DESPITE FARMERS ENJOYING strong product pricing for beef and lamb, the all-too-common gripe at the moment is that “all the expenses have gone up, therefore it doesn’t feel like I’m making any more money”.

With the annual rate of inflation recently released at 6.9% for the March 2022 quarter, few costs have escaped increases. While some farmers will continue to begrudgingly pay with a ‘just suck it up approach’, now is an opportune time to review the financial performance of farm businesses and implement changes.

While strategies and options for dealing with three of the key input costs are expanded on further below, some of the top tips for dealing with higher input costs include:

- Review and update the goals and objectives (or develop some if not present). The goals of a multi-generational family farm, versus a corporate investment type farm are likely to be different; so may the strategy be for dealing with rising costs.

- Don’t lose focus on income by ‘counting pennies’. Focus on increasing income – income is what pays for the costs. Just make sure the cost of achieving the income is less than the extra income.

- Know what key inputs cost you last year, and what they are now or likely to cost this year. This allows focus on the biggest areas of cost change and therefore direct impact to your business.

- Have a budget. While cost adjustment strategies will be evaluated in isolation, know what the impact at a whole farm level these changes will result in.

- Prioritise and rank non-critical variable expenditure (discretionary repairs and maintenance or capital expenditure) ahead of time, not in the moment.

- Develop ‘if statements’ or decision points for when non-critical variable expenditure would be incurred or delayed.

- If the price rise is thought to be temporary, buy only what you need and when you need it (don’t get sucked into multi-buy promotions and irrelevant giveaways if you don’t need quantity).

How to deal with rising costs

While it may seem overwhelming that every cost is increasing, working through the expense items in last year’s financial statements (or this year’s up-to-date management accounts) using a line-by-line approach can establish where we can manage some of our costs.

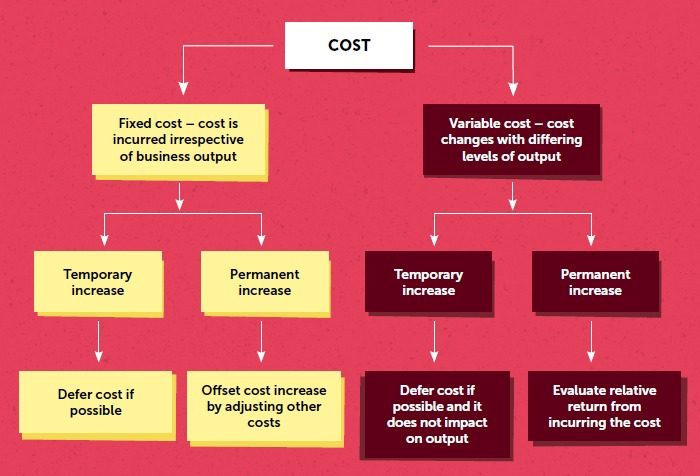

The diagram below provides a method for each cost to be evaluated, and options and strategies for dealing with the cost increase. While some costs are fixed and have seen a longer term rise (e.g: interest rates), there may be little other option than to pay the higher cost. But when looking at the whole farm business, other costs may have to be offset to absorb the fixed cost price rise. Focusing on the variable costs will yield the greatest gains.

Strategies and tips for managing higher costs over the three key expense areas:

1. FERTILISER

For most farms, fertiliser is the single biggest expenditure item. The recent lift in fertiliser prices has been spectacular, with some the high analysis fertilisers more than doubling in price in the last 12 months. This leaves farmers with a difficult decision as to how much of what product to put on, especially if finances are constrained.

While most commentary suggesting the high prices could be a temporary spike, it is unlikely we will see the pricing fully return to the levels of 12 months ago. Therefore, while we would recommend against whole-farm withholding of fertiliser applications to ride out price rises, some strategies and tips on fertiliser include:

- Don’t have a short-term strategy that compromises pasture production – we don’t want to mine soil fertility to a level where pasture production becomes adversely affected.

- Start at the start – have we got our soil transect lines in the right place to best represent different areas of the farm?

- Develop a tailored application strategy. By obtaining accurate soil test results, based on representative areas of the farm, tools such as variable rate spread can target more productive areas of the farm, or areas we would get the greatest response from.

- Is there an area of the farm with a nutrient status above the optimum? Can we apply a sub-maintenance rate over this area? Note that we don’t want to reduce fertility status to a level where pasture production drops.

- The economics of capital fertiliser applications should be carefully considered and evaluated. Applications could potentially be delayed until we see some price reprieve.

Fertiliser costs on most farms can be between 15-30% of total farm working expenses. Even a 10% reduction in fertiliser expenditure through targeted applications can reduce (or offset recent increases) total farm working expenditure by 2%.

- FEED

While many sheep and beef farms operate a simple all grass system, other farms reliant on conserving, growing or importing supplementary feed should understand the cost of doing so, and carefully consider this against the relative benefits.

Feed costs have increased in three main areas – nitrogen fertiliser, fuel (which affect cropping and supplement conservation), and chemical (affecting cropping costs). While prices for these inputs are generally considered a temporary spike, it is anyone’s guess when these will decrease and to what level. Therefore when evaluating feed costs, the following apply:

- Review the onfarm stock policy – are we using a lot of supplements? Is this still economic at higher prices?

- Have a feed budget and keep it updated – know if or when feed deficits are expected.

- Know what you are going to use to fill the feed gap. This could either be by reducing feed demand (by selling some trading stock) or increasing feed supply (by feeding out or importing supplements).

- Know the relative margins on your trading enterprises – most finishing enterprises (bull beef, prime finishing etc.) are returning somewhere between 20-25 cents/kg drymatter (DM) consumed.

- Know the costs of conserving feed onfarm (through cropping, silage conservation etc.) and importing feed (through nitrogen, buying in balage, palm kernel etc.). Most methods of conserving feed onfarm cost 13-20c/kg DM. Importing feed costs start at 30c/ kg DM with applying nitrogen, and about 50c/kg DM for importing palm kernel or balage onfarm.

- If supplementary feed is grown/ imported, explore options to contract in product schedule pricing. This way the trading margin can be locked in, given we know the feed cost.

- Be disciplined in the selling if the cost of supplying the feed is going to be more than the return from retaining the stock.

- REPAIRS AND MAINTENANCE

This cost centre is different than the previous two, as the recent increases in material pricing for fencing, water reticulation etc, are unlikely to reduce again. Therefore it is important to consider the following:

- Decide ahead of time what is contingent expenditure (i.e: the business will fall down if the cost is not incurred) versus discretionary (the nice-to-do job list).

- Decide which jobs are time-critical (cannot be delayed) vs flexible.

- Rank and prioritise the job list based on the two above points.

- Develop ‘if statements’ or decision points for when discretionary flexible repairs and maintenance expenditure would be incurred or delayed. Is it when we know (or have achieved) our average lamb sale price? Is it when we hit our target pasture covers pre winter and don’t have to use nitrogen to boost feed supply?

- Consider the above points as part of a whole-farm budget – e.g: we didn’t achieve budgeted lamb sale value, is it more important to get all the fertiliser on and leave roofing the back docking yard for another year?

- Get quoted pricing for materials.

The above shows examples on working through the three main areas of expenditure on farm ‘fertiliser, feed, and fencing’. The same principle applies to working through all other cost centres. Breaking the cost down to determine whether it is fixed or variable, and deciding whether we think the rise is a temporary spike, versus permanent lift can help determine our strategy. Although gains at an individual cost level may be small, 10 small gains can add up to a reasonable cost saving over the total farm working expenses bill.

- Dwayne Cowin is a senior consultant with Perrin Ag.