Challenges aplenty for exporters

Export markets are improving for New Zealand beef, but consumer behaviour in China has not returned to pre-pandemic levels, there’s continual competition from other countries, and people’s tastes are changing. By Glenys Christian.

Shipping and labour disruptions caused by Covid are still affecting all markets.

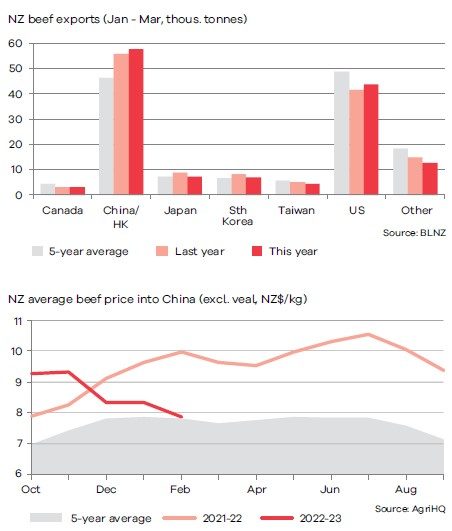

Meat Industry Association chief executive Sirma Karapeeva says New Zealand’s exports to China grew by 4% in 2022 to 219,000 tonnes and their value lifted 34% to $2.1 billion.

“But the recovery is remaining somewhat underwhelming. The Chinese consumer is remaining cautious and their revenge spending, which was predicted, isn’t really happening as they’re concerned about their jobs and income.”

There are predictions of 4.4% growth in the overall meat market for the coming year, as well as a growing shift from pork to beef and other meats. The Chinese government has been pushing consumers away from pork as a reaction to the African swine fever outbreak, meaning there’s less on the market – a “really positive” sign for NZ beef. And with another more recent outbreak, this could well lead to beef exports growing later in the year.

After a challenging last quarter for New Zealand beef exports in 2022 and a slow first quarter this year, Alliance’s category director for beef Darren Drury says the situation is looking a lot steadier than it has been in recent times.

“And we need that. It won’t be all plain sailing.”

Prices peaked in June and July last year but then tapered off by 20–30% by September, due to the Chinese government’s continued strict Covid control measures, which restricted economic activity as its citizens weren’t able to leave their homes.

“Given the scale of uncertainty associated with the situation, many partners began to slow their demand commitments as they sought to work out the future market needs,” Drury says.

China picks up

The end of January saw the most normal Chinese New Year holiday period for some years with people travelling to their families as well as eating out.

“That gave the economy a bit of a boost.”

By early February, prices had recovered by about 10% and have been steady since then.

“But the market feels flat,” he says.

“There’s no real dynamism. Consumers are becoming more discerning. They’re epidemic-weary and a new normal is for them to take a conservative approach. We’ve got to be very focused on the right cuts at the right value so a full range of markets is necessary.”

Silver Fern Farms (SFF) sales general manager Peter Robinson says China is slowly seeing a return towards more normal activities around dining, such as the restaurant trade.

“But there are still elements of conservatism.”

SFF had been part of the Taste Pure Nature programmes in China in the past year, along with its own-branded promotional campaigns, and the approach will continue this year.

Close competition

ANZ agriculture economist Susan Kilsby says with Australia well through its herd rebuilding phase, there could be greater competition in the Chinese market. Brazil’s beef trade was halted due to an incidence of BSE, but access was regained in early April this year, along with four new plants being certified to supply the market, the first since 2019.

Rabobank’s Beef Quarterly says Brazil achieved record export volumes and returns in 2022, thanks to growing Chinese demand. It’s forecasting total beef production to be steady in the first quarter of the year with a 5% lift in Australian production. And with an expected 2% increase in Brazilian production, that almost offsets declines in beef in the US, Europe and NZ.

Karapeeva says Brazilian exports to China sold at a lower price point but are expected to grow. However, NZ is sending higher quality and differentiated product as it is grass-fed rather than grain finished.

“And NZ is trying to make more of a bigger deal of our lighter environmental footprint.”

Other Asian markets of Korea, Japan, Taiwan, Thailand and the Philippines are important for diversification. Robinson says Japan is valuable as a chilled market, servicing the retail and food service sectors, particularly with cuts, such as tenderloins, striploins and cube roll. Japan, Korea and Taiwan offered viable alternatives when the US and China powerhouses came under pressure with their own lockdowns.

