Skins in the game

By Glenys Christian

With shipping delays and price increases, a drop in car manufacturing due to component shortages and wool prices slipping back after recent lifts.

Until about 25 years ago cattle and calf hides as well as sheep pelts were processed locally, but with increased investment required to keep competitive with China and Vietnam, domestic manufacturing shrank. Most finishing work is now carried out overseas with only one local tannery carrying out that operation in Wanganui.

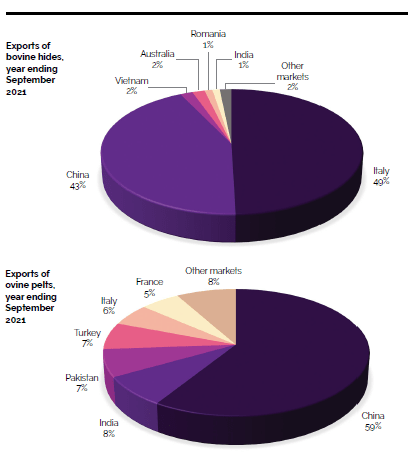

From January to August 2021 exports of hides and skins were worth $112 million, an increase of nearly $10m on the same period in 2020. Beef hides accounted for all this increase, and were worth $89m, up $11m from the same period last year. The two major markets were Italy, taking $46m worth of mainly wet blue hides, where the leather is tanned but not dried, dyed or finished. Salted hides generally go to China.

Wallace Group’s tannery operations general manager Ted Hulbert says prices have bounced back since the middle of last year when he described the situation as “just horrible”.

Then farmers were warned they might have to pay the company to collect dead calves and cows, which make up a quarter of its processing throughput. That was due to international leather prices being the lowest in almost 50 years. Since then not only have prices increased but industry rationalisation had seen more processing of hides and pelts closer to their source.

Lighter-weight cow hides were still under pressure from alternative footwear such as Allbirds, made from wool. And many people were wearing casual shoes, particularly if they were working from home rather than in an office through Covid-19 lockdowns.

Heavier bull and steer hides had found a good market in the automotive industry but less were now being used, magnified by a widespread backlash by some consumers against the use of animal products.

“There’s always pressure on leather to prove that processing is environmentally friendly,” he says.

That means some consumers prefer to spend $100 on a cheap man-made jacket they would throw away after just a year rather than a more expensive leather one that would last.

The increase in shipping costs is affecting returns with jumps from $US2000-7000 to ship a container to Italy which can add from $US6-$7 a hide.

Prices rebound

With high-end accessories such as handbags made from calf skins, prices have rebounded to where they were two years ago, with Italy taking 60 to 70% of exports.

Tony Egan, managing director of Greenlea Premier Meats, which has co-owned Wallace Group’s tannery operations with Wilson-Hellaby since last year, says the improved prices for pelts and hides provides a counter to recent increases in freight rates. While more demand is being seen as the confusion of Covid-19’s effects last year subsides, shipping delays present logistical challenges which are likely to last into the new year.

“And dry goods make an easy target when there’s pressure on the system,” he says.

Greenlea is working on marketing initiatives, emphasising sustainability, to move hides to a higher level of sophistication in the marketplace. This involves identifying companies with suitable branding in order to further enhance the good reputation New Zealand hides, especially those from the North Island, already had. It is early days but already one suitable United States company has been identified, and it is hoped to extend that to a range of others in different countries.

Alliance Group specialty ingredients and materials general manager Derek Ramsey says hide prices have increased from 69-135% and pelts by 28 to 100%, so fewer skins have been composted than in previous seasons.

Global shipping costs, delays and shutdowns have seen a reset of the marketplace, so China now views NZ as a closer and faster option for supply than South America. It is also more confident in its trading outlook with the US under the Biden administration. But intermittent power cuts have seen tanneries close without planning or warning.

Demand from the automotive industry is down due to the long-term trend of moving to vegan interiors, with BMW and Volvo the latest car companies to say they will reduce the use of leather in future models. And production is constrained due to a shortage of semi-conductors.

The trend over the next 10 years is for a decline in use and price for skins.

“Fast fashion prefers synthetic, which delivers faster timelines and cheaper input costs,” he says.

Alliance’s strategy is to find key partners who value the circular economy of animal products rather than synthetic options, which often have similar carbon footprints.

The company is encouraging its leather industry partners to move to more sustainable practices such as vegetable or eco-tanning, which use natural tannins. Combining that with sustainable farming practices, regenerative agriculture and traceability gives NZ an extraordinary story to take to the market.

Prices up 35%

Ramsey says calfskin demand is strong with pricing up 35% on last year. Consumers have been spending lockdown savings on luxury goods such as handbags, with Alliance supplying Italy’s €6 billion ($NZ9.8b) luxury handbag industry which is home to global brands such as Gucci and Prada.

Silver Fern Farms (SFF) decided to bring sales for its hides and skins back in house earlier this year, as part of a strategy to get closer to customers and markets. It wanted to better understand market dynamics and how it could work with current and future customers to deliver products and share value, a spokesman says.

While there was good demand for hides and skins earlier in the year with strong discretionary spending on items such as leather furniture, there has been a dip in the final quarter of the year. Part of that was due to recent constraints with automotive industry. But while that is having an impact on demand for hides for premium automotive upholstery, the longer-term outlook for sheep pelts demand is positive.

In contrast to hide exports, those of sheep pelts have decreased, worth $23m in the year-to-date, down $1.6m on the same period last year. But the major market, China, saw an increase in exports, up $400,000 to total $13.6m.

Bruce Reay, chief executive of Hawke’s Bay specialised ovine skin processor, Progressive Leathers, says there had been a general lift in demand for sheep and lamb skins along with the rise in wool prices. Previously the number of skins de-woolled had been reduced because of the cost of doing so, the drop in slipe wool prices and strengthened environmental constraints. But with wool prices lifting over recent months that had meant a return of about $3.20/kg clean on the floor for slipe wool. Under Level 4 lockdown conditions wool scours couldn’t operate as they weren’t regarded as essential business. So with wool accumulating onfarm prices have come back to about $2.70/kg, he says.

But lamb pelts had been giving a positive return to farmers over the last 12 months after being negative for many years. Demand from France has dropped to be replaced by Pakistan and India. With salted pelts being a commodity product the supply chain timeline is tight, so there are challenges around the lack of shipping space as well as hold ups with containers in Singapore.

Sheep pelts which had been difficult to sell went mainly to be processed into chamois leather in Turkey to then be sold in large US retailers. Italy also took some of these skins as well as Poland. But with no demand for skins with less than an inch of wool on them, many had been shredded or composted. Previously they had gone to landfills but are now rejected for environmental reasons.

About 95% of salted wool skins had been going to Chinese tanneries which are coming under pressure to convert from coal to natural gas, causing a reduction in demand. South American countries have taken some of these skins in the past but freight costs are now higher, reducing the return received. And white sheepskin rugs sourced from NZ but processed in India have also been hit as tariffs imposed by the US in recent years are still in place.