What’s the deal with forestry?AgriHQ analyst Reece Brick reports a bumper log harvest is reaping strong rewards.

With all the talk about forestry conversion, now is the ideal time to give a run-down of what’s happening in log markets. Lately New Zealand has moved into the early stages of the ‘wall of wood’– the term used to describe the masses of trees planted in the early/mid-1990s reaching maturity.

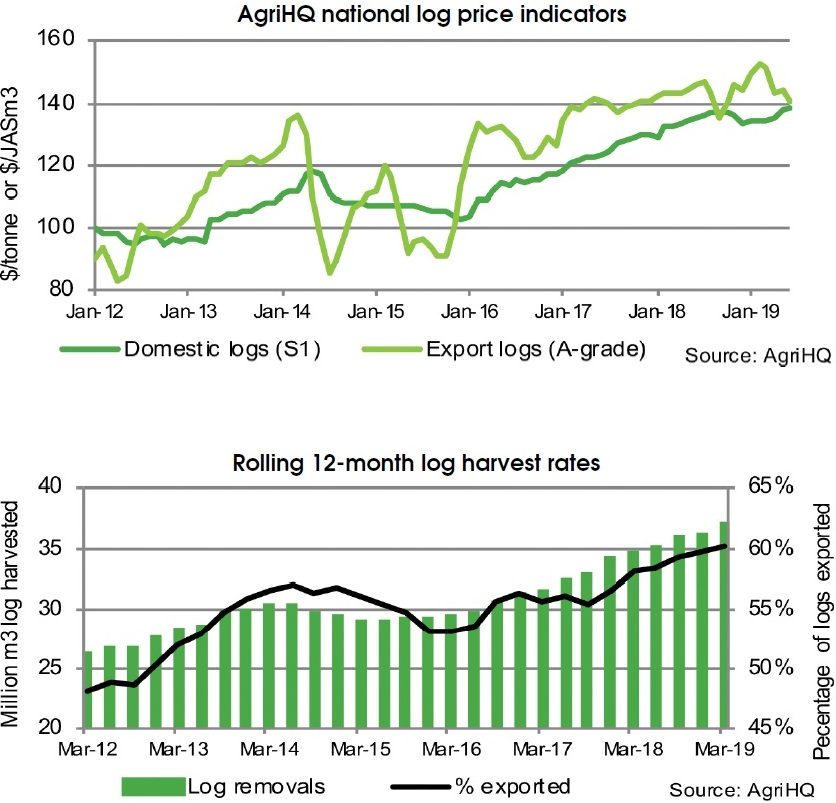

In only two years log removals have lifted 18% to 36.9 million cubic metres/year (as at March 19), almost double what was reported a decade ago. All signs point to this number lifting even higher in the next five to 10 years, though that will depend on harvesting decisions (trees are mainly logged at 23-30 years).

Logic would tell you higher supplies = lower prices, however the reality is quite different.

Instead it’s been a golden period for log sales with high, and more importantly steady, prices reported for three years straight. As a guide, the national S1 indicator (unpruned structural log) has gradually risen to the upper-end of $125-$135/tonne since mid-2017, previously floating between $95-$115/t in 2010-2016.

Export demand has largely been responsible for the very strong log prices.

So where are all the extra logs going, you ask?

The short answer is China. The long answer is a little more complicated. Traditionally logs have been split 50:50 between local mills and export markets, NZ mills mainly taking the better logs, and a mix of China, South Korea, India and Japan taking a fair chunk of the rest.

Nowadays the dynamic has shifted with about 40% of logs staying locally and more than 80% of the exports on a direct path to China.

Is it a risk a being so reliant on China?

Yes and no. The likes of Japan and South Korea have faded away due to Chinese mills producing similar timber for lower prices, however they can service similar markets. India’s always been an opportunistic market, stepping in when prices are low, so their absence is more a sign of China’s strength than anything else.

There are a few factors pointing to China staying a reliable market. The main competing log suppliers, Russia and North America, have shrinking footprint due to regulation and tariff changes, while Chinese local supplies are also down following a crackdown on native forest logging. Construction numbers continue to paint a positive picture for end-user demand too.

The big red flag is the United States-China trade war. Construction is tightly aligned with macro-economic trends, and if China’s economy begins to get the wobbles, likely due to the trade war, you can be assured there’ll be flow-on effects to log prices.