BY: MEL CROAD

The new processing season is nearly upon us, making this a perfect time to review the year to date and also focus on what is in store for lamb prospects towards 2021.

It is safe to say 2020 has been a testing year on all fronts and our lamb market has not been immune to it. To begin with, increasingly dry conditions in January already had many farmers on guard. The record money of $9/kg achieved through November 2019 saw many hold on to lambs for much longer than normal. As the dry conditions took hold into the New Year, processors were swamped with lambs. Backlogs grew as there were very few options to lighten stock numbers onfarm. Processing space remained at a premium and farmgate prices were being reduced by as much as 20-30c/kg a week.

Then the Covid-19 shutdown of China in early February sent panic waves through the industry. These concerns were somewhat pushed to one side when New Zealand went into lockdown in late March. Never in such a small space of time has there been so much working against us.

Farmgate lamb prices fell by 50c/kg through April as meat companies were unsure how markets were going to manoeuvre their way through the impact of Covid-19. They looked to reduce their exposure to export markets by slowing throughput at processing plants. These meat companies also grappled with spacing requirements at processing plants, which impacted their ability to process livestock efficiently. But it was a trade-off they were prepared to make to keep plants open.

From the peak of $9/kg CW in November, lamb prices continued to fall week on week before bottoming out in May at an average $6.58/kg in the North Island and $6.40/kg in the South Island – a fall of between $2.40-$2.60/kg. The usual downside through this period is 45-50c/kg. This shows the severity of the market conditions lamb has dealt with this season.

