Lamb prices hit record levels

As restaurants start reopening in export markets, lamb prices have recovered to reach record levels. Mel Croad reports.

As restaurants start reopening in export markets, lamb prices have recovered to reach record levels. Mel Croad reports.

The lamb market has witnessed a phenomenal turnaround in demand and pricing in the second half of 2021. This has flowed through to strong upside at the farmgate with prices already at record levels.

Much of this improvement stems from key markets rolling out Covid-19 vaccination programmes. Almost overnight restaurants started reopening and with that, tourists gained freedom to travel, throwing the foodservice sector a lifeline.

Competition with the already strong retail sector to secure and rebuild supplies of red meat protein has been replicated through numerous key markets, leading to strong pricing upside for our exports. Regardless that lamb is considered a niche product, it continues to move in tandem with other red meat proteins and benefit from the strength of consumer demand.

With little competition in the global lamb space, New Zealand exporters have noted rapid upside in asking prices as demand outpaced supplies. Key indicator prices are breaking new ground or at the very least pushing well ahead of year-ago levels as markets re-awaken and look for product.

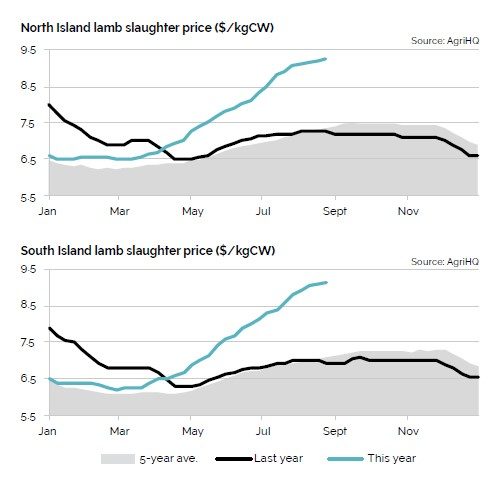

At a farmgate level, prices for lamb have soared. Expectations were formed back in March when supply contracts started to be released by meat companies to secure the supplies they needed. Having traded sideways for the first quarter of this year at $6.30-$6.50/kg, the release of these contacts gave the market an injection of confidence it was so desperately lacking.

AgriHQ reports prices have lifted by $2.55/kg since the start of April – this compares with the usual $1.05/kg. The strength of the overseas market and a slowdown in the supply of lambs to processing plants has enabled farmgate prices to lift to record levels.

As more and more supply contracts were released for early winter, it became apparent the market was shifting towards a new level. As a result, the flow of lambs into processing plants diminished as farmers opted to wait for the higher prices further down the line.

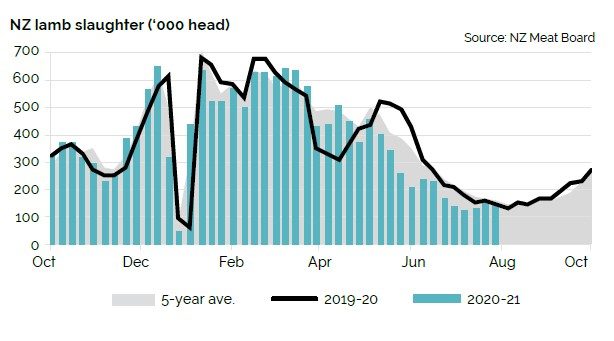

This scenario possibly wasn’t anticipated and resulted in greater procurement pressure early on to entice a more even flow of lambs into the processing plants. However, as the estimated slaughter stats show – the higher prices through July still weren’t enough of an incentive.

Meat Board data shows weekly lamb slaughter rates in May were averaging 154,000 head/week in the North Island and 204,000 in the South Island. By July the weekly average had fallen to 102,000 and 28,000 head in the North and South Island respectively. It is usual for slaughter rates to drop between May and July, but this year’s July kill is 18% lower than normal in the North Island and 42% down on normal in the South Island.

Instead of increased slaughter rates through July – more activity was noted in the sale yards.

The release of a $10/kg contract, by one meat company for late September created an immediate scramble for store lambs as plenty looked to cash in on this eye-watering high price.

Despite this contract being filled almost instantly, it sparked plenty of demand for lambs, drawing store prices higher than many had anticipated. As store lambs rallied to $200/hd and above, more lambs were recycled through the saleyards to capitalise on these heated prices.

The high prices paid to secure these lambs means for many the need to take them to heavier finishing weights to extract a reasonable margin. This is also adding to the slowdown in slaughter throughput and increasing the risk of a very congested lamb kill through September.

