Venison schedule needs to lift

Tom Ward explains the forces behind the season’s lamb, beef and venison markets.

Tom Ward explains the forces behind the season’s lamb, beef and venison markets.

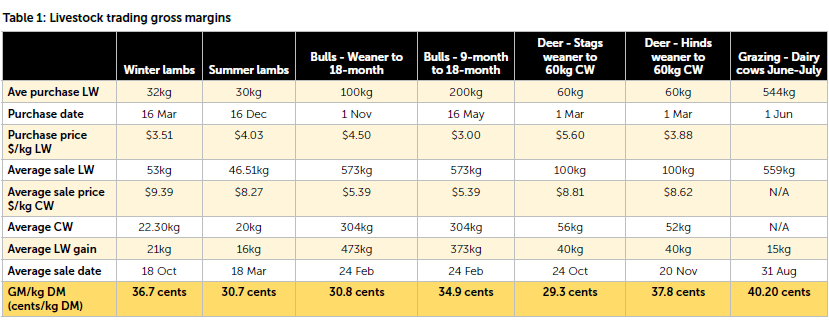

A collection of this season’s trading/ finishing gross margins across lamb, bull beef and venison show a reasonably tight spread with all in the 30-40 cents per kg drymatter (c/kg DM) range.

However, some gross margins are closer to 40 than 30c/kg DM, and these deserve some explanation. First, the winter lamb job has benefited from the Southland drought with buying prices in the $3.50 to $3.60/kg liveweight (kg LW) range until the end of April. A $4.20/kg LW) buying price reduces the gross margin to 28 cents/kg DM.

The nine month to 18 month bull enterprise benefits from a bull purchase price of $3.00/kg LW, compared to $4.50/kg LW for the 100kg LW weaner bulls.

The weaner deer sales in March were highlighted by the savage difference in price between stags ($5.60/kg LW) and hinds ($3.88/kg LW) giving the weaner hinds a boost to profitability despite a slightly lower liveweight gain potential.

If the venison schedule fails to improve as forecast at $9/kg carcaseweight (CW), and stays closer to $8/kg CW, the gross margins would be 20c and 32c/kg DM for stags and hinds respectively. Of concern to farmers is not just the peak venison schedule in the October window, but also how it is maintained through the rest of the killing season with considerable numbers normally killed at less than ideal weights, simply to catch the schedule before it falls.

This highlights the need for breeders to organise their breeding hind management carefully. Adult hinds need to be in good order and well grown to achieve earlier and tighter fawning, bigger fawn birth weights and fawn growth rates, and earlier weaning at higher fawn and adult hind liveweights.

Management changes

A 70kg LW fawn by mid May is ideal, making a 110kg LW (60kg CW) stag from October 1 realistic. Animal health remedies work better on well-grown fawns. Two sizeable deer operations in South Canterbury have recently made changes to their management to enable deer to be better grown in mid to late summer. One changed their lamb sale policy from fattening to selling all lambs store early January, the other quit a substantial bull beef fattening enterprise in favour of breeding cows.

The dairy grazing price is still being haggled over (June 1) even as cows arrive on their grazing blocks. I have used $35/cow/ week, which, with a 12.5kg DM per cow per day crop consumption, is 40c/kg DM. That excludes the cost of straw, and assumes the dairy owner does the work. The graziers are making the most of the high dairy pay-out, and inflation in cropping costs, to push the dairy boys hard.

You cannot make a decision looking at these enterprises in isolation, the whole farm management needs to be analysed. With wintering dairy cows this is especially relevant as a large winter cropping programme with its associated rotation, may be required. In addition, the regional council will need to consent to nitrogen loadings.

Last year, one dairy cow grazier I spoke to, trying to respond to dairy farmer requests to reduce his fodder beet area, was denied by the regional council because reducing the ratio of fodder beet to kale would have increased his nitrogen leaching number. In mid Canterbury the greatest lift in land sale prices on the plains has come from parcels which have already wintered dairy cows, i.e. have a relatively high nitrogen baseline.

While all livestock options are doing well it is especially pleasing to see venison improving. The venison schedule reached $8/kg CW this season just past, up $2.70 on this time last year, and in line apparently with the five-year average. More importantly, it held up right through the season.

No better than beef or lamb

However, the schedule needs to continue to improve; as noted earlier an $8/kg CW schedule makes deer finishing no better than beef or lamb. Venison deer breeders, already concerned at the lack of scale in the sector, are also concerned about the lack of confidence (probably reflected in the discounted hind price). Venison marketers say they are unwilling to pressure their customers on price.

A representative breeding hind herd, selling weaners, could earn a gross margin of 12c/kg DM, or if finishing all progeny, 16c/ kg DM. At High Peak Station’s 2018 weaner sale, well-grown European and hybrid red stags and hinds sold for $7-$8/kg LW.

Regarding beef, one could take the view that there needs to be some caution around the schedule. Choice beef (premium beef) and pork retail benchmarks in the United States, still at historically high levels, are down 20% and 14% respectively on this time last year, despite no significant change in supply. Total beef slaughter is up 15%, but this is breeding cows, driven by drought, and it affects the grinding beef retail price only.

Demand for beef is down as consumers absorb significant increases in living costs. Nevertheless, the US 95Cl price remains about $3.00/lb and the exchange rate at 65 cents (7% better than twelve months ago).

As an interesting aside, the Americans are likely to pay more for their beef eventually, due to herd liquidation (highest in 30 years) and higher feed costs. The meat processors are already paying 17% more for prime cattle than a year ago, something they can readily afford. The USDA has revised downward their production forecasts for 2023 by 7%, and their import forecast upward by 6%, with most coming from Brazil and Mexico, and eventually Australia.

- Tom Ward is a South Canterbury farm consultant.