BY: TOM WARD

This article is about risk management, so when I refer to hedging it is in a general sense – measures farmers may take, from time to time, to manage risk.

Everything we do, whether a farmer or not, whether in business or family life, is a decision on the future value of a matter or issue or asset. Generally, we leave the matter open, trusting on our experience, or the advice of others, that our decision will be a good one.

From time to time however, the farmer will be motivated to “fix” the future value of a purchase or sale, thereby eliminating or perhaps reducing the future risk.

There are different levels of risk mitigation:

1. Whole farm level including balance sheet strength,

2. Livestock and crop policy,

3. Intra-season decision-making in response to events as they arise.

There are different types of risk mitigation, ie forward contracts in a physical sense, increased flexibility in management, and derivatives (futures contracts on the financial markets).

Today, many, but not all farmers, employ a variety of physical “hedging” strategies within their farm operations, both in a strategic and day-to-day basis.

First, these farmers have systems which allow a majority of stock to be sold early in the season – trading cattle are a good option here – when pastures and stock are healthy, and markets firm.

These cattle can be sold at any time from spring till when the farm starts to dry out. In addition, if the dry persists, replacement cattle do not need to be bought, reducing the winter stocking rate.Contrast that with the predicament faced by many farmers this month where, having waited to have stock killed as the drought put freezing works under pressure, they are again waiting for the works, delayed by reduced freezing works throughput caused by Covid-19 manning requirements.

Secondly, they have systems in place which accumulate supplementary feed or cash in good seasons, or run a low stocking rate, or have areas of heavy soil, or invest in irrigation, or run a low debt. These strategies appear inefficient until you appreciate that they are really hedging strategies.

Thirdly, they will from time to time sign a contract to fix the price of their products for sale or inputs to purchase.

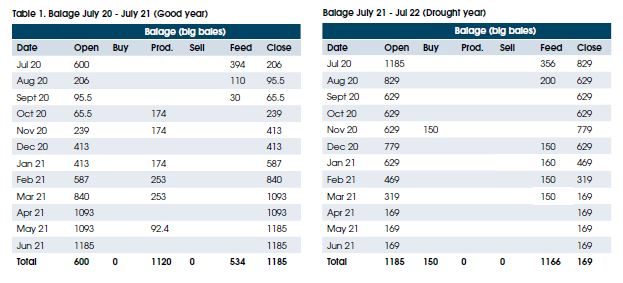

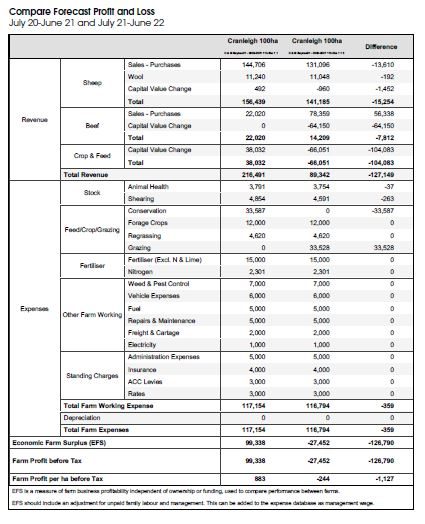

Table 1 shows a FARMAX analysis where a moderate stocking rate allows surplus grass to be conserved as balage in a good season. The following year, a drought, the balage is fed out to ewes, two-year cattle sold a little earlier, only 50 cattle bought to replace the 100 sold, and hogget replacements grazed off. The actual cash results are $61,306 and $102,790 for 2020-21 and 2021-22 respectively.

Sir Sidney Kidman, the iconic Australian grazier of the late nineteenth and early twentieth centuries, built a farming empire in the driest part of a very dry continent, and prospered at a time when many were failing.

His stations were not strategically located to provide diversification. They were situated and were managed, to enable the business to survive and thrive in a highly uncertain environment.

