To lease or not to lease

It pays to crunch the numbers and weigh up your options before deciding to buy or lease your tractor, Kerry Dwyer writes.

It pays to crunch the numbers and weigh up your options before deciding to buy or lease your tractor, Kerry Dwyer writes.

I recently wrote about the costs of buying and running farm tractors, but we can also look at leasing as an alternative to buying because there is no capital outlay required. That means the impact of interest rates, devaluation, depreciation and some repairs and maintenance is carried by the owner (the leasor) rather than the leasee.

For a farm tractor of 140hp, with a front-end-loader, I found a fairly tight range of quotes for tractor leasing, with some variety as to any additional costs. Some covered service costs and some didn’t. All were on a dry hire basis, meaning the leasee paid all fuel, oil and driver costs. And all were based on a set number of tractor hours; running over that number incurs additional cost but under that does not reduce the lease cost.

Leasing is an attractive option if you don’t have sufficient capital to buy a new tractor, as a 140hp FEL tractor is going to cost about $200,000 to buy new. For some contractors who are clocking up 2000 hours a year it looks to be a very good option because there is a large replacement cost with that number of hours.

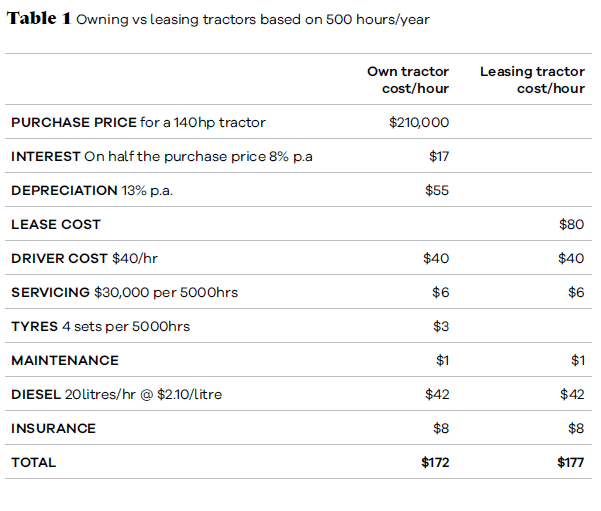

In my article on owning tractors (Country-Wide February 2023) I worked on the basis of a 140hp FEL tractor for general farm use, doing 500 hours a year. That it is bought new with half the funding coming from sale of the previous tractor and that a cost of driver is included in the total running cost. The figure I came to was $172/hour running cost, which is variable depending on all the financing, labour, fuel use, etc, however it gives a basis that you can work out the figures for your situation.

IF YOU ARE IN THE BUSINESS OF LEASING TRACTORS OUT, THE RELEVANT FIGURES NEEDED ARE:

Original value of the tractor

Likely value at the end of a lease period

Depreciation rate on the tractor

Interest to be charged against the original value

Any major risks to the integrity of the tractor e.g. destruction.

I am not an expert on tractors so cannot compute these figures, but the people in the industry do. The standard leasing model is based on the tractor doing enough hours to make sense of the annual depreciation i.e. a $200,000 tractor depreciated at 13%p.a. incurs a cost of $26,000/year if it sits still. If it does 500 hours/year that is a cost of $52/hour whereas that reduces to $32/hour if it does 800 hours/year.

Leasing a tractor to run for 500 hours/year is no cheaper than owning one, on the basis used in my previous article. The comparison is shown in Table 1.

Tractor leasing is based on an agreed number of hours used, with a monthly payment on that basis. Using the figures above, if the tractor was used for 800 hours/yr the total cost reduces to about $150/hour, because the monthly lease cost is spread over more hours of use.

THE ADVANTAGES OF LEASING TRACTORS ARE:

No capital outlay required

The lease cost is all tax deductible

No replacement cost when finished with that tractor, go rent another

Access to new tractors with new technology and efficiency.

The main disadvantage is that it has to be used for enough hours to make sense of the depreciation factor incurred by the owner you are leasing it from.

Kerry Dwyer is a North Otago farm consultant and farmer.