How low will it go?

As the 2026 Global Dairy Trade (GDT) Index starts to show its colours, it is evident that global markets are transitioning downwards from a peak in May 2025. High Ground Dairy’s, Stu Davison, says we are firmly in the midst of a commodity market cycle, moving from the most recent peak toward the next trough. Words Stu Davison.

Commodity markets are inherently cyclical, and dairy commodities follow the rhythm of a classic soft commodity market. The most recent low point of the Oceania dairy market was in August 2023, where, for reference, the index hit 850.

The market then reached a recent high point in May 2025, when the index hit 1,333, respectively marking the minima and maxima of the commodity market cycle over the last two and a half years.

Due to milk being in a wide range of products, from cheese through to infant formula, dairy supply and demand dynamics are more complex than many other soft commodities. Dairy demand also moves in different directions depending on where and how consumers are operating. Supply is equally complex, with weather and pricing, among many other factors, driving input costs and sentiment. Differing production systems must also be accounted for – European systems respond to grain pricing far differently than how Kiwi farmers might.

“Over the last 12 months, global milk supply has moved from restricted to oversupplied, with farmers globally responding to increased milk prices, while herds have also recovered from animal disease outbreaks.” – Stu Davison, High Ground Dairy

However, when one side of the supply-and-demand equation becomes overweighted, the balance beam can shift rapidly. Over the last 12 months, global milk supply has moved from restricted to oversupplied, with farmers responding to increased milk prices, while herds have also recovered from animal disease outbreaks.

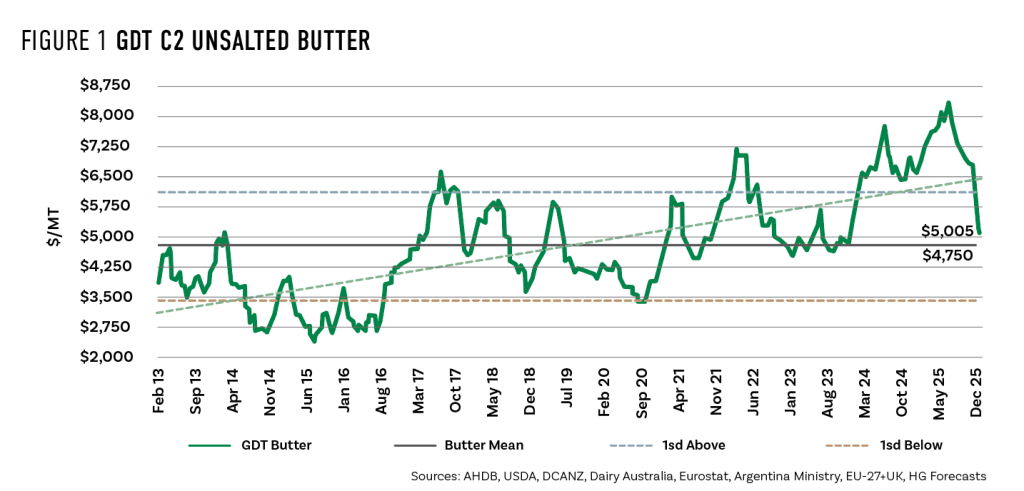

I do not need to remind any Kiwi farmer about milk prices over the last two years – they have been impressive. But a similar story has played out in the United States, Argentina, Uruguay and the European Union. The United Kingdom, now outside the EU, has also corrected its internal milk pricing situation, with farmers responding with strong output growth this year. Elevated milk prices have incentivised producers globally to ramp up production. The key driver of this dairy cycle has been butter pricing, with both European and New Zealand butter prices reaching record highs as milkfat availability became exceptionally tight over the past year.

Part of the milkfat deficit stemmed from multiple animal disease outbreaks across the European Union and the United States over the past two years, including Bluetongue Virus (BTV), avian influenza and isolated Foot & Mouth cases, all of which kept markets on edge. Notably, BTV has also extended and delayed calving patterns across parts of Europe, with affected cows getting in calf later than planned and therefore calving later, compounding the milk production response in the second half of 2025.