“They remain important from a competitive market angle, but they also have the potential to be a bigger part of our differentiated beef programmes, such as Reserve, Angus and Net Carbon Zero,” Robinson says.

After the US set records in both volume and value for beef exports last year, there’s now a contraction in production with beef cow numbers the lowest since 1962 and feedlot numbers down.

Karapeeva says while NZ’s leaner grass-fed beef complemented domestic production, there had been a slight decrease in imports in 2022. But a 1.5–2% increase is now forecast, as domestic herd rebuilding drove stronger demand.

Drury says Alliance has seen clear data for the past six to eight weeks that US domestic slaughter is tightening as farmers are growing what they can and holding off sending their cattle for slaughter. There had been a small appreciation in grinding beef prices, which were high early last year, fell in the middle and didn’t recover until late 2022.

“Now there’s a slow and steady increase with high US$2 a pound for lean meat being paid.”

There’s still good demand for grass-fed beef with consumers ready to pay a premium for this attribute, as well as antibiotic-free status and growth hormones not being used in NZ beef’s production.

Grass-fed getting a push

Robinson says stronger demand for NZ beef is expected over the next six months as large domestic inventories dwindle,which should mean good price growth. Grass-fed beef is creating a following, but consumers are wanting to go further in their buying decisions as they consider ‘better for me’, ‘better for the planet’ options. SFF believes this has created an opportunity for Nature Positive beef options, starting with products like Carbon Net Zero Beef, but these are likely to develop even further in the future.

With B+LNZ, the Taste Pure Nature campaign has billboards on the US West Coast espousing the benefits of NZ’s grass-fed beef, and telling consumers where to buy it locally.

Karapeva says the European Union (EU) free trade agreement (FTA) is delivering a smaller amount of access than expected. While beef production and consumption is declining, the market consumed 6.6 million tonnes each year.

“It’s still a big market and there will be opportunities.”

In 2022, NZ exports to the EU earned an average of $22/kg, more than double the average value in all other export markets.

“Even if the volumes are not great, the value holds up, it’s still lucrative.”

UK FTA implications

The United Kingdom (UK) FTA put NZ on a good path and is well placed to take up opportunities. However, a 1.5–2% drop in consumption of all meats is predicted for the coming year as household spending declines.

Drury says Alliance’s beef market presence is extending to the UK because of the strength of partnerships in that market and market familiarity with grass-fed beef. There are opportunities to grow its Handpicked Beef, which has been showing strong double digit year-on-year growth.

Robinson says initial discussions with various sectors in the UK suggest there would be good opportunities for manufacturing meat for the ready-meal sector as well as packaged cuts for the retail shelf. Options are also likely to be available for specialty programmes, leaning towards a Nature Positive offering for high-end food service.

Karapeeva says the labour situation at meat plants is still “a mixed bag”.

“Some companies have secured the necessary migrant workers to operate at the optimum level, but some are still struggling,” she says.

In some cases there’s frustration that the processing time for visas isn’t consistent.

“Some are processed smoothly but some are waiting for months on end.”

With the flooding earlier in the year, some farmers are taking a calculated risk and holding on to stock, meaning there could be a surge in processing demand in the next few weeks.

Robinson says SFF’s labour situation is improving but there are still some constraints. The company has had some success with overseas workers – 250 arriving since September 1 and another 240 expected in the next few months.

Kilsby says there’s likely to be an autumn bottleneck as stock from Cyclone Gabrielle-affected East Coast properties is finally sent off farm for processing. Some stock have been moved to grazing in other areas and there’s plenty of grass around. “But growth will slow down and there are fewer supplements around because it was too wet to make hay.”

With shipping, Karapeeva says feedback from companies is that there’s now a steady flow of product. “It’s on the mend. The crunch has eased but we’re not out of the woods yet.”

Repositioning of empty containers is still an issue. Typically a 20ft container is best for chilled product but there’s a general trend to move to 40ft containers to free up space and make shipping more efficient. But this could mean more complications for NZ exporters.

Drury says there’s now a steady flow of product into markets after a challenging period.

“Problems with the repositioning of empty containers will take a while to resolve.”

Robinson says SFF has seen some improvement in shipping services this year.

“But we still need to see a return to a full global schedule, vessels completing rotations as planned and improved equipment availability.”

Occasionally there’s a shortage of 20ft containers, which will only worsen as they aren’t replaced, but the move to 40ft containers had been well signalled by shipping lines.