Best direction steer calves

Kerry Dwyer samples the sales figures from Temuka saleyards to get a steer on the numbers of dairy-origin calves compared to those of beef breeds.

Kerry Dwyer samples the sales figures from Temuka saleyards to get a steer on the numbers of dairy-origin calves compared to those of beef breeds.

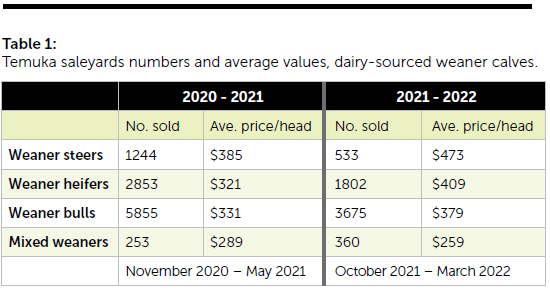

Last year I wrote an article on calf rearing, considering the number of dairy sourced calves sold at the Temuka saleyards in the 2020-21 season. It is interesting to do a comparison for the 2021-22 season to date.

Sourcing these figures I have used the saleyards results from Temuka over the times, noting that most of the weaner steers are beef-dairy cross, as are the weaner heifers. The bull calves are Friesians while the mixed are exactly that.

The sales to date in 2021-22 show the throughput at the Temuka saleyards is 2700 calves less than in the same time the previous season, while prices have generally risen by an average of $50/head, from $335/hd to $385/hd in 2021-22.

My estimated rearing cost, at June 2021, was $300/hd to get a calf to 100kg liveweight so the average reared calf will have given a profit margin of maybe $85/hd. Unless the price of a four-day-old calf is markedly different between beef calves and Friesians, bulls and heifers, then the best profit has been in the steer calves.

These figures raise several issues worth discussing further.

Sales numbers

The total number of calves sold at the Temuka saleyards this season is about 25% less than the last, by 2700 head. There is no accurate gauge for the number of dairy-sourced calves reared until they hit the saleyards or slaughter.

Taking the number of bobby calves processed off the total number of calves expected to have been born is a fairly blunt tool that might be accurate to within a few 100,000 calves. By comparison the number of beef-bred calves can be fairly accurately measured by the average calves rate of the number of beef cows, which is a far smaller number than that of dairy cows in New Zealand.

Does the lower throughput mean fewer of these types of calves were reared? Or have there been more paddock sales to make up the difference? Or have they been reared and retained onfarm? As a calf-rearer I would like to know where the difference lies because it impacts my business, lack of that quality information is a major impediment to planning.

Types of calves

The reduction in numbers has been spread across the three main sale types – steers, heifers and bulls, which may indicate a general reduction in calves reared.

Our calf-rearing operation has removed Friesian bull calves from the mix due to a lack of profitability compared with beef-cross calves, for obvious reasons as the figures show. It costs similar to buy and raise beef-cross calves as Friesian bull calves, with far better profit margins. The market pays a premium for beef-cross steers over beef-cross bull calves, of the same weight and the same breeding.

Mycoplasma bovis has reduced the movement of South Island calves to the North Island, which seems to be a major cause of the lower bull calf prices in the south. Without a census of what is shifted across the Strait it is difficult to quantify that impact, but it seems to have been enough to alter the South Island calf-rearing industry. Combined with the reduction in NZ pasture land and a general aging of farmers, bulls have become less attractive to many.

Profit margins

Rearing beef-cross calves, for sale as steers and heifers, feeds into the general prime and local trade beef system, which has been going very well with record high export pricing for the last year.

A few years ago the average annual margin on finishing cattle was about $500/head/year. In the past year that has increased markedly and margins of $1000/head/year or better have been achieved. That might indicate that store cattle have been under priced to some extent on the back of a general pessimism in the covid years.

I do wonder what is going on here versus Australia. Store cattle there are running at twice the price per kg liveweight (or more) compared to here. Their slaughter prices are higher also, but not enough to explain the relative differences to NZ. Exporting meat from NZ seems to consistently have pessimism attached to it rather than optimism.

I saw an article recently promoting rearing all dairy calves for beef, a noble ambition that may eventuate as dairy processors push to have no calves lost from the industry. To gauge the profitability of some calves we can look at what profit can be achieved on an average Jersey bull:

- 550kg liveweight Jersey bull = 300kg carcaseweight

- Average daily growth rate 570g/day

- Sold at $5.80/kg carcaseweight at 32 months age

- Consumed 7500kg DM to get to 32 months age

- Sale value $1740/hd / 7500kgDM = 23c/kg DM

Virtually all other beef rearing options can return better than 23c/kg DM, which puts the Jersey bull calf at a relative value of zero at 100kg LW. And that is without taking the attitude factor into account.

High milksolids pricing will have some impact on the numbers of surplus calves reared in the dairy industry, along with on-going staff shortages.

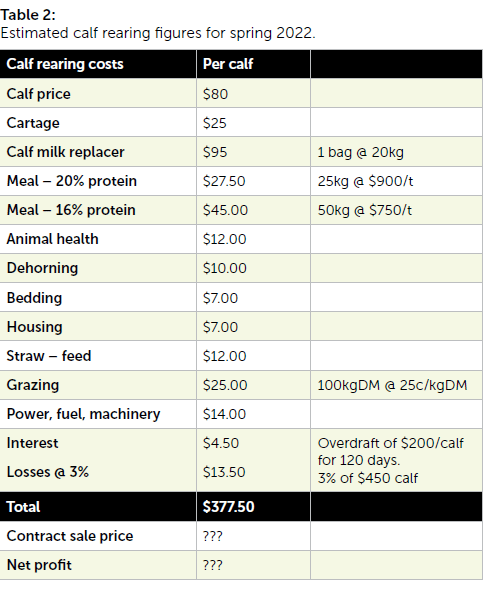

The 2022 spring costs

We have some autumn-born calves being fed milk at present, but how the pricing will work out for the spring of 2022 is not set as yet. We are seeing rampant inflation in most costs which will considerably raise our costs for the coming season.

Maybe it will look like the figures in Table 2.

- Kerry Dwyer is a North Otago farm consultant and farmer.