His stations were not strategically located to provide diversification. They were situated and were managed, to enable the business to survive and thrive in a highly uncertain environment.

The farms stretched from Northern Territory to South Australia, providing a pipeline from breeding to market. They were connected (or nearly connected) to each other so that livestock could be continuously moved if necessary to pastures which had received rain.

They were located astride or beside stock routes, rivers and stock water sources (which his company dominated), and finished adjacent to railheads so fat cattle could be moved to markets in any of the big three cities – Melbourne, Sydney and Adelaide.

In general, his farms were understocked, and there was an opportunity cost to this. However this moderate stocking, ability to move cattle, and graze areas with feed when rainfall was sporadic and random, was effectively a “real” futures option play.

Very little derivative hedging is done in New Zealand farming, with only the dairy industry easing into that. Outside of agriculture, power distribution companies hedge their electricity costs, Air NZ hedges it’s fuel costs, some exporters/importers hedge their foreign currency, and there are share and interest rate (swaps) hedging.

A futures contract or option (an option is the opportunity, but not the obligation, to take up a future sale or purchase) is called a derivative because it derives its value from an underlying physical good and always runs parallel to the physical good transaction. For example, if you are selling weaner steers in the autumn, and you wanted to hedge the sale price, you might sell a futures contract in the financial markets. You would then buy that contract back, to close it out, at or about the time you sell your steers physically.

If the markets are working well, the change in the sale price of the steers should negate the change in the nett value of the buy and sell derivatives transactions. If the price of steers increases you will not get that benefit, which is the opportunity cost of your hedging.

In the United States about 48% of the beef cattle pipeline is hedged through derivatives, and the hedged operators often drive the physical price. For example, last August hedged feedlotters, after a fire in a major meat works in Kansas, which was expected to reduce beef processing capacity nationally, increased the rate at which they sold their fat cattle. This was driven by their ability at that time to close out their futures contracts at a profit (ie: they could buy back their derivative sale contract for less than it was sold for). These extra cattle on the market depressed the fat cattle market further.

In the United States about 48% of the beef cattle pipeline is hedged through derivatives, and the hedged operators often drive the physical price. For example, last August hedged feedlotters, after a fire in a major meat works in Kansas, which was expected to reduce beef processing capacity nationally, increased the rate at which they sold their fat cattle. This was driven by their ability at that time to close out their futures contracts at a profit (ie: they could buy back their derivative sale contract for less than it was sold for). These extra cattle on the market depressed the fat cattle market further.

As time passed, the freezing companies were, through overtime and working together, able to process cattle with minimum delays. The following is a theoretical illustration of the above discussion:

• Expected sale price (Sept 2019) of steers sold April 2020 $1500 (a)

• Sale of Futures contract (Sept 2019) for steers, matures April 2020 $1500 (b)

• Actual sale price of steers April 2020 $1400 (c)

• Purchase price of Futures contract (close-out price) $1250 (d)

• Gain in Futures transactions (b)-(d) $250 (e)

• Nett return for steers (c) + (e) $1650

A similar scenario exists today in New Zealand, with the freezing works currently struggling to adjust to the strict Covid-19 manning protocols. I think in two or three weeks throughput will be pretty good, although probably not in a form that is sustainable long term.

If you think derivatives “hedging” is a waste of money, you might be right – if you had hedged your cattle price you would not have benefited from the high beef prices caused by African swine flu in China, if you had hedged your milk price you would have missed out on $1/kg milksolids (MS) this year, and if you were American Airlines it would appear a good move that you have not hedged your fuel purchases.

But you might also like to put yourself in Sir Sidney’s shoes. His farming business existed in a very uncertain environment – it was set up to manage drought! If severe droughts increase in severity, as many climate change proponents suggest, or if volatility continues to be the norm, some farmers will recognise that their business will not survive a very bad year. For them some form of hedging would be desirable and their financiers may actually decide that for them.

• Tom Ward is an Ashburton-based farm consultant.