Large sheep stud a worthy winner

Wairarapa’s Wairere Station stands out for its innovative approach to farming in a challenging environment. Tony Leggett reports.

Wairarapa’s Wairere Station stands out for its innovative approach to farming in a challenging environment. Tony Leggett reports.

Awarding this year’s Keinzley AgVet Wairarapa Sheep and Beef Farm Business of the Year award to the country’s largest sheep stud enterprise probably turned a few heads in the province. But last November’s delayed field day at Derek and Chris Daniell’s Wairere property showed it is a worthy winner.

Its financial performance is boosted by the sale of up to 3000 rams each year, but it carries a cost structure that reflects running a highly stocked farm and operating the stud.

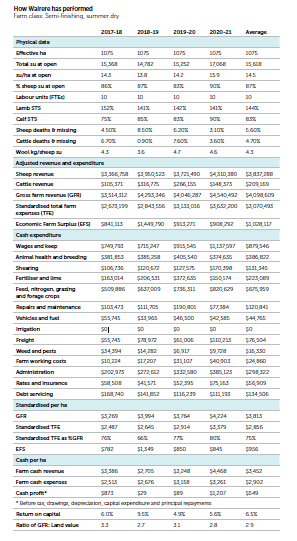

Gross farm revenue (standardised through the BakerAg FAB system) has averaged $3813/hectare over the four years to 2020-21. Standardised farm expenses are 75% of that average at $2856, leaving an average economic farm surplus of $956/ha over that same period.

One of the competition’s three judges, local farm business consultant Geordie McCallum says the large stud component of Wairere meant its financial numbers were vastly different to those from other farms in the region.

“It’s not a normal business, but remember they have a full-time data person plus two salespeople on the books and other costs associated with the stud. But the physical farm performance is right up there too.”

Return on capital is 6.5% average and gross farm revenue to land value/ha ratio averaged 2.9 over the four years, after a peak of 3.3 in 2017-18.

The judges were impressed with the quality of management of the complex business, including single sire mating of the recorded flock, ongoing trials and a much higher stocking rate than normal for the region – nudging 16 stock units/ha in the 2020-21 year and averaging 14.5su/ha over the past four years to that point.

Sheep comprise 87% of the total stock units, reflecting the massive stud component of the business. Average lambing percentage sits at 147% and survival to sale is 144%.

McCallum says both rounds of judging at Wairere were a great experience.

“We (the judges) had three powerhouses around the table. Derek, right out there, a big picture thinker and not afraid to be breaking new ground; business manager Simon (Buckley) operating like a tag team with Derek, and farm manager Sam (O’Fee), the young buck at the time, a previous winner of the Emerging Red Meat Leader award the previous year.”

He says they had a dynamic that was great to see, and as people in a team, it was exceptional for the judges to see.

He says Wairere stood out for its innovative approach to farming in a challenging environment.

“Everyone says you have got to be innovative, but there has to be balance as well. When you’re thinking about the rams Wairere needs to be producing in 10 years’ time, that means taking risks and others providing the balance.”

McCallum says it is pleasing to see the commitment to developing talent in the Wairere business.

“The University of Wairere as it’s known, you can go anywhere in the country and you mention Wairere and someone will have worked there, known someone who has or heard about what a great place it is to work.”

About half the field day audience had either worked at Wairere or were working there now, had bought rams off the stud, or were connected to families involved at Wairere.

Joint ventures with top operators ‘stretch‘ the boundary’ of Wairere.

About 10,000 sheep wintered on Wairere and a similar number on other farms around the country.

Joint-venture farming of stock started in the late 80s when Daniell could see growth in demand for the type of sheep he and others were producing but wasn’t in a position to buy more land to do it himself.

Daniell says the agreements with outside partners range from grazing arrangements to long term breeding agreements where rams are supplied by Wairere and a selection of the ram progeny is bought back or sold under a shared brand with the partner.

At the same time, they could also see demand coming for terminal sires, composites and specific traits like facial eczema tolerance. Joint venture agreements also gave them a speedier pathway to scale to meet market demand.

He says it is a service business and they have to supply what people want.

“You are the ones facing the real world, it’s not us telling you what you need.

“We need to be in tune with you, but 10 years ahead of that because it takes a while to do that breed development.”

Buckley says if they don’t they won’t have a business.

One of the advantages of joint ventures is to work with top farmers and managers like Sully Allsop, Wairarapa; Hugh Abbiss, central Hawke’s Bay; Murray Gemmell, King Country, and James Bruce, south Wairarapa.

Daniell says he regrets not buying more land at the time when the joint ventures started to develop, saying he had a “mental block” to it. In hindsight, he can see how cheap it was – relative to now – after a decade of low income years following the removal of subsidies in the early 80s. In terms of wealth creation, investing in land is hard to beat.

He paid $1.13 million in 1990 to buy out two quarter shares in Wairere owned by his two sisters and then bought the other quarter in 1996.

“I was 39 when I bought out my sisters and it really was the time to buy it. Our gross income that year was $900,000, our costs were $450,000, and that included our wages bill of $94,000. The relativities are totally different today.”

He said that was the time to buy land for his generation. The challenge facing young people today is how to get started with land at 15 times more than it was back then,” Daniell says.

Instead of buying more land, he invested in commercial property and business ventures. While some worked well, others didn’t.

Read more: Lessons learned from long-term hogget mating,