From the hill blocks of North Otago, Blair Smith reflects on some taxing prospects.

The problem with socialism is that you eventually run out of other people’s money” – a great Margaret Thatcher one-liner, and goes nicely with Winston Churchill’s “Socialism is the equal sharing of misery, driven by ignorance and envy”.

I have a wife that seems to feel the need to share famous quotes while we are working in the woolshed in 31C heat. I usually switch off as I’m trying to hear the cricket score but given the recent capital gains tax circus, I thought these were relevant under a Taxcinda ‘Socialist 101’ regime.

Some sort of tax bomb was inevitable under a red/Green/Winnie government but the red devil detail lies in the eight other taxes bundled up in a package given oxygen by the ill-informed yet opinionated Fish and Game and Landcorp.

This package should have just been called the ‘Don’t start a small business, don’t become an employer, don’t innovate, don’t take risks, don’t work hard as the harder you work, the more you will be taxed as the Labour government leads an arms race to the bottom of the birdcage.’

We should be growing the size of the pie for everyone by doing some bloody smart trade deals, not just dividing up the same pie into smaller pieces. Has someone up there forgotten that every 1% drop in GDP results in $800 million less tax collected.

I’m not sure when Landcorp earned the right to an opinion on running a business anyway – a $2 billion asset that returns less than 0.2% to the taxpayer. For an entity that is a self-proclaimed “World Class Agricultural Leader” (plastered all over their marketing facade), the $65,000 they spent changing their name to Pamu could have been better spent helping train some farm cadets.

Yet again the $8b of iwi-owned assets have a leave pass on both tax on profit and capital gains tax along with those large-scale companies owned by religious groups that continue to fly under the tax radar. I might send my receipts for Weetbix and my cattle crush up to the Beehive and see if I can get a tax refund too.

On a brighter note, sheep and beef farming is in a great space with returns finally sitting where they should have been for the past decade.

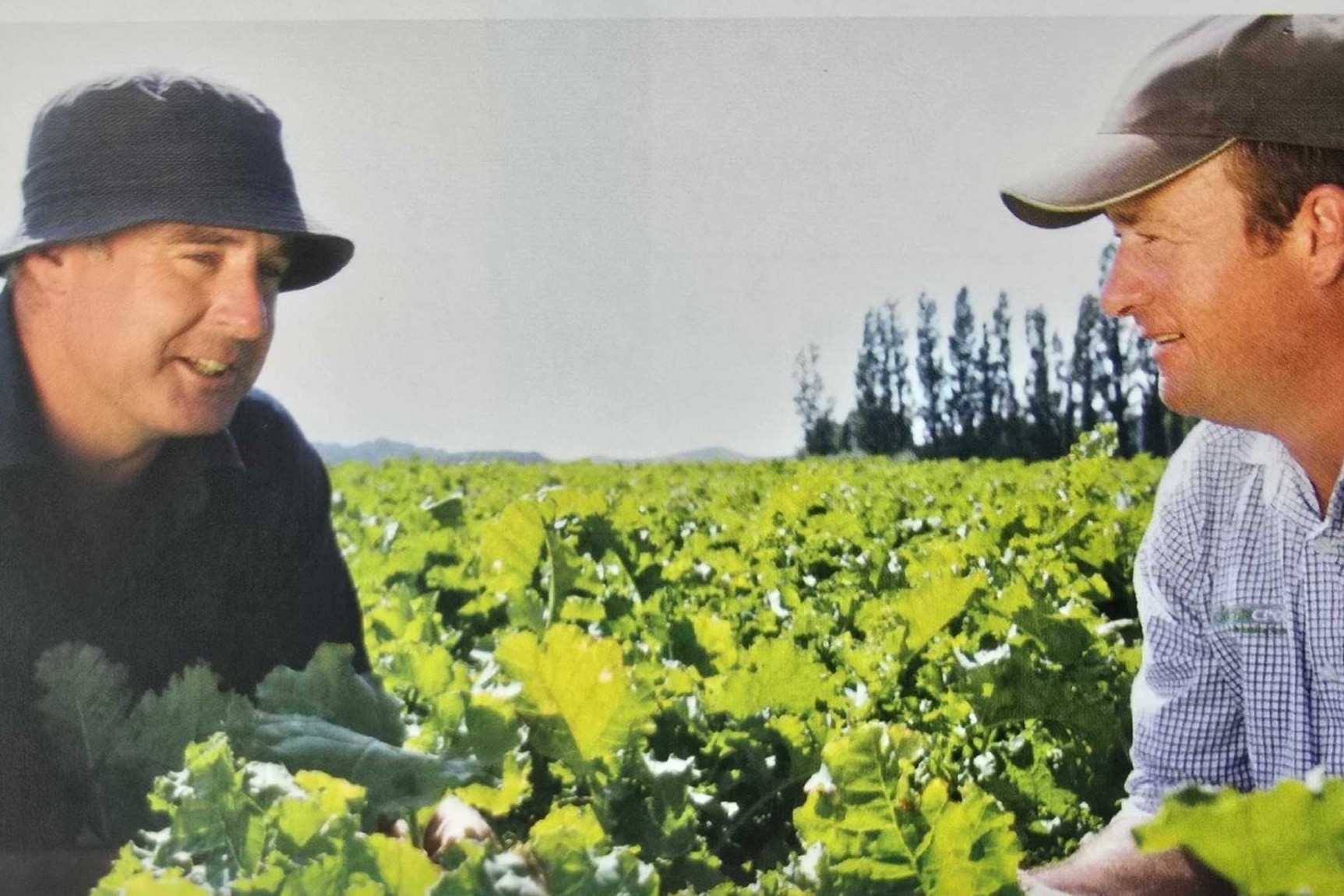

While North Otago has dried out considerably (back to its normal summer/autumn weather pattern), the Angus cows and calves are working their way through the feed on the hill blocks, with heifer scanning this week showing a 94% in-calf rate to the first two cycles after a hill country mating in sizable mobs.

We have just finished our ram selling season at Newhaven with both our Perendale and Romdale clients having a great year in terms of scanning, lambing, calving and returns for both store and finished stock. Our sector needs certainty of good returns to be able to set long term goals in place for progress.

One big motivating factor for us has been joining a RMPP Action Network group – eight farming couples that are all running very different businesses but with very similar long-term goals. This has been a game-changer for us all and pretty cool to see a meat company (Silver Fern Farms) investing their time and resources into farmer-driven learning.

The Gateway programme for high school students continues to be a real success – we have now had students here at Newhaven one day a week for the past 20 years. With all the debate around tertiary funding, keeping it simple and getting students interacting with potential employers at an early age is a basic, yet effective model.

Like most farmers, there hasn’t been a lot of time off farm over summer although we have the Otago Ballance Farm Environment Awards coming up this month so a chance for me to venture into the big smoke. Jane is always cautious of taking me out in public but if all else fails, she has found a gateway placement for me.