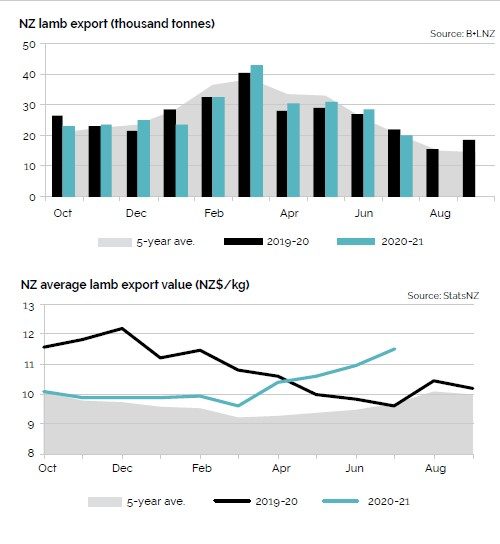

Surprisingly the tighter slaughter rates over winter haven’t impacted export volumes. NZ has shipped 79,000 tonnes of lamb between May and July. This is higher than for the corresponding period over the last two years.

Based on the high prices received for lamb into key markets, exporters will have drawn on stocks of lamb in storage to complement the supply. The average export value for NZ lamb into export markets has soared in the second and third quarter of 2021. Since bottoming out in March at $9.61/kg, strong overseas demand has propelled export values to record high levels.

July values averaged $11.51/kg. This is $1.90/kg above year-ago levels and $1.83/kg higher than the five-year average – a clear indication of the strength of global demand. 52% or 41,000t of NZ lamb exports were shipped to China over this three-month period.

Demand from the United States has also recovered with prices spiking and exports lifting. About 10% or 8000t were shipped to this lucrative market, where key indicator cuts such as Frenched racks are pushing back towards pre-Covid-19 levels. Demand from the United Kingdom and Europe has been mixed, with shipments to France remaining on par with historical levels however the UK and German markets have been quieter than normal.

Robust finish predicted for season

While the market traverses the winter slowdown in production, the outlook is for these strong conditions to flow into the new season.

Early indications point to Average Export Values for lamb climbing even higher between August and early October. This aligns with the usual peak in farmgate prices around late September/early October as markets gather supplies for the Christmas chilled trade period. From late October increased buying from China will commence as they look to secure increased volumes to service Chinese New Year celebrations in early February 2022.

The recently released Stock Survey report from Beef+Lamb NZ encouragingly points to the expectation of a larger lamb crop this season. Most of this is derived from easier weather conditions through early lambing and better scanning results compared to last season rather than greater breeding ewe retention.

These numbers will be revised in November once docking/tailing is generally complete. Any upside in lamb numbers shouldn’t be viewed negatively given the strength of overseas demand, with markets in a position to absorb larger numbers. If anything, the upside in lamb numbers may be confined to more lambs prior to Christmas.

Early lambing mobs are still finding favour with farmers, however hill country breeding properties – often key suppliers of later-born lambs – are falling victim to changing land use patterns, especially from the spread of forestry or carbon farming in some regions. This could pose a further challenge through mid-2022, if kill rates are skewed to earlier in the season.

Despite the encouraging signals from key markets, there are also several external factors worth flagging that could take some of the shine off what will be a record start to the new season. Staffing at processing plants and shipping have been two issues plaguing the industry since last year and neither appear to have made any concrete improvement. Therein lies a potential worry about processing ability leading into Christmas and what that could mean for farmgate returns despite favourable export markets.

The last thing the industry needs is the inability to process livestock in a timely manner, especially heading into summer.

While new season lamb prices will benefit from strong global demand there will still be the usual seasonal pricing downside into the new season as lamb supplies ramp up and export demand reverts to a greater proportion of frozen cuts. However, with farmgate lamb prices set to peak at the mid-$9/kg level, any ensuing downside will still result in a much higher price for new season lambs than last year.

Several supply contracts released by meat companies covering early spring through to Christmas provide a glimpse at where prices may track, however AgriHQ forecasts point to a more robust finish to the remainder of 2021 with farmgate lamb prices remaining above $8/kg in December.

Ewes with lambs at foot all counted are already selling well in the early regions with prices ranging from $100-$125 depending on the ewe condition and number of lambs. Interestingly this market was firmer in August 2020, despite farmgate prices for lambs being softer then. This possibly indicates some of the feed pressures farmers are under in certain regions.

A stronger pricing start to the new season is positive for those who can get lambs away early, and it will also underpin a firmer store market for those early trading lambs.

While store prices are partly connected to weather and feed conditions, they will also reflect the strength of farmgate slaughter prices. While the store market will start strong it will inevitably reflect increasing store numbers for sale and the downside in farmgate slaughter prices into December and ease accordingly. However, if spring feed conditions keep competition strong for store lambs, the downside in pricing may be softer than usual, reflecting a level of confidence in the longer-term prospects for the market.