Profits fall but beef remains strong

After a topsy-turvy couple of years in farming, Tom Ward analyses the impact of income and costs.

After a topsy-turvy couple of years in farming, Tom Ward analyses the impact of income and costs.

After very good income levels in 2021-22 most farm incomes are declining although there is some variation. Venison schedules, for example, have improved by about $1/kg carcaseweight (CW) to $9. This article is an attempt to show the effect on one farm of declining income levels and inflating costs between 2021-22 and 2022-23.

The dairy pay-out affects the dry-stock sector through demand for grazing and supplement. It is expected to be back about $1/kg MS to about $8.75/kg MS, with the substantial decline in product prices countered somewhat by a lower exchange rate. In addition, dairy farmers are facing significantly increased costs.

Continued poor forestry returns have growers deferring the cutting of trees. However, the financial benefits from sequestering carbon in the emissions trading scheme will assist hill country farmers with significant plantings. The capitalised carbon income has significantly increased hill country land values, providing a boon to those who wish to sell land, and a hindrance to those who wish to buy it.

There is ongoing pressure from the Government and customers on the primary industry and other sectors to make public efforts to reduce their emissions.

Fertiliser prices show little change compared to 2020-2021, with nitrogen products reducing $100/tonne, phosphate and potassium increasing $200/tonne.

Shearing costs are an interesting subject. Crossbred shearers will be paid an additional 50c a sheep ($4/sheep) with contract rates for crossbreds lifting to $6/sheep.

Australia’s weather and shearing rates are better than New Zealand’s so Kiwi shearers head across the ditch to work. Contract rates for fine-wool sheep are $9.50/sheep and shed-hands are also very difficult to procure and retain.

Fuel prices

In Mid Canterbury, petrol at the pump started at $2.10/L in July 2021, rose to $3/L, and has now retreated to $2.30/L. Diesel was $1.50/l in 2021 July and peaked at $3/L and is now 2/L. All prices are gst-included.

Inflation was 17% for building costs in 2022 and wages increased 3% on average across the country. Wage inflation is expected to remain a factor, as it is supply driven (i.e. there is a shortage).

Interest rates have lifted off, going from 5% to 7–8 %, and it is quite likely farm term-loan rates will be 9%.

Forage cropping costs (kale and fodder beet) are up 10–20%.

Electricity has seen minimal change, and insurance, rates and ACC are fairly stable.

Foreign exchange rate

In April 2022, the NZD/USD cross rate was 70c, in October last year it was 56c, December 2022, 64c, and January 6 it was 62c. The exchange rate generally fluctuates in the 60–75c range, with occasional brief dips to 55c. With milk at historical highs, our USD/NZD cross would normally be close to 70c. However, high US interest rates and New Zealand’s large trading deficit have held this cross rate down.

In the latter part of 2022, prime beef, which reached $70/kg CW in the spring, was about $6.20 in the North Island and a little lower in the South by December 2022.

The bull schedule was $6.50/kg in the spring. By December, 2022 it was 20 cents lower compared to prime.

Since October 2022, all three lamb indicators (flaps, French racks and lamb legs) have declined by about 20% in NZD/kg. This coincided with the NZD appreciating against the USD from 55 to 63c USD. The NZ Reserve Bank rate (4.25%) now exceeds both the US central bank rate (by 0.25%) and the Australian central bank rate (by 1.15%).

Lamb reached $9.50 in spring 2022 raising false expectations. Covid issues and a general shortage of meat workers meant frustrated farmers watched the schedule slide as their lambs waited to be slaughtered. The schedule by mid-December 2022 was $7.80 to $8.00.

Farmers were told in early December to expect the schedule to be close to $8.00/kg CW later in the season. Advice from Silver Fern Farms (SFF) in mid-December is to expect $6.50 to $6.70 for lamb by March 2023.

In addition, there has been significant rain and the store price has lifted 40c to $3.40/kg LW.

The ewe schedule has seen the biggest decline: from October 2021 to December 2022, It fell from $6.77/kg CW to $4.60/kg CW, a $52/head reduction on a 24kg CW cull ewe.

Crossbred wool at $1.80/kg greasy shows no change, still abysmal.

Venison seems stable with the October 2022 carcase return about $9/kg, and some doing a little better. SFF’s prediction for March 2023, despite some customers affected by inflation trading down to cheaper protein, is $9–$9.15.

My understanding is there was a poor turnout at Fieldays, reflecting farmer sentiment.

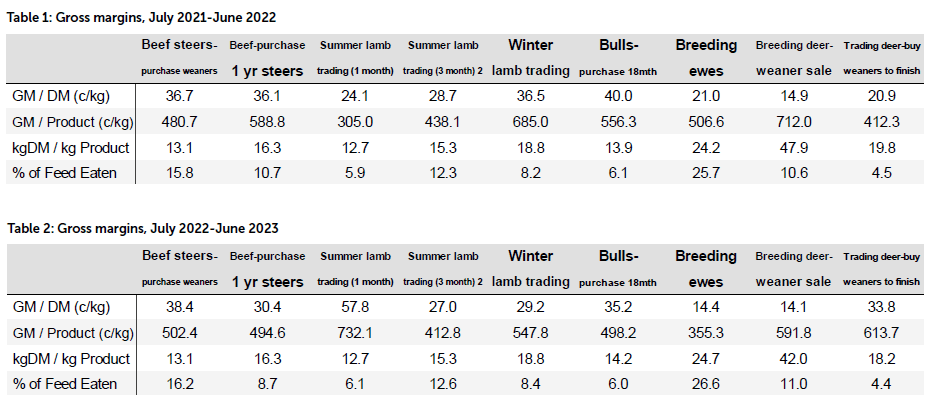

Tables 1 and 2 are indicative gross margins for the two years studied.

