Mel Croad

Beef markets both at store and slaughter level within New Zealand have changed dramatically in the last six months. No one foresaw the impact the global spread of Covid-19 would have on prices, demand and international trade.

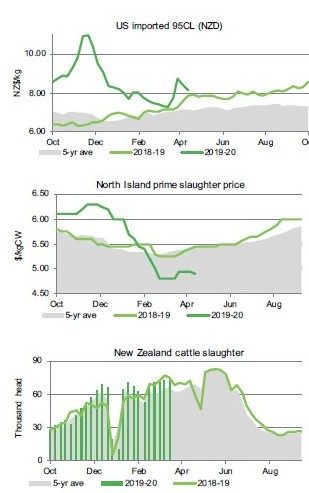

At the start of 2020, the NZ beef market was still reacting to the drop in prices and demand from China that had occurred in late December. It is a necessary requirement for China to cease buying a month out from Chinese New Year, due to shipping restrictions. Unfortunately, many expected the strength of Chinese demand to continue and therefore held on to cattle longer than normal. As summer weather patterns prevailed, backlogs grew and when cattle were finally offloaded, it was at pricing levels that were on average 60-65c/kg lower than only two months earlier.

By February the beef markets were rocked with the closure of Chinese borders and the halt to exports there. The sheep and beef industry were still coming to grips with the slowdown in global demand when lockdown measures were implemented in NZ in late March.

By February the beef markets were rocked with the closure of Chinese borders and the halt to exports there. The sheep and beef industry were still coming to grips with the slowdown in global demand when lockdown measures were implemented in NZ in late March.

It has been a whirlwind and defining month for the industry. There has been plenty of head-scratching and confusion. The near immediate closure of saleyards across the country rattled even the hardiest of farmers that rely on this method to buy and shift stock.

Cancellation of weaner and in-calf cow fairs saw farmers and agents scrambling to find new solutions to sell stock. While some farmers dabbled with online selling systems, others have relied on loyal clients and have managed to shift weaner calves relatively easy.

The closure of saleyards has also made it harder for vendors to determine a value for their weaner calves.

Results from the earlier fairs indicated the market was much softer than we had seen for a number of years and some held calves back.

Unfortunately, market conditions have not improved, if anything they have got worse and vendors are now needing to be realistic with prices if they wish to shift beef calves. The market started out above $3/kg for steers. While $3/kg is still achievable for the odd annual line of top-quality calves, most have since retreated to the mid-high $2/kg depending on breeding and condition. For older store cattle the market has stalled with more cattle on quote than selling.

Many beef farmers are carrying more cattle than they would like for this time of the season. For those in drought regions, it has been a struggle to offload numbers.

Covid-19 processing protocols have meant plants cannot work to full capacity as distancing requirements among staff becomes the priority. This has extended backlogs and is pushing wait times closer to winter. For some the hard decision to offload breeding cows, which has not been made lightly, has been the only option to lighten feed pressures heading into the cooler months.

Covid-19 processing protocols have meant plants cannot work to full capacity as distancing requirements among staff becomes the priority. This has extended backlogs and is pushing wait times closer to winter. For some the hard decision to offload breeding cows, which has not been made lightly, has been the only option to lighten feed pressures heading into the cooler months.

This comes at a time when herd numbers had been enjoying a resurgence, a reflection of the improvement in weaner prices and the beef market in recent years. The impact of this is that cow numbers are likely to drop even further this year and will therefore restrict overall cattle numbers and subsequent slaughter and export volumes in the short to medium term.

Farmgate beef prices have continued to trail historical averages through the opening months of 2020. By April, farmgate beef prices were even weaker, with bull and steer prices across the country floundering below $5/kg. For many farmers in the North Island, it had been quite some time since farmgate beef prices were this low. Market movements, demand and pricing moved away from traditional trends as covid-19 spread across the world. Typically, we would expect to start seeing some upside in beef prices through late autumn, although this is always very dependent on overseas demand remaining robust.

While China looks to be turning a corner with regards to the spread and containment of Covid-19, other key markets are still adjusting. And this is going to impact any pricing upside at the farmgate in the short term, especially when combined with slowing throughput at processors and increasing wait times and backlogs

We have witnessed further pricing downside in the United States manufacturing beef market. Since peaking at US$3.20/lb in late November (albeit an unsustainable level) the 95CL bull price has eased back to US$2.20/lb.

US consumers have shifted their buying requirements to fresh US beef at retail in response to the fast food and restaurant closures as a Covid-19 isolation method. Many consumers stockpiled fresh mince to freeze down at home.

Imported beef saw very limited benefit of this rally in consumer demand given its reliance on the foodservice sector. However now as foodservice demand slumps and retail buying retreats after the first wave of virus-induced panic, there are growing concerns that the US could be facing an oversupply of meat protein.

Normally the US would be gearing up for peak grilling, which increases protein consumption.

With backyard barbeques ruled out and fast food outlets still closed because of isolation requirements, it’s potentially going to limit consumption and limit the usual spike in demand for imported beef through this time. Added to this is the economic impact of Covid-19, as incomes are stretched, consumers are expected to turn to cheaper pork and chicken at the expense of beef.

As noted, NZ exporters are noting an improvement in interest and buying from China for beef. The lockdown in China saw many consumers test out home cooking and many had success with beef, particularly NZ beef. Chinese consumer sentiment towards NZ beef has also lifted given our handling of Covid-19. While the cogs may be turning in China it is going to take more than one market to pull beef prices back to the normal ranges farmers have been accustomed to over the last few years. Over the coming months the long-term impacts of Covid-19 on our industry will become clearer. It may be that farm budgets will need to be reviewed and chances are beef finishers will have to accept that the record high prices witnessed at the farmgate late last year are unlikely to be replicated any time soon.

What we are seeing is that store cattle prices are moving in tandem with slaughter prices. While prices received for finished stock are much lower than in recent years, the replacement cost of store cattle should help support margins in the short-term.

There has been such uncertainty and turmoil inflicted on our markets in recent months it is easy to keep a shortsighted view. If we can look at the positives, we can see, using China as an example, that markets can move through this and if there is one thing for sure, consumers have shown us in this unsettling environment that meat matters and in a crisis they will return to what they know and trust.

- Mel Croad is a senior analyst for AgriHQ.