Lamb prospects mixed

Exporters say consumers in the major Chinese market for New Zealand sheepmeat are changing buying habits, Glenys Christian reports.

Exporters say consumers in the major Chinese market for New Zealand sheepmeat are changing buying habits, Glenys Christian reports.

The Chinese market will continue to play an important role in New Zealand sheepmeat exports in the short term. But there are concerns about slowing economic growth and continued lockdowns in response to Covid-19, both affecting consumer demand.

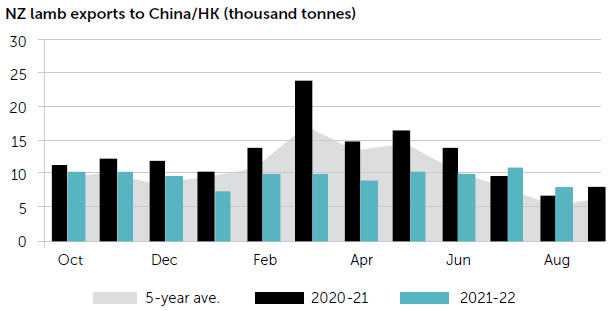

In the 2021 year, sheepmeat exports totalled $4.3 billion, up 12% on the previous year, despite volumes being down 10% at 365,223 tonnes. China accounted for more than half of the volume at almost 190,500t, worth $1.6b. In the most recent figures for July sheepmeat exports reached $384 million, an increase of 40%. Volumes were 32% higher exported to China compared with the same month in the previous year, showing recovery in that market.

ANZ bank has recently revised down its economic forecast for China to a gross domestic product (GDP) growth rate of 3%, lifting to 4.2% next year. It hit a low of 2.2% in 2020 before bouncing back to 8.1% last year, coming off average rates of 10% between 1998 and 2007. ANZ expects the Chinese currency to further weaken against the US dollar until at least the end of the year which also erodes buying power.

Alliance’s marketing manager Shane Kingston believes the Chinese market is likely to hold up well until new year celebrations next January. But after that he says reducing consumer spending ability there could subdue demand, meaning the company may look at changing product formulations or promotion in the market.

“Consumers are behaving differently,” he says.

Many Chinese homes aren’t set up for cooking which has compounded the effect of lockdown restrictions which are estimated to have had an impact on 264 million people over the last nine months.

domestic sheepmeat supplies with a national flock of 331m, up 2.4% from last year. While Australia is busy rebuilding its sheep flock there aren’t indications it’s tilting back towards China after having a reduced presence due to political tensions.

Silver Fern Farms (SFF), general manager, sales, Peter Robinson says that as with beef, China plays an important role in rebalancing challenges in its other markets.

“Lamb sales are positive and demand looks solid. We expect this to remain the case at least until after shipments of product for 2023 Chinese new year are completed in late November.”

The market had picked up some extra volumes of lamb legs to partly compensate for reduced sales in the United Kingdom.

“But we cannot expect them to fully cover volumes particularly when the seasonal kill ramps up.”

China is a really important market for the company. “But they can’t carry the whole load and so we need the other markets to improve.”

Mutton market stable

On the mutton front, very stable, positive demand sees prices well ahead of other markets, underpinning schedules into next year.

While China’s importance will continue, Meat Industry Association (MIA) chief executive Sirma Karapeeva says value rather than volume will drive future sales. That’s likely to mean more choice about the markets that are supplied.

“We’ll probably start to see a drop in volume as farmers grapple with climate change policies,” she says.

“But it’s not all dire straits because if value holds up we will be in a better position.”

That means Middle Eastern and South Asian markets, where it’s good to have access, may miss out if the prices they’re prepared to pay don’t match those in other countries.

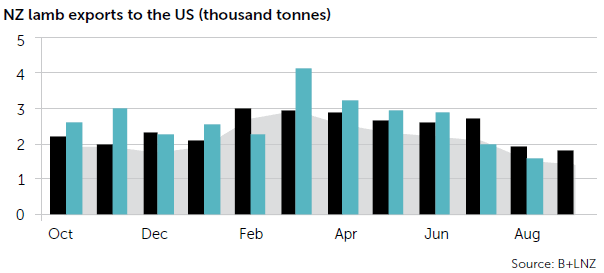

While NZ meat companies know the Chinese market well and have good connections there when it comes to sheepmeat sales, she says alternative markets are starting to pop up. She points to the United States which, while volume grew 18% in 2021/22 to almost 32,500t, there was a 62% value increase to $601m.

