Qualified support for levy

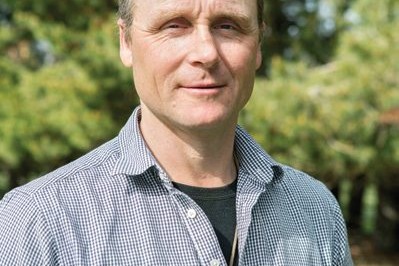

North Canterbury farmer Mark Zino would pick the farm level levy out of the two main He Waka Eke Noa greenhouse gas agricultural pricing options.

NORTH CANTERBURY FARMER Mark Zino would pick the farm level levy out of the two main He Waka Eke Noa greenhouse gas agricultural pricing options.

But he’s not that happy about it. He sat through the first webinar and plans to attend another and also the in-person workshop, if space.

“The whole thing’s got big issues and I can see Beef + Lamb and Dairy NZ have got a hard job trying to find a way through.”

They are doing their best to find a solution that suits 25,000 different farming businesses, he says.

“That’s a lot of farmers to work with.”

His gut feeling is that accounting for onfarm emissions must be done at the farm level – days stock spend on the farm. He says a tax at the processor level option two, when an animal gets killed, means it all falls on finishers. It also doesn’t reward a farmer who grows lambs with fewer emissions.

“If we are all in the canoe together, then it needs to be fair for all types of farmers and be geared to drive change onfarm.”

He says the finisher would have to pay all the levy although the lamb, calf or deer is sometimes born and raised on a separate breeding farm.

“The breeding property has emissions too.”

For such important and ground-breaking legislation – a first in the world – he believes it’s being rushed through.

“Farmers need a year to work it through, not two months.”

He has issues trying to resolve that NZ farmers are very efficient at growing meat in terms of emissions per kilogram when compared to other farming countries, but are going to be the first globally to be taxed.

“I feel a bit like a sacrificial lamb on the world stage.”

He says is really about burning fewer fossil fuels and providing the world with high quality food from efficient farming systems.

One thing is very certain for him. He is not in favour of the proposed 2008 cut off for eligible exotic forest, shelter belts or riparian strips to be included as offsets.

They say this is because the satellite imagery is not good enough until 2008, but it just wipes a whole lot of our farm amenity plantings off being eligible and we have records of what was planted and when. It’s about 40 hectares.

Farmers have paddock plans, diaries and records that can show tree planting back to 1990.

Farmers should be given credit for all of their onfarm trees for sequestration value.

“If you want to levy me for emissions, you’d better let me claim all of my sequestration onfarm, otherwise it is simply an unfair tax.”

He also argues green grass under irrigation should be counted.

The proposed administration costs are a bit frightening, he says. Zino would like to see every proposed levy dollar stay onfarm to be invested in emission reductions. This could be externally audited to ensure emission reductions are happening.

“It is very obvious that a levy is a very inefficient way of delivering emission reductions onfarm – most of the money will be wasted in bureaucracy before it even hits the farm level, to actually reduce emissions.”