Good news for New Zealand lamb from Australia

Australia’s flock moves to maintain heavy liquidation, pointing to tight supplies from 2025 to 2027, which foreshadows well for the New Zealand lamb industry. Words Simon Quilty.

Australia and New Zealand collectively account for 85% of global lamb and mutton exports. Australia is expected to ship almost 372,375 tonnes of lamb during the New Zealand 2023/24 export season, compared with NZ’s 291,000t.

Australia’s mutton exports for the same period are expected to be 225,920t, compared with NZ’s 81,000t.

So, Australia’s export volume significantly influences the pricing of NZ lamb on the hoof and in a box, whether it’s lamb or mutton. The one market that both countries don’t share on equal terms is Europe, where Australia has limited access to only 5,851t of cold carcass weight (CCW) compared with NZ’s considerable access of 125,769t CCW. Unfortunately, this market alone cannot shield the NZ industry from oversupply issues in Australia.

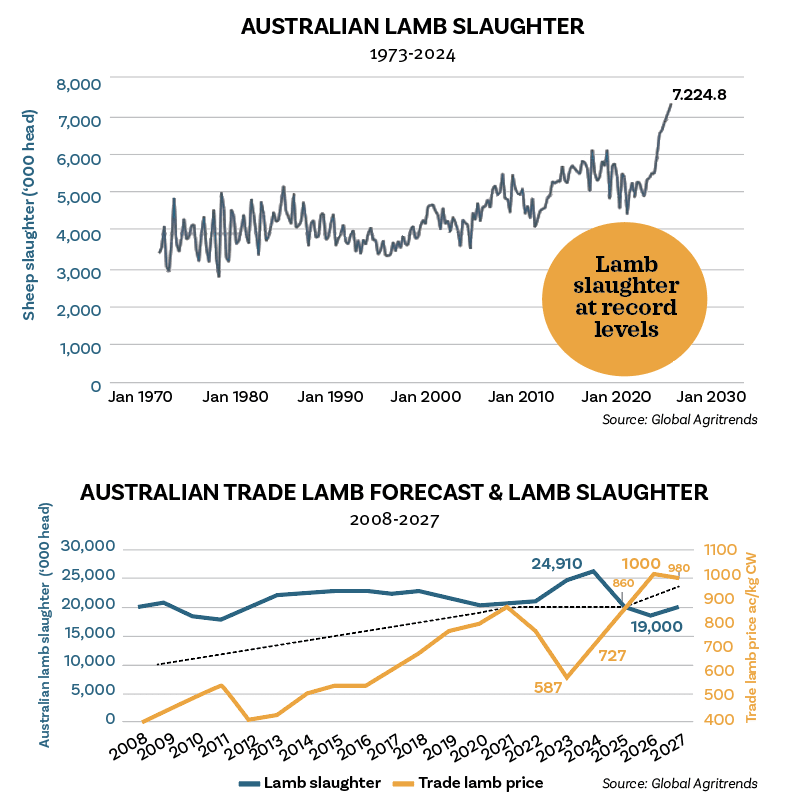

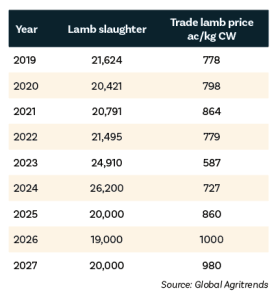

In the latest second-quarter ABS figures, lamb slaughterings reached a record level of 7.2 million head, which is likely to see total slaughterings in 2024 at 26.2m head. This is an unusually high lamb kill that is disproportionate with the mutton kill and points to a large number of female lambs being slaughtered, with few being retained for rebuilding.

In the latest second-quarter ABS figures, lamb slaughterings reached a record level of 7.2 million head, which is likely to see total slaughterings in 2024 at 26.2m head. This is an unusually high lamb kill that is disproportionate with the mutton kill and points to a large number of female lambs being slaughtered, with few being retained for rebuilding.

