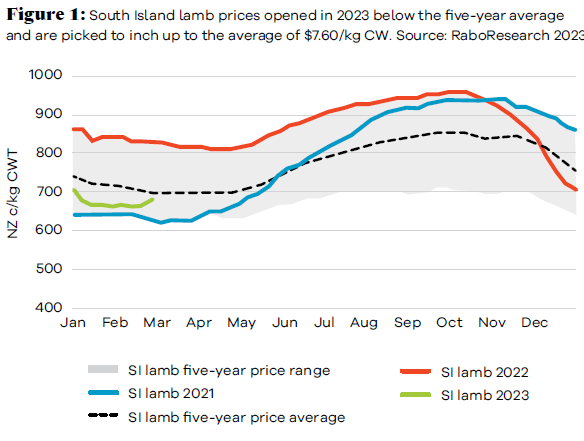

LAMB AT $6.60/KG carcaseweight (CW) felt like such a time in the doldrums, given the super summer prices of 2022. Farmers tried to be consoled by the fact it was only a shade below the five-year average for mid-February. But when will it bounce up?

Rabobank analyst Genevieve Steven carries out “educated” crystal-ball gazing for a job. “At the bank we are looking six months out, but also looking at trends that will influence prices five years out – what are the upside and downside risks.”

She said we saw some promising signals from the United States and China through February and expect schedule prices will continue to lift over the coming months to levels in line with five-year average prices.

The five-year average South Island lamb price is $7.60/kg CW for lamb (across the whole season).

Higher returns for lamb and mutton in China would bolster schedule prices. With lockdowns in China lifted and life starting to return to normal, sheep meat demand and pricing is expected to tick up gradually through the year, Steven said. But there are some downside risks to the schedule, as farmers keep lambs longer to add extra weight, we could see more lambs coming out in March and April.

“Processors could possibly respond by holding prices or taking a few cents out of the schedule if a situation arises where there are backlogs – this scenario is more likely in the South Island than in the North Island.”

Another factor to consider is the additional bobby calves that need to be run down the slaughter chain this spring, due to changes in Fonterra’s policy.

“They may come on stream when farmers are selling those Merino/crossbred lambs that went through winter,” Steven said.

“The schedule is heading in the right direction, but don’t fantasise about big schedules anytime soon.”

The record highs seen in 2021/2022, are unlikely to be seen again in the medium term, she said.

Steven’s advice is to do what’s right for your farm – do a good feed budget and gross margin analysis and explore selling store lambs if a feed market is pushing them to good prices.

Mutton kill is well behind in the South Island, because of labour challenges and little demand from China, Steven said. Demand from China is strongest during their winter months and in the lead up to the Spring Festival.

In 2022, 206,000t of NZ sheep meat was exported to China at an average price of $7.65/kg FOB (free on board). This was down from $8.19/kg the previous year, she said.

Chief economist at Beef + Lamb NZ Andrew Burtt said by early March, the vibe from meat companies went from being nervous and hopeful to feeling a lot more confident about lamb.

NZ lamb is expected to recover to near levels achieved last season, despite the weak start. B+LNZ is forecasting that at an exchange rate of US$0.63, the average farm gate lamb price to be 760c/kg for 2022/23. Burtt said the farm gate price can be different to the schedule base price as it reflects what is actually paid to the surveyed farmer, including premiums.