There are two useful catchphrases when thinking about commodity markets: “I’ve seen gluts not followed by shortages, but I’ve never seen a shortage not followed by a glut,” often attributed to Nassim Taleb, and “High prices cure high prices,” which can just as easily be flipped to “Low prices cure low prices.” Together, these capture the most recent swing in prices.

The butter shortage of 2024 and early 2025 as outlined in Figure 1. now results in a milkfat glut, illustrating how markets respond to price signals. New Zealand butter is now priced $3,270/MT below the record high – a 40% decline – while whole milk powder (WMP), which is heavily influenced by milkfat values, is $1,355/MT below the May 2025 peak, a 30.3% decline.

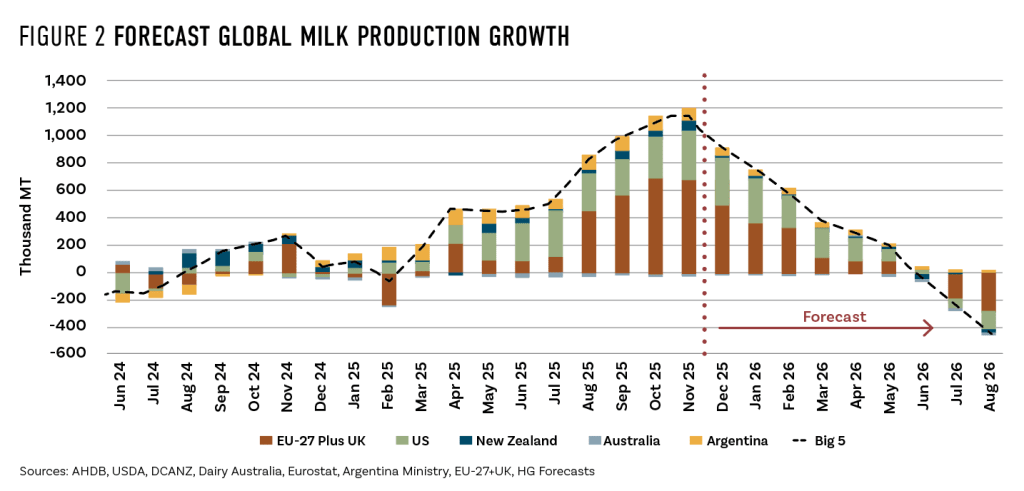

The market is now in the midst of a milk supply glut. Figure 2. outlines recent milk production growth and highlights the impressive contribution from the Northern Hemisphere. You will also note that milk production has been forecast through the first six months of 2026, with those projections suggesting strong, compounded growth from the world’s top five dairy exporters.

Commodity pricing is declining rapidly as the market remains significantly oversupplied, a direct consequence of the elevated prices required to encourage additional milk production during the butter shortage. Barring a black swan event in the Northern Hemisphere – such as a Foot & Mouth outbreak in Germany – the dairy market is likely to remain under pressure until global milk production rebalances. We believe that rebalancing is unlikely before the end of 2026. With that in mind, the outlook for farmgate milk prices over the next 18 months, globally and particularly in New Zealand, is likely to be materially softer than what farmers have experienced over the past two seasons.

Commodity pricing is declining rapidly as the market remains significantly oversupplied, a direct consequence of the elevated prices required to encourage additional milk production during the butter shortage. Barring a black swan event in the Northern Hemisphere – such as a Foot & Mouth outbreak in Germany – the dairy market is likely to remain under pressure until global milk production rebalances. We believe that rebalancing is unlikely before the end of 2026. With that in mind, the outlook for farmgate milk prices over the next 18 months, globally and particularly in New Zealand, is likely to be materially softer than what farmers have experienced over the past two seasons.