Succession: The third pillar: Fair comes before equal

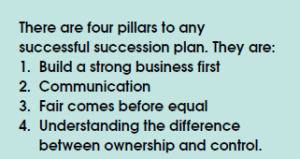

Peter Flannery continues a series of articles advising the steps to a successful succession plan, focusing on the third pillar.

The third pillar to creating a successful succession plan is that it is more important to treat everyone fairly, rather than equally. Fair and equal can be the same thing depending on a range of factors.

The underlying principle is you should only treat your children equally if it is fair to do so. As a parent myself, that principle applies to more than just succession.

This underlying principle is so important, I will repeat it: You should only treat your children equally if it is fair to do so.

If none of your family are interested in coming home to the farm, and no one has contributed any more to the success of the business than anyone else, then it is absolutely fair to treat them equally. But if that is not the case, treating them equally would not be fair.

How do you work out what is fair and who decides it? Every family is different, and every business is different, so there is no “off the shelf” solution. What was fair for your neighbours, your cousins or your best mate’s family, may not be the same for your family.

Working out what is equal is relatively easy. You only need to know the size of the pie, how many mouths there are to feed and have a pretty simple calculator. Knowing what is fair, is an altogether different kettle of fish.

The only way you can work out what is fair in your family’s situation is to talk about it and listen to what is being said. Refer to my previous article on the second pillar – communication. Discovering what is fair can only come from understanding, and understanding can only come from communicating.

No professional can come into your family and tell you what is fair. A professional can facilitate, challenge and offer insights, but it is not their role to tell you and your family what is fair.

Follow a process

An accountant can offer clear cut accountancy advice, a lawyer can offer clear cut legal advice and a farm consultant can offer clear cut management advice. But none can dictate to you what is fair for your family. However, they all have a role to play, and that is ensuring an appropriate process is followed.

If you are to use a professional, their role is to facilitate an appropriate process to allow you and your family to define fairness. Having an independent professional to lead the family through a process can be hugely valuable.

The problem is, there will be conflicting needs, wrapped up with some considerable wealth, love and affection, family competitiveness and most probably some financial constraints. Therefore, you need to have a clear understanding of what you are trying to achieve and how to prioritise them.

Most families have the following objectives:

- Look after Mum and Dad.

- Keep the family together so they can all still enjoy family gatherings and continue to support and love each other.

- Keep the family farm/home within the family.

- Allow a successor to succeed.

- Non successors not to be excluded from fair and timely financial help.

If the business is not strong enough (pillar one) to allow those objectives to be met, it is going to be difficult to achieve a successful and fair succession plan. Secondly, if the order of priority isn’t quite right it is going to be challenging to find the right solution to meet all objectives.

If the successor is not able to succeed, the farm will not stay in the family for long, and family unity will most probably take a hit. Conversely, if the successor gets it too easy, jealousy and suspicion will rear its ugly head and once again family unity will take a hit.

Keep end in mind

It gets complicated even further when the opportunity or time cost of money comes into play. Let’s say, for example, there is a family of three, and the middle child is the successor. The older child is seven years older than the youngest.

Let’s say seven years ago the farming business helped the oldest into their first home. A good house back then might have been $400,000 and let’s say the farming business “gave” the first born $200,000 being 50% of the purchase price.

Seven years on, the youngest puts their hand up and asks, can you help me into my first home? In the art of being fair, you probably should. The problem is, a similar first home is now twice the price at $800,000. So how much do you provide? $200,000 or $400,000 or somewhere in between.

What happens if the farming business has recently either expanded and is now “fully lent” or has taken a financial hit from drought, flood or a drop in commodity prices or all three? What then? Don’t make the mistake of starting something you can not finish, which is another of Stephen Covey’s Seven Habits of Highly Effective People – Habit 2 – Begin with the End in Mind.

Be seen to be fair

In a similar vein, don’t make promises or give expectations you cannot meet. That is the job of the Government.

Another point, not only do you need to be fair, you need to be seen to be fair. That again, comes with good communication. I was recently contacted by a woman whose elderly parents had both recently died. They had four children. Once the dust settled, her older brother “got the farm” and also an equal share of off-farm assets. How is that fair she asked? I was employed by her to do some investigation.

It turned out her brother didn’t “get the farm”. He in fact bought the farm in four stages starting in the early 1980s, before finally acquiring the last of it in the mid 2000s when he bought his parents a house off the farm.

The capital he borrowed to buy into the farm over the years was invested in the sharemarket by his rather astute father, which led to a significant share portfolio, which, along with the house, was then split four ways.

There was nothing unfair with that in my view. But because none of this had ever been discussed she assumed she was being cheated out of something she was owed. Sadly, because her attitude had become so entrenched based on an incorrect assumption, I don’t think she ever believed me which unfortunately will probably lead to strained family relationships.

This starkly highlights the importance of being seen to be fair.

What if you work out what is fair, but the financial constraints are too great to allow a fair plan to be put into action? It is not a good place to be, and this all links back to the first two pillars.

First, build a strong business and effectively communicate with your family. There will have to be compromises for sure. So have a clear understanding of the objectives you want to achieve as discussed above and don’t start down a path that has no exit.

Start with the end in mind. It’s not easy, but as I say to the families I work with, if you ignore it long enough, it will not go away. So if you haven’t already, you need to make a start.

- Peter Flannery is a Southland and Otago-based agribusiness consultant, specialising in business planning, financial management and family succession.