Outlook for prices strong in 2022

Record prices for export beef have continued into 2022, despite continued disruption to international shipping, Mel Croad writes.

Record prices for export beef have continued into 2022, despite continued disruption to international shipping, Mel Croad writes.

Farmgate beef prices have hit the ground running in 2022. Prices have never been stronger for this time of the year as export demand underpins returns. This is in stark contrast to the opening months of 2020 and 2021 where depressed prices featured heavily.

What caused the low prices in ’20 and ’21?

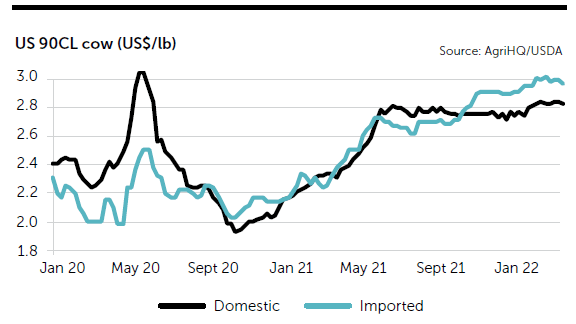

Basically, prices dropped so low during our first run with Covid-19 in April 2020 – they took a long time to recover even to near normal prices. Then we had a large flow of cattle into processing plants through early 2021, depressing prices again – alongside a stuttering foodservice sector.

That all changed from April 2021 when global food service started to recover and markets looked for beef. That trend hasn’t stopped hence the strong export prices achieved into 2022 which has kept farmgate prices at a record high for this time of the season.

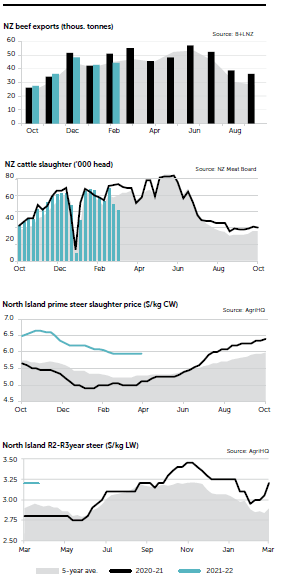

North Island bull and prime steer averaged $6.14/kg in January, a year earlier prices were languishing at $4.90-$4.95/kg. This equates to a $360-$375/head year-on-year premium on a 300kg carcase animal, giving a very clear indication of the different market dynamics at play this year. South Island prices displayed similar trends in January although the pricing difference was slightly greater enabling increased returns of $390-$420/head.

Seasonal pricing trends since January have seen farmgate prices edge lower, but nothing to the extent farmers usually expect. Give or take, the average reduction has been close to 20c/kg but even with this downside accounted for, prices are still a record high. Considering prices tend to bottom out through these late summer months, the outlook for beef prices remains strong well into 2022.

What’s driving it?

A few key drivers are underpinning this strong pricing run. Domestically the supply of cattle into processing plants has been limited since the start of the new processing season on October 1. At nearly the halfway point in the processing calendar, the national beef kill is running 6% or 70,000 head behind last season – this is almost split evenly between the two islands.

Tougher spring conditions knocked the condition of killable cattle, delaying their arrival into processing plants. Many were forced to carry cattle into the new year and even now there are reasonable volumes of R3 cattle trading on the store market.

The arrival of Omicron on our shores has also impacted processors’ ability to efficiently operate plants due to a lack of available staff. This has further impacted slaughter numbers since the start of March and led to backlogs developing at plants across the country. Fortunately, these backlogs have not translated into significant pricing pressure at the farmgate. This suggests prices have been more in tune with export returns than previous years where procurement pressure was the driving force behind farmgate prices.

Average export values (AEV’s) for New Zealand beef have been on the march higher since April 2021, underpinned by a well-documented recovery in the global foodservice sector. However, shipping logistics are still slowing parts of the global supply chain, and lower beef production in key markets, continue to prolong the sense of urgency globally to secure beef.

AgriHQ data shows AEVs for beef in April last year were $7.72/kg. By February this year export values for beef had broken a record for the third consecutive month, pushing to $10.40/kg. This is a little over $3/kg or 43-44% above both last February and the five-year average for the month. The NZ dollar also helped drive export returns for beef through February.

The counter seasonal shift higher in AEVs through January and February for beef was unexpected. It has meant relatively stable, albeit record farmgate prices for this time of the season. While there are questions as to why farmgate beef prices haven’t shifted even higher to reflect the record export returns, there are a few factors to consider.

Plants unable to run efficiently

Meat processors are dealing with a vastly complex landscape in terms of increased costs right throughout the supply chain. Shipping and freight costs have gone through the roof since the start of the pandemic. Equally labour costs continue to punch higher. But the real kicker has been the inability to run processing plants efficiently.

The community spread of Omicron through NZ has further tightened the labour force, reducing plant capacity but doing little to reduce overheads, therefore eroding margins and profitability. Fortunately costs and returns have moved in tandem. Achieving this balance has meant record farmgate prices have been maintained through early 2022 while also accounting for high costs of producing and exporting beef.

Regardless of the slower throughput at processing plants, NZ beef exports this season haven’t fully reflected the lower production. Total beef exports for the season to date clicked over 200,000 tonnes by the end of February. This was a reduction of 6000t on last season. However, when viewed against historical data, it is the second highest export volume recorded for the first five months of any export season.

Despite all the disruption to global shipping lines, NZ beef continues to access key markets. There has however been some redirection to Asian markets where shipping has been less of an issue than accessing the United States market.

China remains our largest market based on volume. This season NZ has shipped 86,000t of beef there, a lift of 5000t on last year. This takes China’s market share of NZ beef to 43% up from 39% over the corresponding period last season.

The US market remains in second position, however volumes shipped there have dropped by close to 8000t this season. This is despite the record prices on offer within this market. Again, shipping congestion at key ports on either coast of the US continue to hamper trade to this market. Fortunately, overall demand for NZ beef has been widespread this season, which has spread the risk profile and enabled beef returns to trade across the top of the market.

Omicron, drought hit

As the autumn cow cull gathers momentum there is concern that the three short processing weeks through April will condense the kill into May and possibly stretch it out into June. How this processing period plays out will also be determined by how far through the Omicron wave NZ is and whether processors have recouped staff numbers.

By early April, most North Island processing plants were starting to claw back capacity as staffing numbers improved. In contrast, many mid-to-lower South Island plants were only just taking a staffing hit. Unfortunately drought conditions in Southland have added to these processing woes within the lower South Island. The inability to shift finished stock off-farm and into processing plants has also stalled the store market in these regions.

Overall, store cattle prices are the strongest they have been for four years on a straight cents per kg basis. But relative to where farmgate slaughter prices are sitting, they could be considered on the soft side, suggesting buyable store cattle still exist. But slow going in the processing space is delaying the return of buyers to the store market, keeping demand in check.

The strong start to the year for beef prices does appear to have the stamina to continue towards spring. AgriHQ recently forecast a return to pricing upside from early winter centered on an improvement in processing ability and a continuation of strong export demand.

- Mel Croad is a senior analyst for AgriHQ.