Think about an alternative weaner finishing system.

That was the message from Southland farm consultant Graham Butcher following the presentation of gross margins for a range of livestock enterprises at a Southland Advance Party Deer Group meeting in November at Otautau.

The Farmax-based analysis is a broad comparison of Southland sheep, beef, deer and dairy support systems based on c/kgDM consumed and average pricing/costs.

Gross margins (c/kg DM) for Southland deer-based enterprises

Red hinds, selling weaners 6.9

Red hinds, weaner finishing 9.4

Velvet (non selected) 9.5

Buying weaner deer for finishing 11.0

Wapiti/Elk early kill 11.7

Velvet (industry average) 14.1

Velvet (elite) 23.5

Source: Graham Butcher, Rural Solutions

Of the 26 enterprises modelled, Red hind/selling weaners was the worst performer recording a gross margin of 6.9c/kg drymatter (DM) consumed. A Red hinds and weaner finishing system achieved a gross margin of 9.4c/kg DM, which was in a similar range to the finishing of autumn-bought steer calves (8.9c/kg DM) or heifer calves (8.3c/kg DM) both finished as R2s; or breeding cows calved at two years old and their progeny finished (8.8c/kg DM).

Butcher said deer farmers tend to focus on finishing yearlings for the spring chilled market after the first winter, but in Southland that was often too difficult.

“When you think about it, venison production is possibly the most difficult enterprise to get right in the Southland climate and growing environment.”

He said hinds fawn in November, which was not a good match with pasture growth and quality factors. Their reproductive performance was still not brilliant, and in winter a deer’s growth rate naturally declined so the opportunity to grow weaners post weaning to premium spring values were limited.

Model 1: Standard Southland Red breeding hind/R1 weaner finishing with limited Spring premium sales.

540 MA hinds

60 R2 hinds

262 R1 hinds

262 R1 stags

20 breeding stags

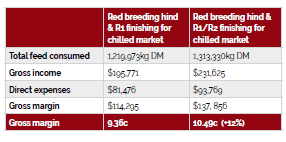

Butcher suggested changing the timing of finishing to increase net income and the resulting gross margin. In practical terms that meant focusing on the top line of weaners – those that may make the chilled market following their first winter – and holding the rest for selling into the chilled market after their second winter. This approach had the potential to lift the gross margin by 12% to 10.5c/kg DM.

Crunch time at weaning

The venison-based results of the gross margin analysis came as no surprise to deer farmers, including NZDFA chair John Somerville.

A second year of depressed venison prices had some, especially those in mixed sheep, beef and deer enterprises, questioning their future with deer. It was likely that some would start swapping out hinds for more sheep or cattle.

“The crunch time will be weaning next year, so it’s crucial we have some positive indications in the New Year that prices are lifting,” Somerville said.

Farmer frustration had led to a letter in August from him, on behalf of NZDFA members, to the five venison exporters and DINZ board.

The letter acknowledged the effort venison companies went to following the onset of Covid to clear farms of late season stock, as well as the effect the pandemic had on traditional foodservice markets. However, many farmers felt alternative markets had been slow to develop given the focus on new market development over recent years under the industry’s P2P programme.

Somerville said venison exporters had responded, most pointing to early signs of market recovery and price improvement in the New Year, although there were no indications as to what exactly that meant in dollar terms.

“We don’t want to be negative; we want to be constructive but also echo our member concerns… we want exporters to see it from our point of view.

He said they wanted more direct communication.