What is efficiency and how does it differ from effectiveness? Which one of these is more important?

The best way I can think to answer that takes us back to the late 1970s. There was a genuine fear that the world was going to run out of oil. Coupled with the cartel of the Organisation of the Petroleum Exporting Countries (OPEC) nations, crude oil prices soared, and was a large contributor to worldwide inflation.

Anyone slightly younger than a Baby Boomer, may not recall carless days and the ban on the sale of petrol during weekends. The upshot was, the first question asked when buying a car was “what’s its fuel efficiency?”. It might be a nice car, but how many miles to the gallon does it do? Efficiency.

However, if you jump in your very efficient Toyota Corolla and get lost driving aimlessly around in the fog, you will have had a very efficient journey, which was totally ineffective because you ended up in the wrong place. And that is assuming you actually knew where you wanted to go in the first place.

Ironically, and slightly off the subject, it now seems we have more oil than we know what to do with. I guess that is a result of the sacrifices our generation of Boomers made back then, and we get blamed for ruining the planet? Go figure.

“So you are now effective, but how do you become efficient? In other words, you have done the right things, now how do you do things right?”

Anyway, fast forward to 2021, and we can all get onto Google and solve the riddle of efficiency versus effectiveness. According to Google, effectiveness is doing the right things and efficiency is doing things right. Cool, but what does that mean?

Effectiveness is about understanding the purpose and the vision you have for your business. Efficiency is about having the right plan to achieve the vision. So you can’t really have one without the other, but you need to start with effectiveness. That is start with your vision and start with the end in mind.

As an example, a client of mine has a simple purpose. Turning grass into profit. There are two parts to that purpose statement. Firstly, they need to grow as much grass as they can and secondly, they need to turn the grass into profit. I would argue that the first part of that purpose is effectiveness and the second efficiency.

So how can they grow as much grass as possible and what elements of that can they control? Weather, soil type, topography and aspect are pretty much out of their control. However, on their farm, drainage, soil fertility, pasture species and fencing all add to effectiveness. It allows them to grow more grass. Doing the right things. Then, pasture management, livestock genetics, stocking rate, stock water and shelter all add to profit or efficiency. Doing things right. Admittedly there are crossovers between the two. Is this adding to efficiency or effectiveness? It doesn’t matter which, because they do both go hand in hand.

Start with effectiveness, that is, start with your vision. Like the person driving around in the Corolla, if the fog has descended and you don’t know where you’re going how can you possibly end up at the right place? It sounds so simple. The really good businesses have this so clearly defined and are proactive at designing and chasing their vision, whereas those that don’t are reactive and often react too late. They get the default result.

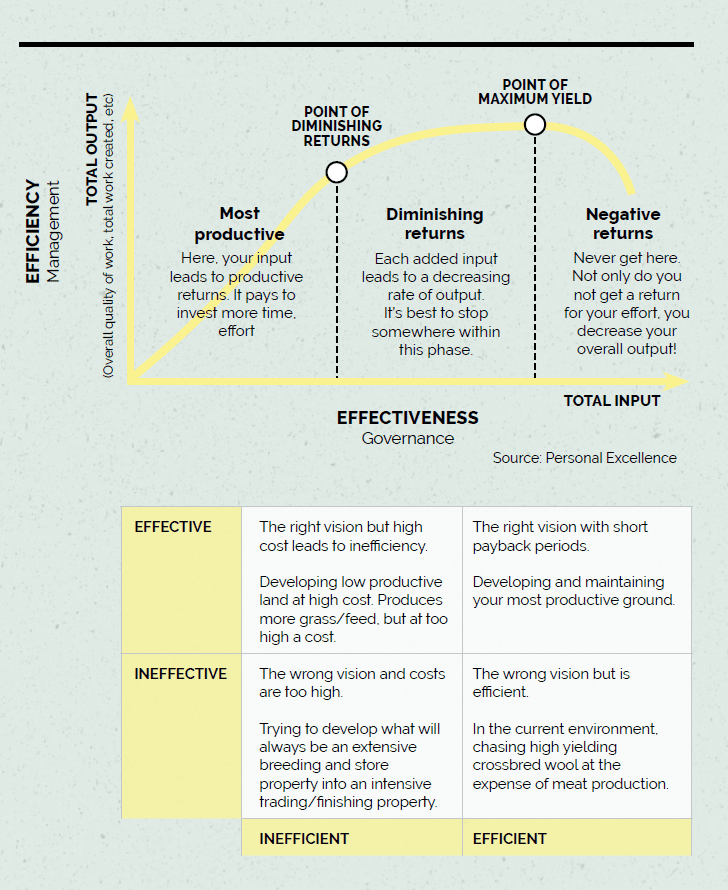

Coming back to growing as much grass as you can. Obviously, this does need to be as efficient as you can. You can waste efficiency in your pursuit to be effective. Or, to put that in layman’s terms, you can waste money in pursuit of profitability. Spending one dollar to earn three is good business. Spending three dollars to earn one is not.

If you can grow more grass or more meat by investing in development projects on your farm that give you a three-to-four-year payback period, that is good business. That equates to about 20-30% return on your investment, when the current cost of capital is about around 4%.

All the same, most businesses do have capital constraints. Borrowing from banks isn’t as easy as it once was. You need to prioritise where to start and be clever enough to know when to stop. Fertilise your best ground first. If you are constrained with access to capital, don’t ignore your best ground in pursuit of developing second class land. Don’t be fooled by doubling production on land that is only growing 3nm/ha. It looks good and might even feel exciting, but it may mean you are lost in the fog.

Whereas by spending half the amount of money, developing or maintaining your most productive land you will get a much better return on your investment. Get your good land producing at its optimum level first and maintain it, then look for the second best alternative and so on. However, don’t over invest. Understand the concept of diminishing marginal returns and know when to stop. Refer to the graph. You need to understand the key profitability drivers of your business, and I can’t stress that enough.

So you are now effective, but how do you become efficient? In other words, you have done the right things, now how do you do things right? To a degree, it is the difference between governance and management. Governance is about setting the vision (effectiveness) and management is achieving the vision (efficiency).

The old adage says the difference between an average farmer and a good farmer is about three weeks. I believe if you move up the curve, the difference between a good farmer and an excellent farmer might only be a week. That is all about management. It is timing and knowledge. Knowing when to act three weeks before rather than knowing that three weeks ago you should have acted. Measure, observe, read, go to field days and employ professional advisors. They are all proactive habits. Yes, you won’t always get it right. Refer to our good friend Murphy’s Law – what can go wrong, will go wrong. However, good habits lead to good results and those results lead to efficiency.

- Peter Flannery is an agribusiness consultant for Farm Plan, Invercargill.