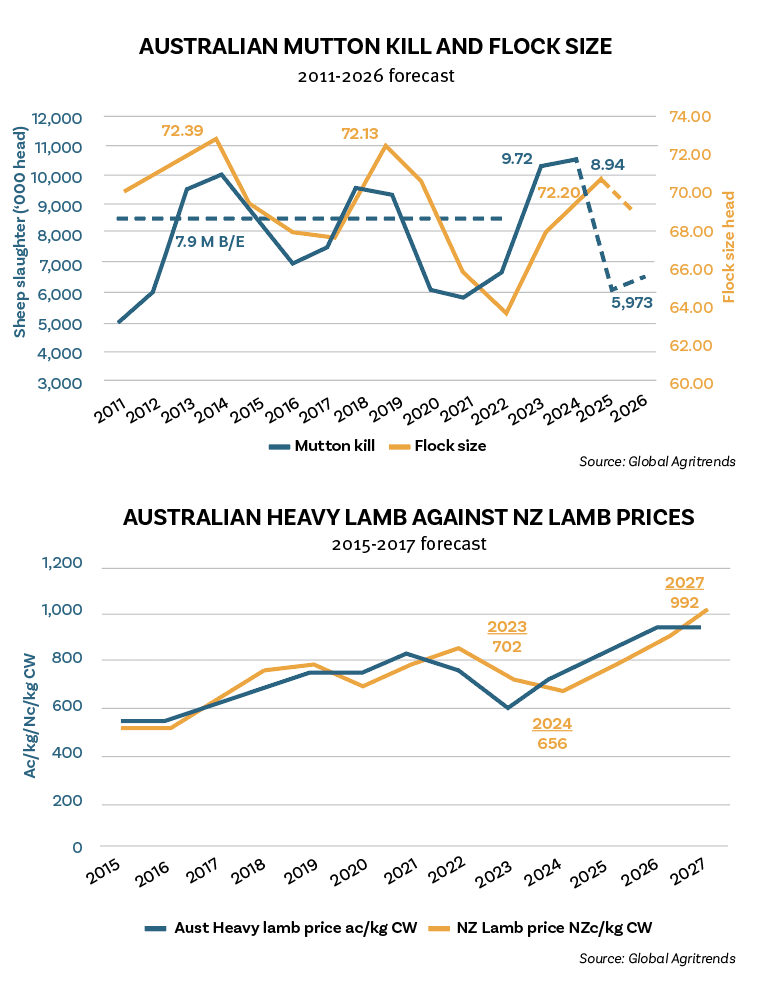

The significant volume of Australian mutton exports reflects the liquidation of the Australian flock, which has seen large kills and, therefore, significant exports for the second year. This liquidation cycle is expected to lead to a dramatic fall in lamb and mutton exports in 2025, with a much-reduced Australian flock size of almost 10% since 2022.

With lower lamb and sheep numbers, the Australian kill is expected to fall, increasing lamb and mutton prices in Australia.

There is an inverse relationship between Australian lamb supply and lamb prices; as supply tightens, lamb prices move higher, and in periods of oversupply, the opposite happens.

Rising Australian sheep meat prices will be price-supportive for NZ lamb and mutton over the next three years.

The trade lamb outlook for Australia, with declining kills next year, is for prices to move from an average this year of 727 Australian cents/kg CW to 860 ac/kg CW next year.

The trade lamb outlook for Australia, with declining kills next year, is for prices to move from an average this year of 727 Australian cents/kg CW to 860 ac/kg CW next year.

Given the heavy liquidation, these prices are expected to improve until 2026, which will likely translate into similar strong prices in NZ. When extrapolating this to Australian heavy lamb forecasts, which have a more robust correlation with NZ lamb forecasts, I see NZ lamb prices for the next three years as follows: NZ lamb prices bottoming this year at an average of 656 nzc/kg CW and then rising in 2025 through to 992 nzc/kg CW in 2027 on the back of stronger Australian prices.

With such a tight supply market, Australia’s prices peak in 2026 and NZ’s peak in 2027.

There is an important caveat to this discussion: the ‘boom/bust cycle’ that is common in the lamb industry. This cycle is driven by oversupply and the lack of labour, which leads to bottlenecks and collapsing prices.

There is an important caveat to this discussion: the ‘boom/bust cycle’ that is common in the lamb industry. This cycle is driven by oversupply and the lack of labour, which leads to bottlenecks and collapsing prices.

I see 2028 as a potential year when the ‘bust’ could occur, which could see Australian trade lamb prices collapse by 35% to 40%.

This, in turn, will lower NZ prices by a similar amount, with lamb prices falling from my estimate of 992 nzc/kg in 2027 to 660 nzc/kg in 2028 as Australia potentially drags down global lamb prices that year.

Much can happen between now and then, but history has a habit of repeating itself.

Therefore, NZ lamb producers must pivot in 2027/28 to avoid this volatility if possible. I appreciate this is easier said than done, but it is important to outline this caveat in my forecasts as I have done when talking with Australian lamb producers in recent months.

- Simon Quilty is an independent livestock analyst from Australia.