding, ready-buyers, and an opportunity to plan wisely for the future.”

While it is good to see a younger generation of farmers and industry representatives working in the wool supply chain and textile industry showing interest, they will have to be more motivated to invest and innovate to capture a greater share of the consumer product value. History clearly shows that if farmers and the supply pipeline continue to trade individually, and focus on increasing wool price in isolation from consumer products made from NZ coarse wool, they will fail.

The key finding in both the “Wool Task Force” and the “Vision and Action” reports is that the central challenge to improving wool prices and profitability for NZ’s coarse wool clip and textile industries in NZ is to increase international demand for textile products made from NZ coarse wool. That’s an ill-considered assumption: history has clearly proven otherwise.

While there is no quick fix for increasing the onfarm price per kilogram for coarse wool, there is a desperate need for a collective commitment from sheep farmers and the wider wool industry to develop a new approach to trading and marketing NZ’s coarse wool. But that is not the only solution.

The report recommends three key actions – these are copied from the report, so please accept our apology for the jargon, buzz words and meaningless phrases.

The recommendations are:

- Develop a market-focused investment case and strategic roadmap for the strong (coarse) wool sector.

Partner with a group of global experts capable of providing an “outside-in” market perspective to identify opportunities for the New Zealand strong wool sector and an investment case for players within the sector to take advantage of these opportunities. By putting consumers and end users at the heart of what we do and understanding their needs, we will be able to position New Zealand strong wool as the high-value natural fibre of choice. This will increase demand for strong wool and lift profitability for all parts of the sector. - Establish the capability necessary to get the sector match fit and ready for the opportunities ahead.

New Zealand’s strong wool sector needs to rebuild its capability to do the work that keeps the sector functional, agile and responsive to new opportunities. An executive officer should be appointed and supported by existing expertise in the wool sector and government agencies to undertake immediate actions in the following areas:- Skills training and capability development

- Research and development

- Accreditation and standards

- Sector data and statistics

- Sector connection and coordination.

- Establish a governance and coordination capability.

To transform the strong wool sector, we need a strong, collaborative governance, coordination and leadership group that represents the sector, builds on the PAG and brings together strong market perspectives with government. This group will be responsible for overseeing development of the investment case and strategic roadmap, providing governance for the executive officer, restoring the sector’s core capabilities and informing actions and investment by government agencies and sector participants to support the sector’s development.

The report says the recommendations are based on historical information and reviewing previous attempts at structural reform over the past 20 years. None of the past reforms have been initiated, so we trust this committee of experts has learnt not to allow history to repeat itself.

The report also says the perilous state of the coarse wool sector is placing sheep farming at risk. It isn’t. Farmers will continue to farm sheep and complain about low wool prices and costs of production and harvesting. They always have, even when the coarse wool market indicator was $6.80/kg in 1989.

Other publicly funded sheep and wool reports and projects are being delivered and managed by the NZ Merino Company, which have been funded by the Ministry of Primary Industries (MPI) and the Primary Growth Partnership (PGP) as well as invisible industry funding.

The MPI website is littered with Wool Unleashed (W3) and NZ Sheep Industry Transformation programme (NZSTX) progress reports. These reports make unsubstantiated claims of exceeding targets and adding value, increasing wool prices and onfarm profitability. They are written in a language that is subjective and vague. Graphs are exaggerated images without factual data, making them meaningless.

The W3 project aims to deliver Fit for Market (FFM) thinking to the coarse wool sector.

There is also the NZSTX programme. This project is a partnership between the NZ Merino Company Ltd (NZM) and the Ministry for Primary Industries (MPI) with the objective to transform the NZ Sheep Industry. It is jointly funded by the Primary Growth Partnership (PGP) and was initially a five-year programme that started in September 2010. The programme was extended for a further two years from July 2015 to enable unfinished work to be completed in the Production Science work stream.

Total funding is $33.5m ($1.20/sheep), of which the Government is funding up to $16.8m.

It says the aspiration of the programme is that by 2029, NZSTX will transition half of the NZ coarse wool growers into production systems whereby they produce FFM meat and wool products from true FFM sheep. The report also says NZM’s aspirational objective is to add two billion dollars per annum to the NZ sheep industry by 2029.

MPI’s website states that the estimated potential economic benefits to NZ will be a conservative $250m a year in economic benefits by 2025.

There are three projects:

- Transforming demand for FFM fibre (completed)

- Transforming demand for FFM meat and co-products (completed)

- Growing NZ’s FFM base through production science (genetics, forage and animal health) and farmer uptake. In 2015 this project was extended and funded for another two years to 2017. (Should now be completed).

However, despite all this funding and applied research, wool prices have continued their downward trend – in March 2017 the coarse wool indicator was NZ$3.92; at the end of August 2020 it was $1.89. MPI’s projected added value of $250m a year and earning an extra two billion dollars by 2029 looks like a pipe dream.

The United Nations declared 2009 as the “International Year of Natural Fibres”. The aim was to raise awareness and stimulate consumer demand for natural fibres and products, as well as encourage Governments to develop policies supporting industries using natural fibres.

A search on the internet shows the Government has poured more than $80m into coarse wool research and product development since 2011. All the research projects have promised increased wool prices.

But for the past decade coarse wool sheep farmers have chosen to work as individuals. They have chosen not to invest in harvesting, research, product innovation or market development for the types of wool they produce.

So if it’s not coarse wool sheep farmers benefiting from all this Government funding, who is?

It seems commercial enterprises such as NZ Merino Company, New Zealand Wool Services International (now an overseas owned company), AgResearch, Lincoln Agritech and Otago and Massey Universities, the Ministry of Business Innovation and Employment and Wool Industry Research Ltd are the main beneficiaries.