Proposed methane price damaging

The proposed methane price would likely see an overshoot in meeting the Government’s emissions reduction targets, and cause unnecessary economic damage. Joanna Grigg reports.

The proposed methane price would likely see an overshoot in meeting the Government’s emissions reduction targets, and cause unnecessary economic damage. Joanna Grigg reports.

I t’s all about the pricing of emissions. Too high and some farmers could go out of business, pushing food production offshore. According to the Beef + Lamb NZ’s (B+LNZ) June 2022 analysis, the most likely farms to feel the squeeze first, are extensive beef, sheep and deer farms. They typically have a low stocking rate, a high proportion of breeding stock and low profit margins.

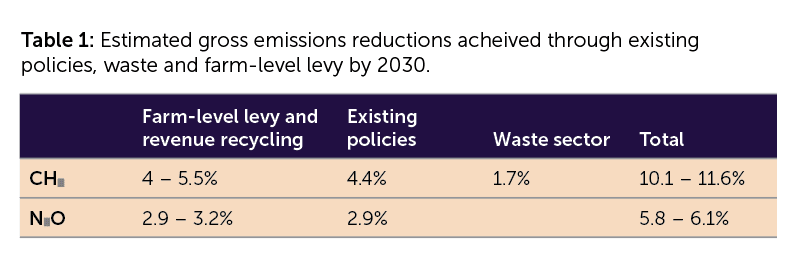

B+LNZ are concerned that the chosen modelling figures by Primary Sector Climate Action Partnership, He Waka Eke Noa, (35 cents per kilogram for methane) implies this is needed to meet New Zealand’s 2030 emissions targets.

In the June report, the sheep and beef farm organisation states this price would be “extremely damaging to many sheep and beef farmers and would likely see an overshoot in meeting the government’s emissions reduction targets, and cause unnecessary economic damage.”

These are strong words for the organisation that is a member of He Waka.

It proposes an alternative maximum start price for methane, at 11c/kg, with a price ceiling to keep under the Emissions Trading Scheme (ETS) level.

Even at 11c, the profit before tax loss is modelled to be a 11% decline. At the top end, one in four farms would see more than 10% of their profit used up paying emissions tax, it predicts.

The flip side is that, if the price is too low, the ‘big stick’ to flog farmers to reduce methane and nitrous oxide emissions, won’t be painful enough to enact change. Where this point is, is the tricky bit.

He Waka Eke Noa modelling estimates that a farm-level split-gas levy will result in a fall in production of 0.1%. This drop in meat exported would be picked up by overseas producers. This shift overseas, to less efficient producers, is known as emissions leakage.

A high ETS carbon price and no hand brakes on exotic pine plantings has been the biggest driver to reduce stock emissions, simply by land use change. This is not the preferred way to reduce NZ’s emissions, as it pulls whole farms out of production.

Plugging in the correct ‘system settings’ for greenhouse gases will be crucial to the competitiveness and viability of NZ’s ag sector. The people behind the system settings would be the proposed System Oversight Board. He Waka recommended they be primary sector experts and representatives. They would work alongside an independent Maori board. They will be empowered to recommend to the Government the levy rates, and how revenue is to be collected.

A high ETS carbon price and no hand brakes on exotic pine plantings has been the biggest driver to reduce stock emissions.

B+LNZ said farmers need to get full access to their sequestration offsets, to control the economic fallout. This conclusion comes from their 2019/20 Sheep and Beef Farm Survey of 452 farms, using stock numbers, fertiliser use and possible sequestration areas.

While the average farm might cope, analysis shows the diversity of farm types means some are vulnerable to severe economic effects. Extensive farms are the most sensitive due to limited ability to reduce stocking rate and inputs further.

B+LNZ director Nicky Hyslop said it supported the model using averages, but analysis must look across the range of farms to see the effects.

“It’s super important to test it across all types and geographies.

“It shows that methane at 35 cents is simply not acceptable, especially when the tools are not there to reduce greenhouse gas emissions from stock yet.”

She said the maximum must be 11 cents, and capped for three years at least.

While boluses, or seaweed solutions might be bandied about, B+LNZ did not assume any use of incentive payments. This is because, at this point, low methane sheep genetics is probably the only practical solution available.

The B+LNZ analysis was possibly far too generous in sequestration offset returns. It assumed farmers would get 100% of the ETS price for carbon, when it’s likely to be 75%.

“Although we will push for 90% of the value,” Hyslop said.

Also, only 10% of pre-1990 indigenous cover on farms will possibly get accepted into He Waka offsets. This is because of the blanket stock exclusion rule. The analysis assumed 100%. This means the decline in profit could be even worse than predicted.

It’s a very challenging picture. Not counting sequestration, the analysis shows three in four farms will have profit before tax reduced by 10% or greater. One in four farms will see it reduced by 30% or more.

When a generous sequestration allowance is added in, half of farms have profit before tax cut by 10% and one in seven farms see a cut of over 30%. This paints a clear picture. Getting sequestration recognised is going to be an important ingredient for extensive farms. And why shouldn’t it be.

The full report is available at https://beeflambnz.com/sites/default/files/levies/files/BLNZ-Modelling-Report-HWEN.pdf

Sequestration won’t make farmers rich

While one hand gives sequestration rewards, the other hand is taking it away in emissions tax. Farmers won’t get rich in the wash-up.

Signing up eligible trees for sequestration through He Waka is unlikely to be a profit-making exercise but it will help, especially extensive farms that can’t drop capital stocking rates much more. Analysis by B+LNZ shows the importance of sequestration, to reduce the economic implications of the emissions levy on sheep and beef farming businesses.

But it predicts that, at a methane price of 35c/kg, there will still be significant impacts on sheep and beef farmers’ profit, even if all sequestration is included.

The June-released He Waka proposals are not very generous with sequestration allowances.

One big sticking point is that, as a minimum, pre-2008 indigenous tree areas may have to be fenced off from stock (or stock excluded somehow) to be eligible. Whipping up a fence is easy to say but expensive in reality.

Are fences needed? Larger regenerating areas may be able to withstand some light stocking rate grazing of stock, and still be a healthy regenerating forest. Why fence with carbon hungry materials? There may be natural boundaries to exclude stock. Nicky Hyslop, B+LNZ Director said much more work is needed on sequestration rates on-farms.

There has been one welcome change in the original proposal, since farmer consultation. This is that these pre-2008 unfenced areas of regeneration might be able to be counted, if they have Active Ecological Management that allows regeneration. This would have to be proven by “a suitably qualified sequestration expert” who can recognise equivalent, or enhanced actions, to determine appropriate value of sequestration. So, fencing may not be needed, if you can prove the bush is growing.

Hopefully the expert won’t be exorbitant.

A forest assessment (with photos and a map), created by the landowner, and assessed by someone independent, was a previously accepted method. It was used to assess regeneration for the Permanent Forest Sink Initiative.

The bad news is that farmers with exotic woodlots planted prior to 2008, don’t look to be eligible for sequestration. This has stayed in the recommendations, despite push back by farmers. He Waka recommends finding ways to get these into the ETS instead.

Maori retain ownership of 340,000 hectares of land. Far more is in indigenous cover than general title areas (33% vs 9%) but getting sequestration offsets might be harder. It would require agreement from a collective of owners. About 500 Maori agribusinesses farm/manage the land but many have lease arrangements. He Waka recommends an independent Maori board to work alongside the System Oversight Board. This board would be funded from levies paid by Maori agribusiness, but the sequestration from Maori reserve land should be made available to others in the primary sector.