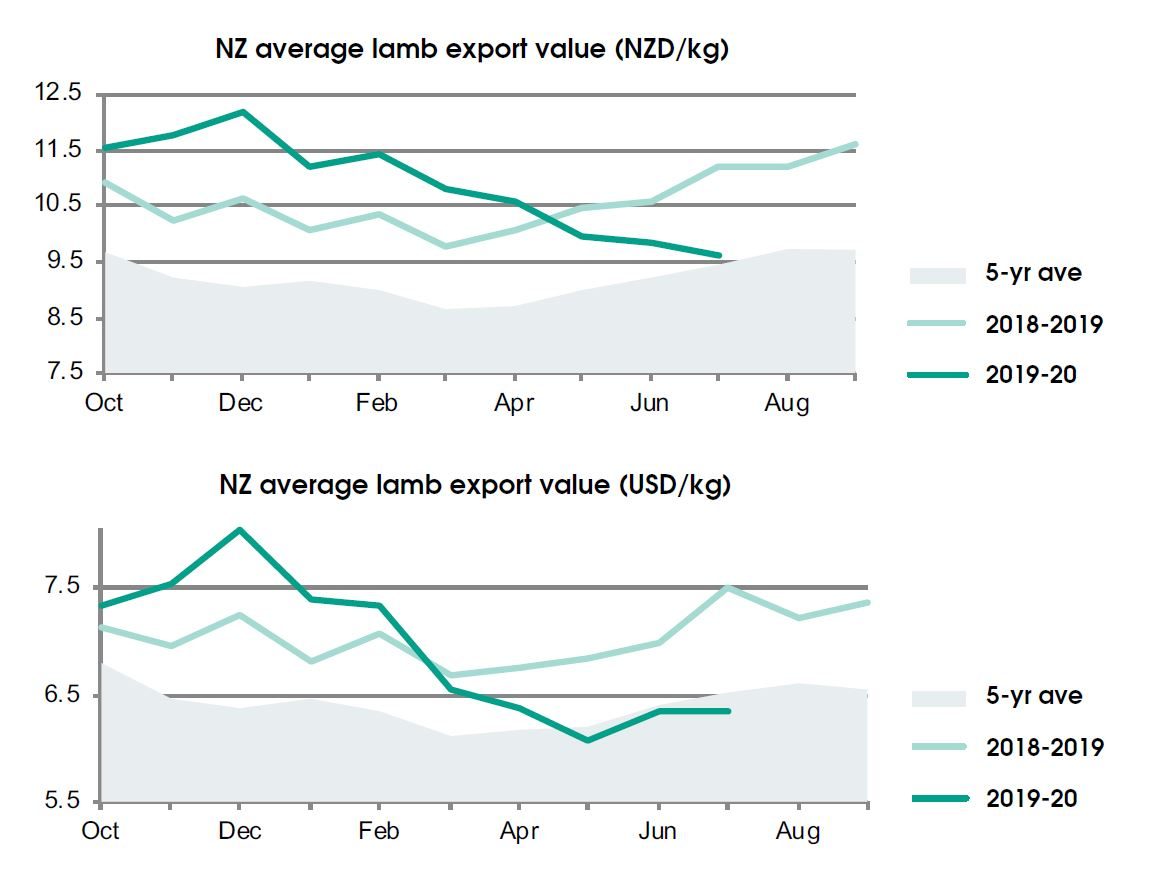

Covid-19’s spread across our global lamb market highlighted the common complexities exporters deal with. Almost overnight, values for high-end restaurant lamb cuts were slashed as, globally, lockdown regulations forced people back into their homes and away from social gathering spots such as restaurants and places of work. An early lesson was that markets with a higher proportion of retail trade weathered the storm better than those more heavily reliant on foodservice and high-end restaurant trade. And this has been the common theme since April. Typically by April, average export values for NZ lamb start their upward march on the back of strong export demand. However, this year they have continued to fall month on month, reflecting the trying conditions of our most relied-upon export markets.

This market weakness is in stark contrast to previous years when overseas demand was strong enough to warrant monthly increases in value from key markets. July’s average export value was $9.61/kg compared with $11.13/kg in July 2019. As a result, farmgate lamb prices have stuttered. Since coming to rest in the mid $6/kg range, farmgate lamb prices have shown some marginal upside but it’s only half of what normally occurs through this part of the season.

Current lamb values are struggling to maintain their position at $7.20/kg in the North Island and $6.95/kg in the South Island. This time last year North Island prices were sailing past the $8.50/kg mark.

Demand for our lamb products remains much weaker than normal. The lack of demand at food service, which encompasses not only restaurants but also the tourism trade and cruise ships, has taken its toll on market returns as they involve most of the higher value cuts.

Retail demand has once again blossomed as more consumers eat at home, and traditional markets where these relationships were already well ingrained have benefited from increased export volumes. However, it hasn’t been enough to offset the lower demand for our higher-valued cuts. Only a full recovery of the foodservice sector will drive that, and unfortunately that recovery looks to be some way off yet.

What is in store for lamb

Many winter lamb trade operators are still banking on some procurement competition to develop into October, which would see some further upside at the farmgate. Many need this upside after the earlier prices paid for store lambs.

The temporary closures of sale yards across the country through our initial lockdown period created some pent-up demand for store stock when they eventually did reopen. Buyers didn’t hold back, and store lamb values catapulted by 80c/kg or more, driving per-head prices well in excess of $100. At that time the expectation that farmgate prices would simply revert to their normal seasonal trends by September and October also encouraged more buyers into the market. However, as witnessed in the last few months there has been very little upside in farmgate lamb prices.

And it’s going to be a tough ask in this current market environment. If we do happen to see any upside in average export values it will be short lived as these values tend to peak in October.

Processors will have to weigh up any procurement competition in the coming weeks against how margins are looking. To date, margins have been much weaker than normal. Some winter trade operators will also look to take lambs to heavier weights to offset the stagnant pricing levels at the farm gate. Caution is advised, however, as the majority of printed schedules are already showing significant pricing reductions for lambs over 25kg carcaseweight.

Beyond the last of the winter trade lambs there will be a lull before new season lamb slaughter rates pick up. A relatively kind winter to date has supported good lamb survival rates but it’s unknown if this will be enough to offset the earlier drought-affected scanning rates.

There has been little to no indication that breeding ewe numbers were on the rise so it’s likely the lamb crop will be near to or below last year when those reports are released later this year.

There is no question that new season lamb prices are going to be significantly below this time last year. There is much weaker demand and simply too much uncertainty in the global market for prices to stage any sort of recovery. While interest has picked up for the chilled Christmas trade, the volumes procured won’t be enough to offset the overall weaker market signals.

Chinese demand should also pick up as buyers start securing product for their Chinese New Year celebrations in early 2021. However, we are mindful that any improvement in interest is coming off a very low base. AgriHQ is forecasting pricing downside as our lamb slaughter rates pick up and export volumes start to lift. This will continue into the New Year.

Chances are we will face less competition from Australia this coming season as they look to actively rebuild their flocks. But the problem is not on the supply side of the equation, it’s squarely on the demand side, and until we see any sort of recovery in demand, and in particular foodservice, then lamb prices are going to face a softer outlook.

- Mel Croad is a senior analyst for AgriHQ.