Increasing costs on hill country farms

Cost rises are affecting farms in all localities, but no two farms are the same, farm consultant Tom Ward writes.

Cost rises are affecting farms in all localities, but no two farms are the same, farm consultant Tom Ward writes.

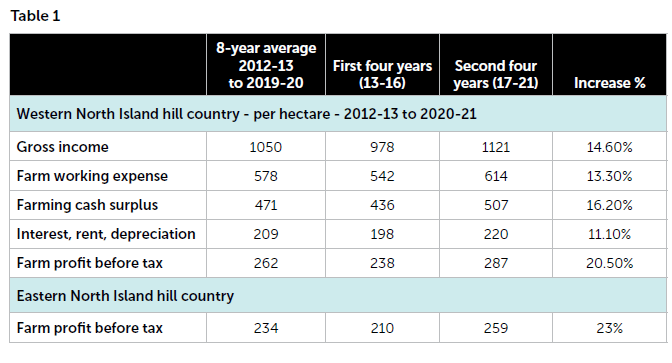

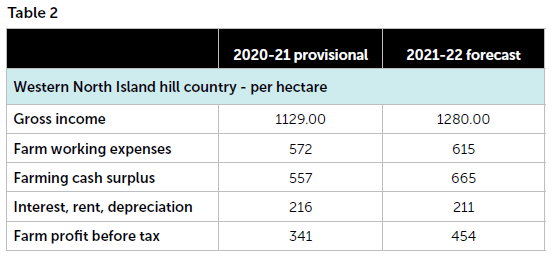

Hill country costs have not changed much in the past 10 years as shown by the Beef + Lamb NZ statistics (Tables 1 and 2), for Western North Island (higher rainfall) and a summary from Eastern North Island data being a dryer farming locality.

It needs to be kept in mind that in farm working expenses there is huge variation between farms, not just between districts but also between farms in the same district. For example, 8500 stock unit Wairarapa hill farms with a $900,000 gross income will vary in running costs between $400,000 and $600,000. Examples of individual cost variation are: Repairs and maintenance $10,000-$60,000, vehicles $11,000-$40,000, weed and pest zero to $30,000.

Because of this variance between farms I have not prepared budgets, restricting this article to comments.

- FERTILISER COSTS

- See Table 3.

- TOPDRESSING COSTS

Fixed wing flying increased 10-15% in the last 18 months, largely due to fuel price rises, however difficulties securing components from overseas has also contributed. Helicopter charge-out rates are up by a similar amount.

- ELECTRICITY

- No change to electricity costs.

- LABOUR

Farm staff wages and salaries have increased in 2021-22 on average 5%, a range of 2-6%.

Through 2022 an increase of at least

10%, reflecting very high employment rates and reduced immigration, and increased emigration, is expected. Shearing contractors have increased rates 3-5% in 2020-21 and are expected to increase by a similar amount in 2021-22. However, they have absorbed substantial increases in food, fuel and rents and one contractor I spoke to expects contract rates to increase by $1.20 to $1.50 per sheep this year.

Higher shearing rates in Australia are making retention difficult.

- TRANSPORT

Petrol has increased 40%, and diesel 60% (although Road User Charges have been reduced temporarily) over the last 12 months. Accordingly, road freight rates have increased at least 10% in the last year and will shortly increase another 5%.

Sixty percent of this increase is due to increased wages, only 40% to fuel. One operator I spoke to is expecting two more wage increases this year. Replacement staff are very hard to find. Repairs and maintenance for this company have increased 24% in the past year.

- ANIMAL HEALTH

Increase 2-5%.

- SUPPLEMENTARY FEED

Barley grain (currently $580/tonne, up 50%), maize grain and silage, grass, palm kernel (currently $520/t, up 65%), and grazing-off costs are very variable, and driven by weather.

- BULLS AND RAMS

Cost of breeding bulls remains unchanged.