Most gross margins (gm), apart from trading weaner steers, show a moderate decline. Note: the standout gross margins are the one-month lamb trading which was an opportunity in December 2022, before warmer weather plus rain raised the store price. So too was the significant reduction in breeding ewe profitability. Also, the venison trading gross margin shows a significant increase due to the $9/kg CW achieved in spring 2022, compared to $8/kg CW 12 months earlier. This suggests that for some farms, those suited to livestock trading, dairy grazing and perhaps cropping, and with useful areas of deer fencing, the reduction in gross income may not be too severe.

Huge profit drop

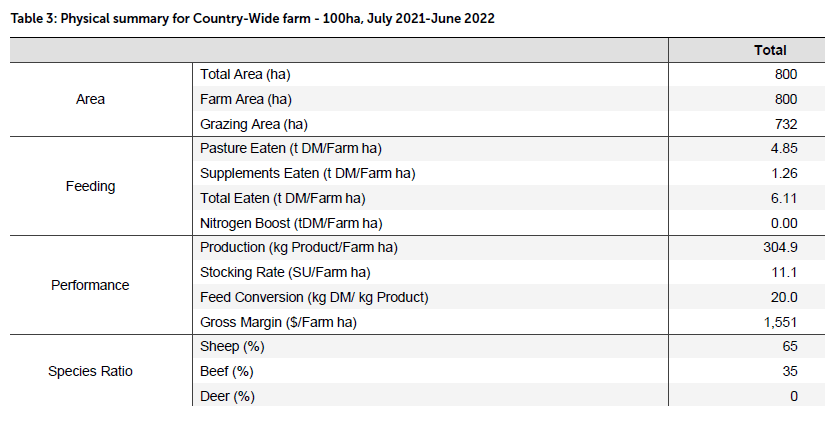

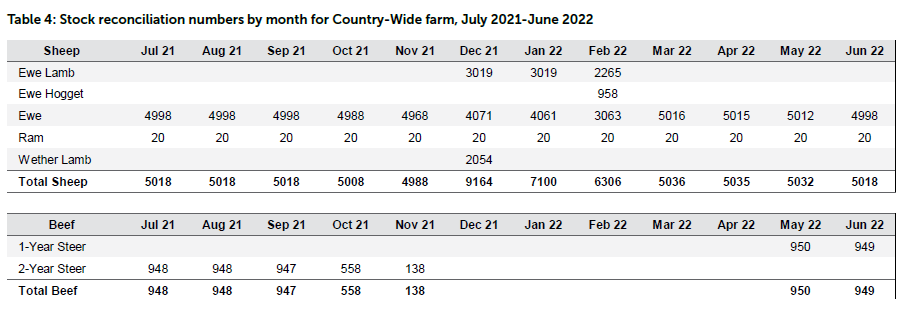

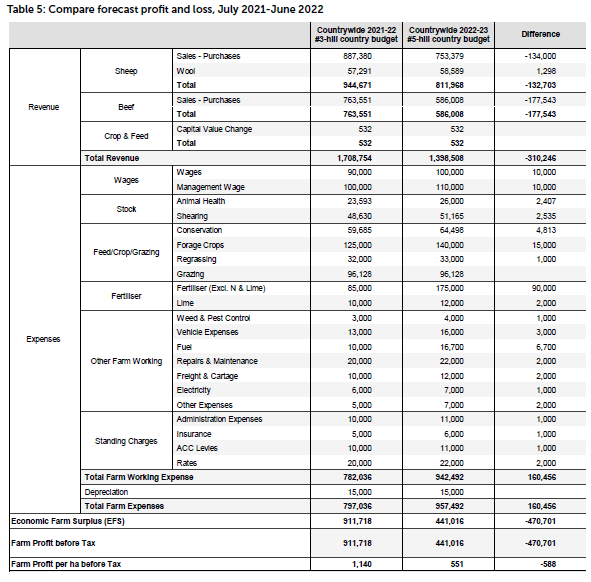

The two budgets (all tables are Farmax) are based on a 8800 stock unit farm called Country-Wide. Cropping is 50ha fodder beet and 96ha pasture silage. One thousand replacement ewe hoggets are grazed off for 12 months, and no nitrogen is applied. The large area of hill country limits trading options (trading yearling steers has a far superior gross margin than breeding ewes) and the fodder beet, subject to climatic risk as there is no irrigation, improves winter carrying capacity.

As expected the comparative budgets show a substantial reduction in profit, from higher farm-working expenses (20%) and lower income (18%). I have not included debt servicing as every farmer’s situation is different. However, if this farm carried $3 million of term debt, the interest bill would increase from $150,000 (at 5%) to $270,000 (at 9%). In 2021-22 this is 16% of the economic farm surplus (EFS), and in 2022-23, 61% of the EFS.

Conclusion

For the breeding/fattening and breeding/store farms there will be some difficulty where balance sheets are not strong. Trading operations’ margins may suffer smaller declines, however these farms will still face higher costs.

Commentators suggest the world is in an inflationary state, with or without high interest rates. Wars (both real and cold), resulting sovereign re-armaments, climate change adjustments, fighting poverty (inequality) and protecting ourselves against future pandemics are all inflationary.

There are a number of predictions for recession in 2023. Nevertheless, the expectation is for the price of beef in the USA to increase in 2023, and it is difficult to see the cost of producing milk (outside NZ) declining any time soon.

- Tom Ward is a Mid and South Canterbury farm consultant.