A ‘North Star’ approach to partnership

Writing down a ‘North Star’ of guiding principles has worked for Hawke’s Bay sheep and beef farmer Sam Robinson when it comes to equity partnerships. By Tony Leggett.

Writing down a ‘North Star’ of guiding principles has worked for Hawke’s Bay sheep and beef farmer Sam Robinson when it comes to equity partnerships. By Tony Leggett.

Finding the right equity partner is like finding a spouse, says Hawke’s Bay sheep-beef farmer Sam Robinson.

Finding the right equity partner is like finding a spouse, says Hawke’s Bay sheep-beef farmer Sam Robinson.

It can happen unexpectedly and there are risks on both sides, especially if trust fades for any reason.

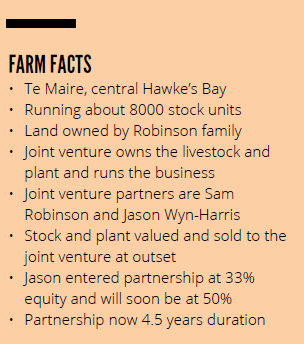

Robinson’s family owns 100% of their Central Hawke’s Bay property and leases it to a joint venture which owns the stock and plant. The joint venture runs the farm business and comprises Robinson and his equity partner-manager Jason Wyn-Harris.

It is Robinson’s fourth equity partnership in just over 10 years and started four-and-half years ago. Wyn-Harris started with 33% of the shares in the partnership and has acquired more using dividends from his share of the profits generated by the business.

Robinson refers to the initial phase of finding the right partner as the ‘hook-up’.

“You could do this informally, and a lot of it is informal, or formally. And we’ve done both, in our business.”

Robinson talked through equity partnership structures with accountants, lawyers, real estate agents, and farm consultants in a formal setting. At the same time, he put effort into networking

and using informal channels to find potential partners he could work with.

“It doesn’t come through the mailbox saying, ‘here’s an opportunity’. You’ve got to go and seek it and that can be hard to do.”

Once a potential partner has been found, Robinson says the parties then enter an ‘engagement’ phase where confidence is built and the relationship develops.

“This bit is a big call because this is where you form a relationship which is enduring, which is going to go through good times and go through bad times.”

“You’ve got to get it right. So, you spend a lot of time assessing who you’re dealing with.”

Robinson says any equity partnership agreement must include clauses to cover how each partner exits the partnership, either at the agreed date or earlier through disagreement, disablement, death or divorce. He’s spent several thousand dollars on external advice but says it was a great investment because it establishes certainty for both parties.

“A thing that Jason and I were advised to do was to write down your ‘North Star’ (guiding principles or values). Both of us wrote down what we wanted out of this partnership, and fortunately, we were closely aligned. You’ve got to have alignment between what you are seeking, roughly anyway.”

As they near the end of their initial five year term, they have agreed to refresh their ‘North Star’ view which may help steer them into a future partnership.

Robinson says a partnership’s shareholder agreement is the most important document. “That’s your rules of engagement.”

In their case, decision making is shared between the partners. “It’s a joint venture and while the equity levels may be different, if directors vote equally and if you’re having a scrap over something, you’ve got a problem.”

“But we have got remediation or an option for an independent to come and help us sort it, if required.”

GOLDEN HANDCUFFS

The shareholders agreement covers the duration of the partnership, dispute settlement, exit clauses and what any dividends will be.

“We have a golden handcuff in our agreement so someone can’t get halfway through and say they have changed their mind. It’s punitive on either of the parties,” he says.

The lease agreement is the second most important document. Robinson says this is where the farm owner has some control over the equity partnership that runs the livestock partnership.

Their agreement has all the usual clauses regarding fertiliser applications, good husbandry and the type of stock the farm is permitted to run.

Robinson says setting the rental fee is tricky because there could be a temptation to set it below market levels.

“And, the confusion for me is I’m effectively the lessor and a partner in the lessee company which is paying the lease. So, whatever rent I get, I’m paying a proportion of it anyway.”

Another important document is the employment agreement. Wyn-Harris has contributed some capital but he is also the farm manager.

“It’s his life. He’s got to be rewarded for his labour and managerial skill for running the business. And that’s only fair.”

Jason’s employment agreement also has incentives for him to strive for higher performance and profits from the business. As profits rise to agreed levels, he receives a higher percentage of the extra profits from the joint venture livestock business.