July figures show that while exports were down by 29%, value was up again, reaching a record $23.31/kilogram. Lamb is increasingly viewed as a high-end product that’s leaner and healthier due to animals being grass-fed, which resonates with consumers. The Taste Pure Nature (TPN) promotion was first launched there and is now starting to have an impact, meaning smaller volumes can be sold while value is maximised.

“That’s where we need to transition to.”

Kingston says that in the US high single figure inflation and greater competition from Australia and Ireland is having an effect.

“We’ve maintained our edge but it’s coming off a little bit,” he says.

“There are more players playing on that pitch.”

The TPN promotion, launched mainly in California, was creating better awareness of lamb’s qualities which Alliance could build on with in-store product availability. The challenge now is how to repeat that success across the whole country.

Exporters fear UK FTA delays

The death of Queen Elizabeth II, following the change of Prime Minister in the United Kingdom has raised fears of delays in ratifying its free trade deal with New Zealand.

This comes on top of continuing shipping disruption, the Russian invasion of Ukraine and the likelihood of consumer demand for lamb dropping as high inflation bites.

In the 2021/22 year the UK took 34,907 tonnes of sheepmeat worth $446 million, but chilled exports were 52% down at 7196t, the lowest volume for 20 years. This saw its value drop below those to the United States at $185m compared with $103m. However in July there was a lift of 98% in all sheepmeat exports to 2703t as the UK market started to be rebuilt.

Alliance had been excited about continuing to grow its presence in the UK, marketing manager Shane Kingston says. But recent events had introduced a lot of conflicting and competing factors around the timing of ratification of the FTA which had been expected to occur next year.

However, there were hopes that despite the disappointing beef access allowed under the European Union FTA, sales of high-end cuts of lamb might be able to be grown sustainably in wealthier northern member countries through long-term partners.

Silver Fern Farms, general manager, sales, Peter Robinson says European markets are still performing okay, but there would likely be an impact due to economic concerns, including the Ukraine war on its doorstep.

While the UK has always been a major lamb market, volumes have been dropping. It still takes about 35% of the company’s lamb legs but is one of the hardest-hit economies as inflation takes hold, with some forecasts showing this could reach 13%.

“With the costs of living including heating and petrol prices increasing, there is less money in UK consumers’ pockets and therefore we can expect some impact on lamb as it is a relatively high-priced protein,” Robinson says.

Challenging times

ANZ bank’s agricultural economist Susan Kilsby says it’s predicting lamb prices to be $1/kg lower during the main export season from February to May compared with that period earlier this year. With more of a hangover of product still in the market she doesn’t expect these decreases to be seen before the end of the year.

“But then they could drop away sharply after Christmas,” she says.

“Everywhere is experiencing tougher economic conditions and that will make selling higher end products more challenging.”

MIA chief executive Sirma Karpeeva says the UK will continue to be an important market especially in chilled sales for the Christmas and Easter markets. But over the last year shipments have been disrupted by logistical problems, which were likely to continue a little longer.

Kingston believes while there’s a steady move towards a level of normality, vessels running on time were still about the mid-30% level.

“It needs to be double that.”

Many factors had had an effect including Chinese lockdowns, the Russia-Ukrainian war and the recent Felixstowe port workers strike.

“We’re not out of it by any stretch of the imagination. There’s a level of nervousness.”

Kilsby says there is some good news with shipping prices starting to ease a little, sailings being cancelled or disrupted less frequently and capacity beginning to grow.

“But if there are still lockdowns and workers away from their jobs there are still going to be disruptions.”

There are hopes some of the collaboration between NZ meat companies in getting around shipping problems would continue, and that this might be extended into more back-to-back contracts capturing more value through products being better suited to market requirements.

An area where meat companies are eeking out more value is in co-products such as offals. During July, exports increased 28% compared with last July, to $230m. Casings and tripe exports were up 76% to $50m. The major markets were China at $72m, the United States at $50m and Indonesia at $18m.

Along with petfood their strong growth has only been slowed by labour shortages at meat plants, meaning the emphasis had to go on premium cuts. But with recent visa agreements for overseas workers Karapeeva says “there’s light at the end of the tunnel.”

Lambs begin their journey to markets around the world.