Global tariff challenges may create opportunities

New Zealand farmers are no strangers to volatility, and 2024 was another year that tested our resilience for beef exports. Words Simon Quilty.

New Zealand farmers are no strangers to volatility, and 2024 was another year that tested our resilience for beef exports.

New Zealand farmers are no strangers to volatility, and 2024 was another year that tested our resilience for beef exports.

As US tariffs are placed on countries worldwide, recently Canada, Mexico, and China, jitters have spread through global equity markets as the fear of a global trade war looms.

There is a risk that tariffs may be placed on New Zealand beef imported into the United States, which would hurt the New Zealand beef industry.

Are retaliatory tariffs likely to be placed on New Zealand beef?

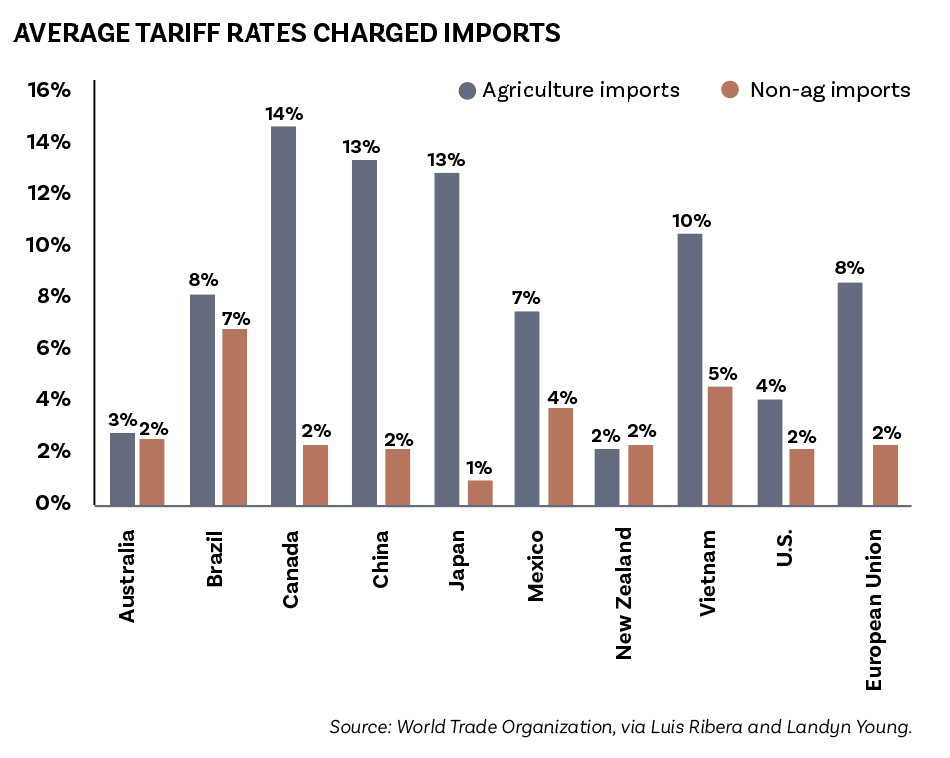

Given the small import tariffs that New Zealand places on agricultural imports, 2%, compared to the US agricultural import tariffs of 4% and other export countries worldwide, this alone would suggest that any tariffs are unlikely. According to the Congressional Research Service (CRS), around 70% of all US imports enter the country duty-free.

It should be noted that successive US administrations have intentionally imposed low tariffs on food imports, prioritising lower food prices for consumers. These tariffs, in particular, apply to products the US doesn’t produce, reducing consumer prices and making food more affordable in the US.

The strategy worked as intended. According to data from the United States Department of Agriculture (USDA), the US spends the least on food as a share of national expenditures compared to other countries. Just 6.7% of consumer expenses went to food in 2023. The importance of lean New Zealand beef in the US is well documented, as is the need for it to be blended with fat meat to produce hamburgers. In the last few years, this has traded at a significant discount, making ground beef and hamburgers much more affordable to the US consumer.

I believe retaliatory tariffs are unlikely.

What are the indirect benefits for New Zealand with US tariffs in other key markets?

As US beef exports are forecast to decline by 7% (USDA) in 2025, New Zealand and Australia will play a key role in backfilling in key markets such as Japan, Korea and China.

This has happened to a certain extent over the last two years but will become more pronounced in 2025 as US beef exports fall away.

The other important role for New Zealand beef exports is in the US market, where US cow slaughter is down 15% yearly compared to last year and 27% from two years ago. There is a critical shortage of lean beef, and with both Australia and Brazil expected to commence rebuilding of their respective herds in 2025, the global lean beef supply will be tight. New Zealand will be situated in an ideal position to supply this shortfall.

Whether it’s backfilling in the US domestic market or in global beef markets that the US supplies, US beef export prices sit at a substantial premium to both Australian and New Zealand export beef values. As supply tightens, this price spread is expected to narrow, with New Zealand prices likely to move higher.

Retaliatory tariffs on US beef and pork or some form of restricted access by some of these key export countries, particularly China, which may look to restrict the volume of US protein being imported, cannot be ruled out.

The China Import Food Enterprise Registration (CIFER) system was developed by the General Administration of Customs of the People’s Republic of China (GACC) to facilitate online registration of foreign establishments that manufacture, process, or store food and agrifood products before export to China.

Under the US-China Phase One Agreement, US export licences are usually ‘auto-renewed’ each year, but in the last two weeks, this has not occurred; as of last Friday, 71 US poultry plants set for auto-renewal on 19 Feb were not renewed and therefore, all US poultry exports from these establishments have stopped.

In the next two weeks, a total of 800 pork, chicken and beef export establishments need to be renewed (this is all of the US export sector) and given the non-renewal of the 71 establishments so far, the timing of US introducing tariffs of 20% on China this week, there is genuine uncertainty over whether any of these licences will be reinstated. In other words, US exports to China for beef, pork and chicken may stop. Should this occur, New Zealand may be required to backfill into China if US beef is absent.

It should be noted that US beef exports to China in 2024 were 179,464t, with a sale value of US$1.58 billion. In contrast, New Zealand beef exports to China for the same period were 146,290t, worth US$631 million.

This is speculation at this stage, but it highlights the precarious nature of global beef supply and how trade flows could abruptly change in the coming weeks and months, creating opportunities for New

This is speculation at this stage, but it highlights the precarious nature of global beef supply and how trade flows could abruptly change in the coming weeks and months, creating opportunities for New

Zealand beef.

Simon Quilty is an independent livestock analyst from Australia.