- MACHINERY

There has been a 25% increase in costs of buying utes, caused by import difficulties and extremely strong demand from farmers up until March 2022. Due to the introduction of the electric vehicle rebate, the demand for farm utes has massively declined in April 2022.

Larger items of farm gear (tractors and combines) are up 20%, with late model second hand items being very well sought after. The weakening NZ dollar may cause further machinery price increases.

- FINANCE

Term loan interest rates are expected to increase 0.8% to 4.40% (18%) however fixed rate loans, debt repayment and reduced overdraft requirements, on average, are expected to reduce the costs of servicing debt by 2.4%.

- DRAWINGS

CPI at 6.9% will increase drawings.

- INFRASTRUCTURE

Building costs have increased by 30% over the last two years.

- FIXED COSTS (INSURANCE AND RATES) Insurance costs are expected to increase 10-12% driven by higher wages. With the increase in building costs (30%) farmers are already absorbing substantially increased premiums especially on dwelling cover. Rural rates increase may remain reasonably static, although a 5-8% increase is expected, and those with substantial community funded works (eg river protection) will see substantial increases. Regional Council rates are forecast to increase 18%.

- GENERAL

Farm supply firms report increases to varying degrees, with glyphosate doubling in price recently. Any agricultural chemical with bulk from Asia suffers freight price and delay issues and 60% of agricultural chemicals have a China component. Cost of alkathene pipe is up 20%.

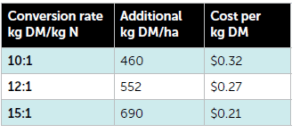

Gross margin for nitrogen use

With urea applied at 100kg/ha (46kg N/ha), total cost will be $1500/t urea applied consisting $1270/t fertiliser cost, $40/t freight, ($40/t – 200km freight) and $190/t spread by air. ie $3.20/kg N and $147.20/ha. At a variety of conversion rates, the cost per kilogram drymatter (kg DM) will be:

Most annual gross margins of livestock enterprises suggest an insufficient return to justify the cost of applied nitrogen, however there have been exceptions. The gross margin for weaner steers bought in the autumn of 2021 carried through to spring of 2021 was 50 cents/kg DM, and the cost of supplementary feed and winter grazing at least 30 cents per kg DM. Given that scenario, the farmer might consider applying spring nitrogen.

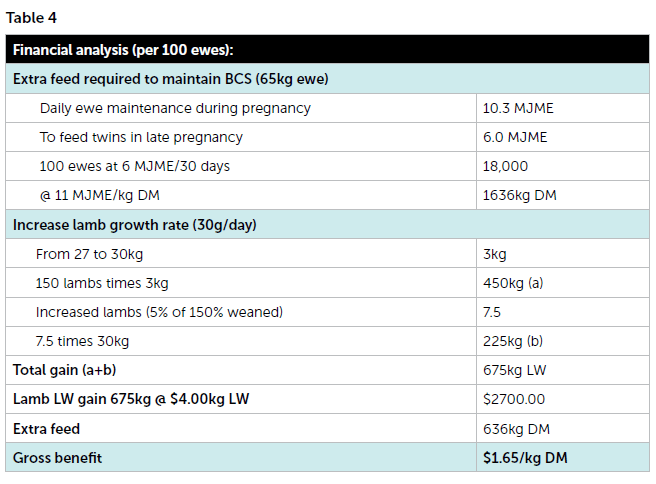

Furthermore, winter/spring is where most of the value is generated from a ewe flock. If the extra feed could maintain ewe BCS at 3.0 instead of losing BCS 0.50, the benefit would be a 5% increase in lamb survival and a 30g/day increase in lamb growth rate. In addition, but not measured for this exercise, both the lamb birth rate, and the ewe survival rate would increase. See Table 4.

As always, sufficient moisture and soil temperatures are critical, however there still appears potential for good returns from urea.

But there is a rider here, and this is where the whole-farm budget is important. The cost per kilogram of drymatter from applying urea may be similar to the cost of reducing stocking rates through running fewer trading sheep, cattle or deer.

- Tom Ward is a South Canterbury farm consultant.