As the landowner, Robinson said the responsibility for dealing with any deferred repairs and maintenance rests with his family and it was documented before he and the Wyn-Harris’ signed their partnership to farm together.

He also advises parties to take death and disability insurance for the farm manager and says it should be noted as an annual commitment in the shareholder agreement.

“This is for the benefit of both parties, of course. If Jason was incapacitated for some reason, we both need the business to go on. He needs it to go on because he’s got shares in it as well. “

Robinson says one of the most challenging aspects of day to day activity is being confident enough to allow his manager-partner to have the right level of control.

“It’s a great credit to Jason that he puts up with my peculiarities.”

“I think the senior shareholder needs

to just take a back seat and allow the junior shareholder to share the control, if not take the lead. I mean, they’ve got the energy and the enthusiasm. They’re very quickly going to get the experience.“

Robinson says he accepts that restricting the manager-partner to just the livestock business, and not allowing them a stake in the land, is denying them the opportunity to build equity from any increase in the land values.

They still have the potential for equity gain from improving stock values and higher dividends from lifting overall profitability, but land prices have increased substantially over the past four and half years since the partnership was formed.

“That’s a vexed question for us. That’s an itch which has got to be scratched. All real estate, be it houses or property, in New Zealand has gone up, and that’s pretty gutting if you’re not exposed to it. So, I feel for Jason on that.”

LEASE OPTION KICKED OFF FIRST PARTNERSHIP

Sam Robinson experienced initial success then two early exits with previous equity partnerships he’s been involved in.

His first equity partnership was about 10 years ago when he and an employee successfully tendered for the three-year lease of a neighbouring 4000 stock unit property to the home property, Te Maire, in central Hawke’s Bay.

“It was quite simple, because we were both lessees. There was no tension about who owned the land.”

The managing partner was paid to manage the property, the pair had regular monthly meetings and kept detailed minutes of each meeting. Later, as the business began to perform well, the meetings became less formal. “But we still had the documents all there to fall back on if we needed them.”

After three years, when the farm’s owners decided to take over the farm again, Robinson encouraged his partner to look for another joint venture property nearby.

“He found one about half an hour from the home property. Unfortunately, the takeover date was six months before we lost the next door lease, so for six months he was running two plots of 4,000 stock units. He was a busy boy.”

After three years, they renewed the lease of the new property a further two years until the owner sold it. At that point, by agreement, they ended their partnership.

“He is now on his own farm at Makuri (in Tararua). He came in with $20,000 and left with enough to get a start in his own farm business.”

Before signing with current equity partner-manager Jason Wyn-Harris, Robinson says he had two partnerships that didn’t last the agreed term. The reasons were complex but are best described as lack of alignment.

“It’s the people, it’s the people, it’s the people. This is relationship-based and only works with complete trust and in most cases, a lowering of expectations.”

ROBINSON’S LIST OF CRITICAL SUCCESS FACTORS

- Ensure clarity of expectations for both partners

- Ensure alignment of values (North Star)

- Ensure compatibility between partners

- Develop a robust shareholders agreement with exit clauses for both parties

- Be prepared to pay for advice from experts, especially when setting up agreements

- Maintain goodwill and open communications at all times

- Allow freedom for farm manager-partner to lead on decision-making

- Allow the farm manager-partner to acquire more shares over time

- Create a robust employment agreement that encourages higher performance and profits

Surprise at seminar turnout

Organisers of an equity partnership seminar in Hastings last month were surprised when 240 people registered or showed up to hear a range of farmers and experts.

Bayleys real estate agent Kris August says he and his colleagues originally tried to run the event in 2020 but Covid-19 lockdown rules prevented it.

“We originally thought we might get 30 or so people to attend, but to get about 240 shows that people are hungry for advice and opportunities to pursue,” August says.

One reason offered for the surge in interest from sheep-beef farmers is the widely acknowledged view that a ‘bubble’ of farm owners will be reaching retirement stage in the next decade.

About a third of those attending were aspiring farm owners, keen to find out if equity partnerships might be a pathway to their long term ownership plans.

Another third were existing farm owners, mostly older, looking for advice to develop a succession plan. The remaining third were a cross section of real estate agents, bankers, farm consultants and a smattering of ‘city investors’ looking for an investment in farm businesses.

August says the feedback to the company was clear. Demand from both sides of the equity partnership model – farm owner and manager-partner – is enormous.

The challenge is providing sensible mechanisms for putting people with the same goals and aspirations together.