BY: JOANNA GRIGG

Wide-spread vaccination protection against Covid-19 should revive restaurant dining. But don’t expect to see it translate into price lifts for prime cuts of meat, until late 2021.

Deer Industry NZ (DINZ) is expecting improved market conditions for venison in the coming year, with better prices for supply in the European game season. Restaurants are starting to reopen in North America.

“Prices for all meats in major world markets have begun what economists expect will be a steady long-run climb,” DINZ chair Ian Walker says.

“In the next few weeks some venison companies will be offering minimum price supply contracts for the game season, for shipment of chilled venison during September and October.”

Westpac Bank senior agri-economist Nathan Penny, expects Covid-19 vaccine rollouts will boost demand for New Zealand meat, first in the United States – where the rollout is going very well – and then later in the year in the European Union and the United Kingdom. This boost will add to the demand strength already present in China.

“That means venison prices, which have been hardest hit, are also likely to turn the corner as European meat demand returns,” he says.

“We expect the farmgate venison price pickup to materialise from around mid-year.”

US bull beef and EU lamb leg prices have both jumped by about 10% above 2020 prices. The note of caution is the strength of the NZ dollar, which has firmed about 10% against the Euro and US dollar since October. This is taking any shine off.

Exports of high value frozen lamb were impacted in 2020, especially in the US and EU. In January 2021, ANZ Research reported that French racks were trading at a significant discount (approximately 35% down) on the five-year average. NZ lamb prices through February held around $6.50/kg/CW however – up on predictions.

“We expect the farmgate venison price pickup to materialise from around mid-year.”

Silver Fern Farms supply chain general manager Dan Bolton, takes a more tempered view of the likelihood of a quick bounce back in foodservice sector prices, following vaccination rollouts.

“While there is some positivity, we need to ensure it’s not speculative, and actually reflects market returns.”

“It is too early to reflect this in our farm gate price outlook.”

Silver Fern Farms will offer special pricing options for winter lamb despite the market being focused very short term.

“Due to current market and supply chain risks our customers continue to play a short game with commitments, which means our pricing signals to farmers are also shorter than normal.”

“Having both an active foodservice and retail-ecommerce channel builds the market tension we are missing at present.”

While restaurants may start to open, getting meat there is the hurdle.

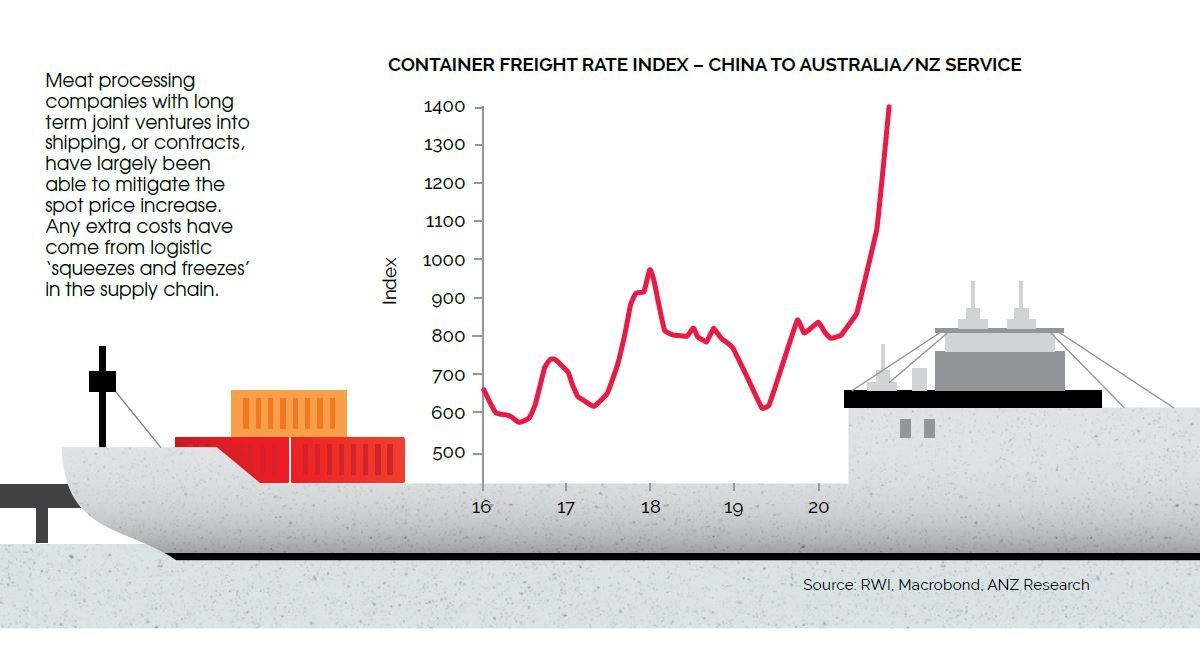

Any vessel calling at the West Coast of the US needs to wait two weeks off the coast before getting a berth. This ties up critical vessel and container capacity. As a result, shipping lines are moving less volume at the same cost. The demand on shipping lines to move product from China and the rest of Asia to the Americas and EU is at unprecedented levels and is forecasted to continue until the end of 2021, keeping shipping lines at capacity, Bolton says.

Eleven years ago, Silver Fern Farms made a decision to enter a joint venture partnership with Fonterra, known as Kotahi Logistics. It exports one third of NZ exports. This has mitigated shipping costs, Bolton says.

“These partnerships mean we have the best chance at minimising impacts back onfarm.”

“Our shipping rates are set for the 2021 period, but the business is facing significant costs for additional storage, detention and demurrage, congestions fees, cost to re-route product, and costs associated with higher inventory levels.”

“We are hearing that some spot rates are six times higher than normal at present,” he says.

“Silver Fern Farms and our suppliers have the benefits of our strong logistics partnerships but also our long-standing cold store and transport partners, which help us achieve priority access to shipping, transport and cold store capacity and access to empty containers.”

“If we are not continually shipping product, we will come to a standstill within 10 days.”

Bolton says their business continuity planning sessions are a key focus for them.

Summing up the 2021 trade outlook for grassfed and sustainable red meat, Bolton says though demand is good, market pricing is lower than where he would like.

“Our customers remain conservative and are continually impacted by on-going market and supply chain disruptions that can change on a dime.”

“And for farmers, we are well aware we have dry areas and are entering the peak cull cow season.”

He is grateful to farmer suppliers who sent messages of support to processing workers in 2020 and sees company and supplier relationships as strong.