Managing tough times

Increasing productivity without adding costs is one of the most effective strategies for remaining profitable in tough financial times. Sandra Taylor writes.

Chartered accountant George Collier encouraged farmers to look for opportunities within their businesses to grow and utilise more feed to increase production.

Drawing examples from his practice’s long-term farm survey, he said costs are typically similar between the top and median performers, the difference is the top performers have a higher stocking rate, lambing percentage and production.

Their economic farm surplus per stock unit (su) is $98 versus $58/su.

“Increasing productivity will reduce costs per stock unit.”

Collier is director of ICL Chartered Accountants in Alexandra and led a recent Beef + Lamb New Zealand Farming for Profit webinar.

He said the trick is to increase productivity without adding costs and this comes down to being more efficient at converting feed into saleable products.

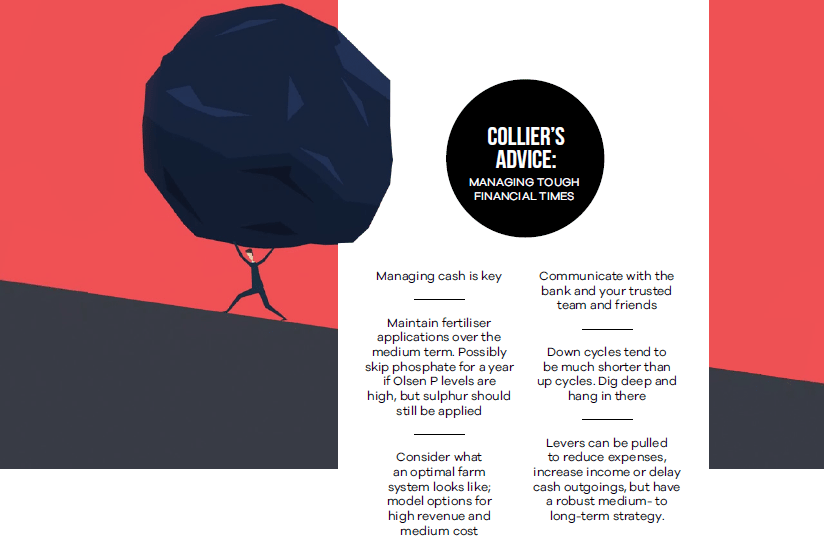

Speaking to the theme ‘managing in tough financial times’, Collier told farmers that managing cash was key and he advised farmers to have a budget and to revise it regularly.

He suggested that when budgeting for the bank, delay income and advance expenditure and be realistic when making assumptions.

“If it doesn’t work, don’t over-inflate income – rework the plan.”

“If it doesn’t work, don’t over-inflate income – rework the plan.”

It was important farmers communicated with their banks, were clear about their strategy for managing tough financial times and have funding limits well in advance.

Collier’s tips for reducing farm expenses in the short term included slowing the pasture renewal cycle by double-cropping, using contractors instead of employees (saving wages, accommodation and vehicle costs) stopping development, and thinking about needs versus wants.

This might mean repairing and maintaining equipment rather than buying something new.

“Postpone principal repayments for 12 to 24 months but climb back on the bus when the inevitable upswing occurs and restart with small one-off lump-sum payments.”

Drawings are an issue for some farming businesses (the mean drawing in the ICL survey was $72,000/annum or $1400/ week) and Collier suggested setting up an automatic payment from the farm account into a personal account while minimising both personal expenses and spending on farm cards.

Tax payments can be delayed through Tax Management NZ or through arrangements with IRD and there may also be an opportunity to revise tax payments.

Other options he gave for generating cash included cashing-up life insurance, subdividing and selling off land, selling surplus machinery, looking for opportunities within the ETS and generating income through a partner going off farm to work.

Medium-term cost reduction strategies include being strategic with fertiliser inputs. If Olsen P levels are high, phosphate levels rates can be reduced, but applications of sulphur need to be continued, Collier said.

Pasture mixes should be limited to two to three species. Research has shown there are no production benefits to increasing the number of pasture species in a mix above three. It just adds costs.

Collier suggested buying chemicals and animal health treatments in advance and in bulk and taking the opportunity to run a ruler over the cost of insurance.

“Get an independent view on insurance, as people are often over-insured.”

Long-term cost reductions come down to feed, which Collier described as being the core constraint and the core cost in any farming business.

Reducing feed costs by matching the farm system to the pasture growth curve, maximising the use of pasture while minimising the use of supplementary feed, and managing pastures to maintain quality and drive regrowth will all help with long-term cost reduction.

“Pasture persistence is critical to reducing costs and grazing management is key.”

Other long-term considerations include the use of improved genetics to drive productivity and at the same time reducing costs associated with internal parasites, the smart use of technology, incorporating the “Lean” concept and where possible, protecting income streams through the use of contracts such as fine wool contracts.

The Lean concept is producing goods of the highest quality at the lowest cost by being time efficient, reducing waste and implementing smart systems.

Collier said there was no substitute for mixing with progressive farmers, getting off the farm, networking widely and getting top advice.

Looking back at the financial performance of sheep and beef farms over the past 22 years, Collier said while there have been some roller coaster years, generally the balance sheet has gone from strength to strength.

“The upcycles are always longer than the down cycles.”