New Zealand farmers are following their overseas counterparts in the move to online livestock auctions. Andrew Swallow reports.

Despite a slow start in New Zealand, online livestock trading platforms will come to dominate in the same way TradeMe and similar websites have largely replaced classified advertising, the founder of a leading South Island livestock agency says.

“It’s the way of the future, but things like this take time,” Peter Walsh of Peter Walsh Associates, told Country-Wide.

PWA’s brokers are using both bidr and StockX. Bidr provides “a huge time saving for the buyer, though not so much for the seller because they have still got to get stock in, sort them, weigh them if possible, and photograph them,” notes Walsh.

Where there is a saving for the vendor compared to selling at a saleyards is in avoiding cartage and yard fees, not to mention the risk of having to bring passed-in cattle home, he adds.

Lindsay Holland, Walsh’s Central South Island, livestock manager is one of four PWA agents accredited as approved assessors of livestock to be listed on bidr.

“It will never do away with the saleyards but for those who want to avoid them, for whatever reason, it does offer an alternative,” Holland says.

Besides avoiding cartage and yard fees, stock offered online stay on feed until sold, hence, compared to saleyards where store livestock are usually yarded the day before a sale, there’s less of a growth check, he notes.

With bidr, vendors can set and, if need be, change reserve prices on stock prior to and even during an auction, just as they can at the saleyards.

PWA’s commission on sales through the platform, at 5.5%, is the same as at the saleyards because the work involved for the agent is at least comparable, Holland says.

“We have to go out to the farm, photograph and if possible weigh the stock then draft them into lines, just as we would at the saleyards. Then when we get back to the office we’ve got to upload it all on to the auction site.”

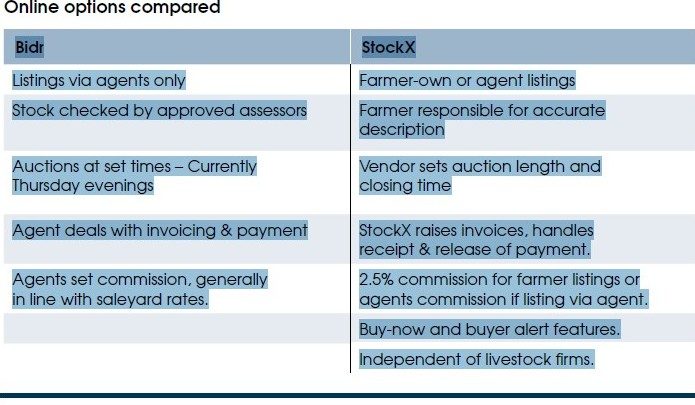

That agent assessment process is a key difference between bidr and StockX, he notes.

“We feel that adds more credibility, but we are using both.”

With both platforms an advantage for buyers and sellers is national reach, meaning a potentially bigger pool of buyers and easier access to stock from further afield with the assurance it’s been checked by an approved assessor.

Only StockX has a ‘buy now’ option, but Holland says bidr is working on that too. Once that’s available, it will help get around the problem of having to be online at the time of the auctions, which are run on Thursday evenings.

“It’s an awkward time. You have to set an alarm on your phone or you can easily miss it.”

Biosecurity is another reason buyers and sellers cite for shifting to the online platform, or at least, dealing direct farm to farm, but Holland says he doesn’t see that as the safeguard some make it out to be. For example, if stock look healthy but are carrying a sub-clinical infection such as Mycoplasma bovis, it may still be inadvertently imported.

However, he acknowledges it does avoid the risk of pen-to-pen transmission of a more infectious disease that could, theoretically, happen at a saleyard.

Bidr listings can only be made through a livestock agent, hence attract whatever fees the agent sets, but on StockX farmers can place their own listings or choose to do so via an agent, StockX managing director Jason Roebuck says.

When a farmer-listed sale is completed on StockX, 2.5% commission is collected by StockX. If the deal’s through an agency, then the commission and any other fees are whatever the agency sets, and in turn the agency pays StockX.

Roebuck stresses sellers must supply exactly what was specified in the listing, within set variances, or the contract which an online deal commits buyer and seller to, is void.

Besides breed, age and sex information, details such as hours off feed when weighed, date weighed, and the range of weights as well as the average are requested.

When a buyer pays, the funds go into a trust account and StockX notifies the seller payment’s been received. The seller then releases the consignment for collection by the buyer who in turn notifies StockX of receipt of the livestock and any variances from what was specified.

Usually it is the buyer’s responsibility to arrange cartage. Truck weights for sales priced by weight rather than tally must be sent to StockX.

StockX’s system creates all necessary invoices but doesn’t deal with NAIT compliance.

“It’s the farmer’s obligation to report livestock movements, but it is an integration we’re working on,” Roebuck notes.

Stock data files from management programmes such as Minda or FarmIQ can be attached to listings to better inform buyers and facilitate data transfer when a sale is made.

Potential buyers registered with StockX can request text and/or email alerts, filtered by stock class and location according to their needs. Registration requires a GST number, photo verified bank details, and an individual photo ID.

“We need to validate who the person is and match them to the trading entity,” Roebuck says.

Originally launched four years ago as a farmer-only platform, with a basic listing and tender structure, a more sophisticated version allowing auctions incorporating reserve and buy-now prices, as well as agent use, was relaunched last October.

Livestock online overseas

New Zealand leads in many areas of livestock production but online trading’s not one of them, at least, not yet.

The United Kingdom’s Sellmylivestock, launched in 2014, has 65,000 registered users including over a quarter of the country’s sheep and beef farmers. Registration and basic listings are free, and buyers don’t pay anything either.

It was founded by beef farmer Dan Luff and tech-savvy friend Jamie McInnes to trade store cattle but users can now deal in feed, grain, cartage, and sheep – prime and store – on the site. A prime cattle facility was promised late last year but hadn’t eventuated as Country-Wide went to press.

Australia’s even further ahead. Its AuctionsPlus was launched in July 1987 by the Australian Meat and Livestock Commission before mobile phones, farm computers or the internet were available. Originally known as CALM – Computer Aided Livestock Marketing – it was bought by Elders, Landmark and RuralCol in 1996 and rebranded AuctionsPlus in 2000.

Today grain, machinery, water rights, wool, wine and even dogs and firewood are traded as well as livestock, A$770m-worth of the latter being exchanged through AuctionsPlus in 2017. Rather than a % commission, sellers pay a per head listing fee which reduces with mob size (see footnote) but does not include agent or assessor fees. Auctions are either simultaneous (ie multiple lots offered at once, helmsman style) or sequential like a traditional saleyards’ event only online.

Footnote: AuctionsPlus fees for trading or prime cattle: =200 head, A$7.20/head; 201-400 head A$6.70/head; 401-600head A$6.20; 600+ head A$5.70/head. Sheep fees: =1250 head, A$0.93/head; 1251-2250 head, A$0.873/head; 2251-3250 head A$0.73/head; 3250+ head, A$0.68/head. Higher fees apply for stud and breeding stock.